Energy and carbon

Carbon Emissions by Source and Steel Production Route

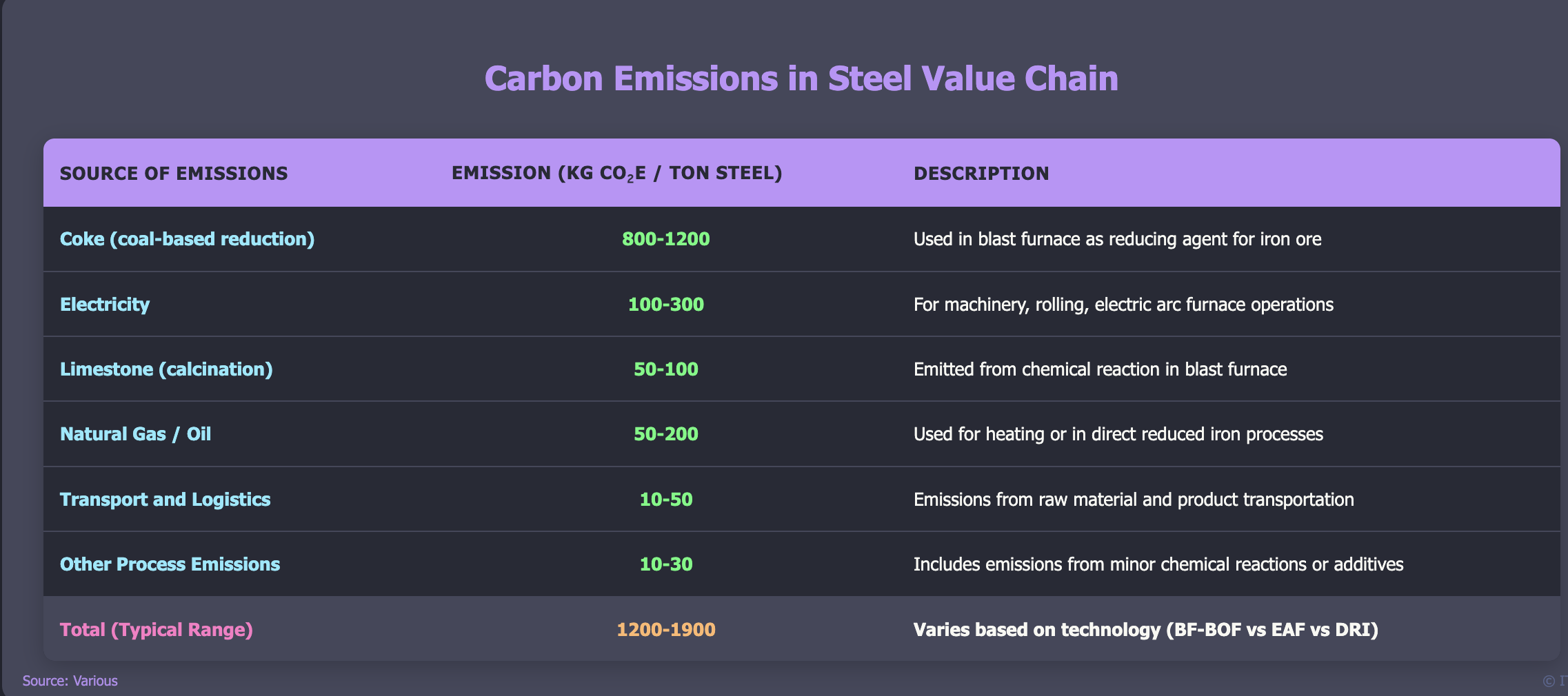

Steel production generates substantial carbon emissions through multiple sources, with significant variation between production technologies. The blast furnace-basic oxygen furnace route and electric arc furnace route demonstrate markedly different emission profiles across key input categories.

Emissions per Metric Ton of Steel

The blast furnace-basic oxygen furnace route typically emits 1.2–1.9 tons of CO₂ per ton of steel, though in less efficient cases emissions can reach up to 2.2 tons. Electric arc furnace operations using scrap generate significantly lower emissions (0.3–0.6 tons), while emissions from the direct reduced iron process vary widely depending on energy inputs..

Global Steel Production Emissions Analysis

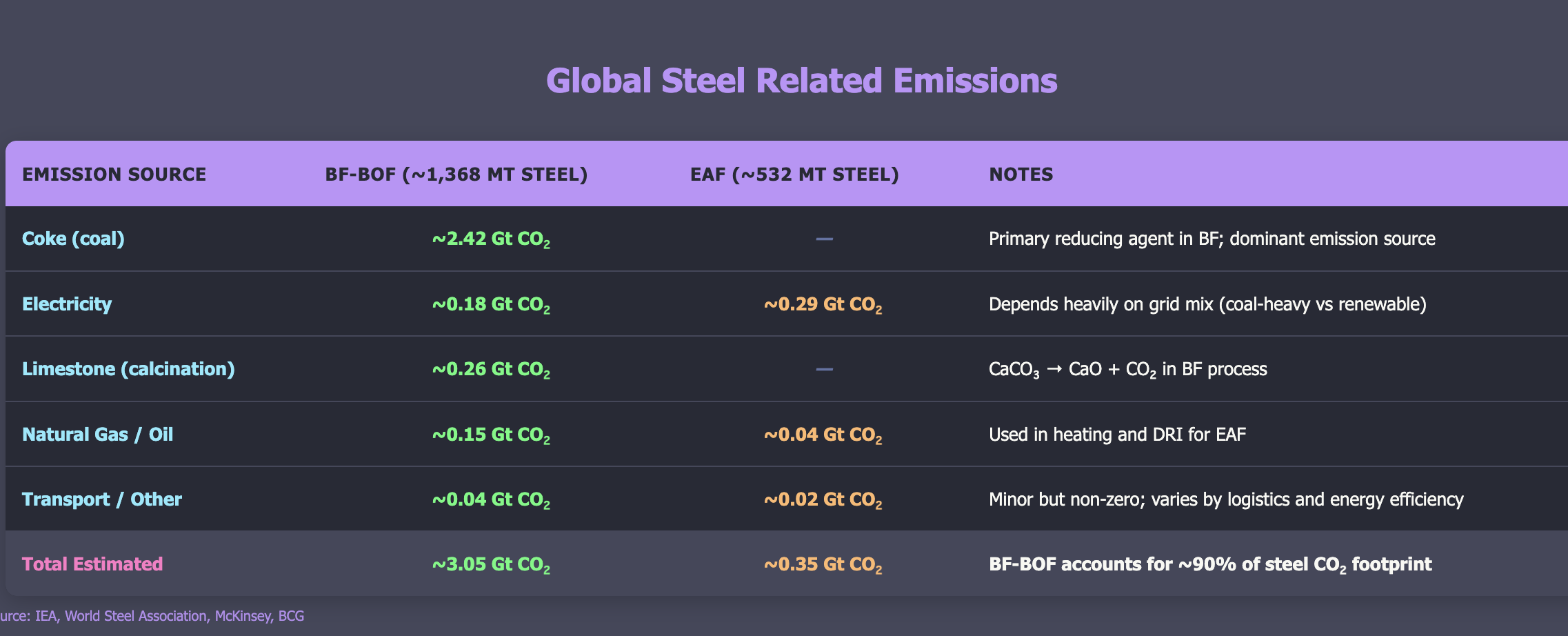

Global crude steel production in 2023 totaled approximately 1,900 million tonnes, with blast furnace-basic oxygen furnace routes accounting for 72% of production (1,368 Mt) and electric arc furnace processes representing 28% (532 Mt). These production volumes generate substantial global carbon emissions distributed across different emission sources.

Global CO₂ Emissions by Steel Production Process (2023)

Global steel production generates approximately 3.4 Gt CO₂ annually, representing roughly 9% of global fossil fuel CO₂ emissions. The blast furnace route dominates emissions due to its reliance on coke as both fuel and reducing agent, while electric arc furnace emissions depend heavily on electricity grid composition.

Hydrogen-Based Direct Reduced Iron: Current Status and Economics

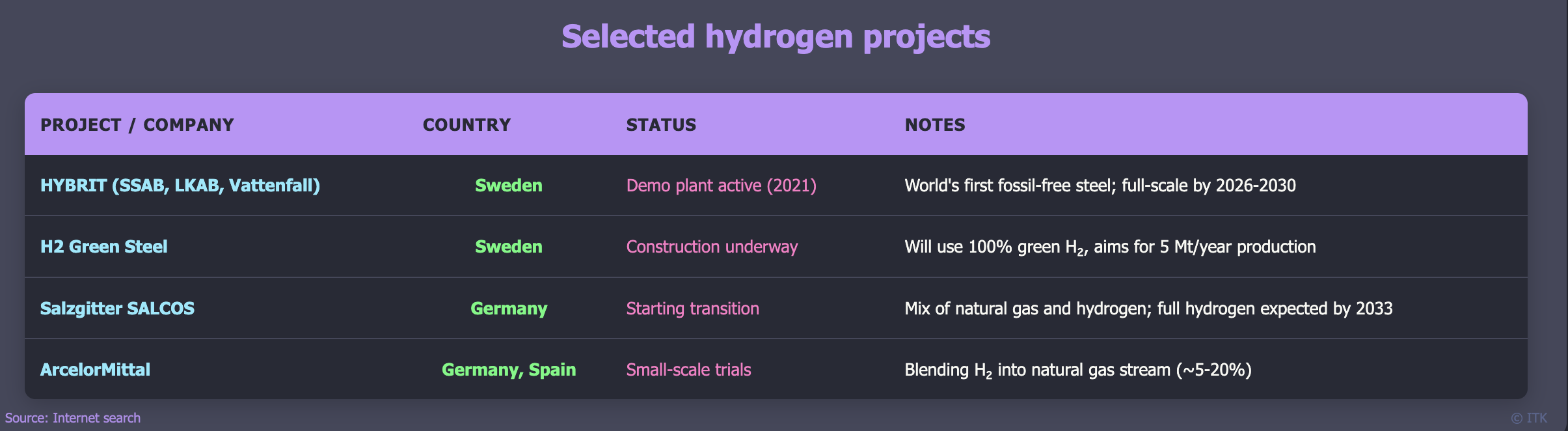

Hydrogen-based DRI represents an emerging decarbonization pathway that is not yet implemented at large commercial scale. Current developments include pilot projects and early commercial plants across multiple countries, with most operations remaining pre-commercial with capacity under 1 Mt per year.

Major Hydrogen DRI Projects

The small table below excludes Stegra which is far more ambitious.

Most current projects utilize natural gas as the primary reductant with hydrogen blending for demonstration purposes, indicating the technology remains in developmental phases.

Energy and Cost Analysis: Hydrogen versus Natural Gas

The economic challenge of hydrogen DRI stems from substantial cost differentials between hydrogen and natural gas inputs. Natural gas costs range from $3-10 per GJ depending on region, while hydrogen costs $32-48 per GJ at current green hydrogen prices of $4-6 per kilogram, representing a 5-10 times cost premium.

Hydrogen DRI requires approximately 50-60 kg of hydrogen per tonne of steel, translating to $200-300 per tonne in hydrogen costs alone. This compares unfavorably to natural gas DRI at $30-50 per tonne for gas input and blast furnace-basic oxygen furnace routes at $50-100 per tonne for fuel costs.

Carbon Price Requirements for Economic Viability

The carbon break-even analysis for hydrogen DRI reveals substantial carbon pricing requirements for economic competitiveness. Blast furnace-basic oxygen furnace routes generate approximately 1.9 tCO₂ per tonne of steel, while hydrogen DRI with electric arc furnace produces 0.2-0.3 tCO₂ per tonne, achieving net CO₂ savings of 1.6-1.7 tCO₂ per tonne of steel.

With additional costs of approximately $200 per tonne for the hydrogen route, the required carbon price for economic parity reaches $120-130 per tonne CO₂. A carbon price of $100-150 per tonne CO₂ is typically needed to make green hydrogen DRI competitive with traditional steelmaking, depending on hydrogen costs, electricity prices, technology maturity, and steel market prices.

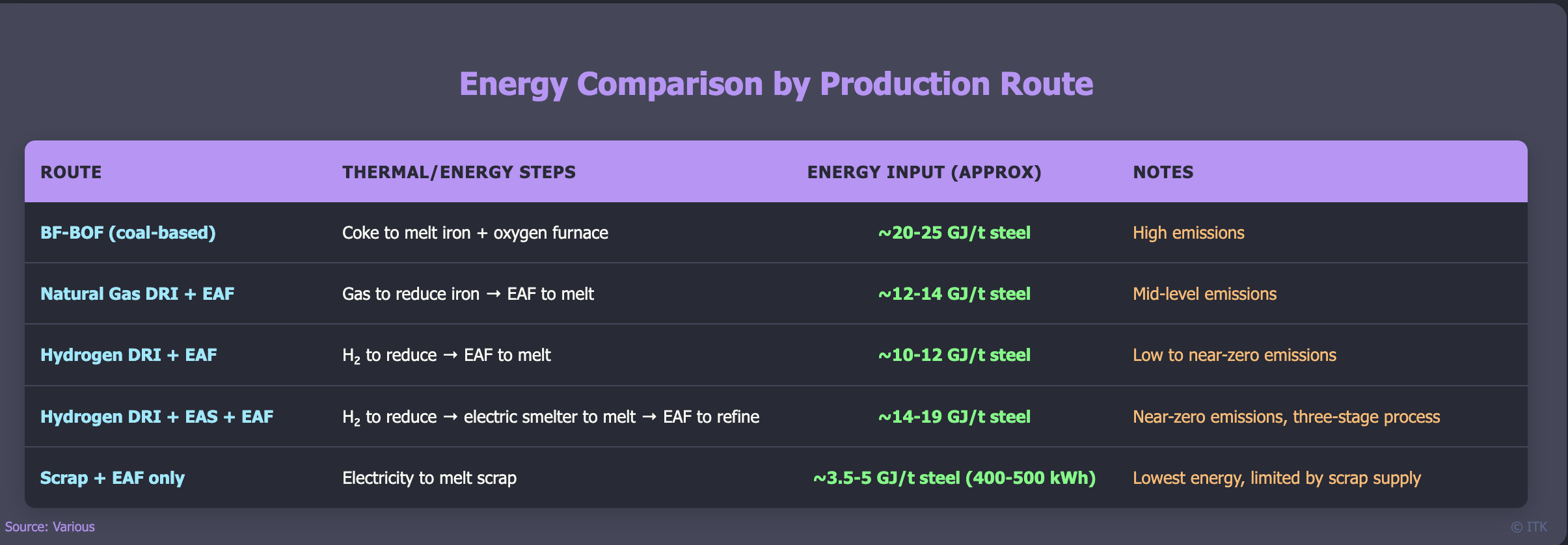

Energy Requirements Across Steel Production Routes

Different steel production pathways demonstrate varying energy requirements and efficiency profiles. The hydrogen DRI plus electric arc furnace route offers energy advantages compared to traditional blast furnace operations while enabling near-zero emissions when coupled with clean energy sources.

Hydrogen DRI reduces total energy requirements compared to blast furnace-basic oxygen furnace routes by avoiding the need to melt iron ore in blast furnaces and utilizing hydrogen as a clean reductant. The process benefits from modular setup capabilities, easier decarbonization pathways, and collocation opportunities with renewable energy sources.