Hydrogen

Hydrogen

Green hydrogen costs have not fallen anywhere near as fast as expected. Electrolysers remain largely embryonic with one European exception and equally solar electricity costs also remain higher than perhaps forecast, possibly due to the totality of balance of system costs. In Australia Fortescue has abandoned, for the time being, its 50 MW PEM electrolyser in Gladstone. The reason likely being that the chosen technology could not deliver as its designers had hoped.

It’s not clear why hydrogen costs have slumped but my own feeling is that global potential for hydrogen was hopelessly over done. In fact I’ve stayed away from anything to do with hydrogen for three years because it seem obvious it was overhyped.

Still there are industries where there will be no decarbonisation without hydrogen given today’s technology suite. And steel is one of them. So for Australia hydrogen remains relevant, possibly as an export industry but in the first instance because we need to produce DRI.

And from that perspective we can see that electrolyser costs aren’t coming down because the industry has failed to launch, not because the predications of the cost reduction potential are necessarily wrong.

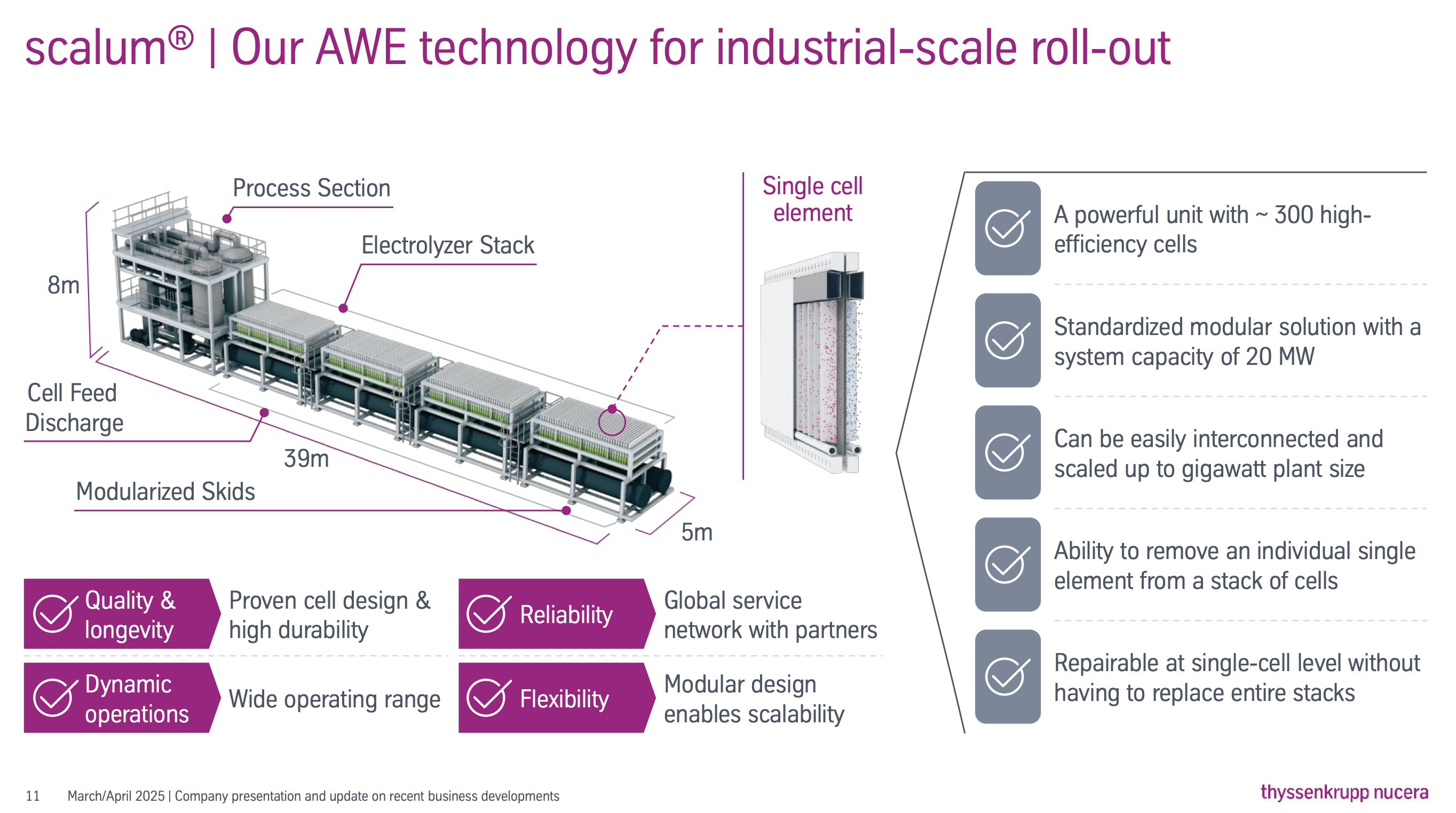

What also seems to be the case, and this is partly speculation on my part, is that hydrogen is an industry for the big end of town. You need lots of capital and a value chain that’s committed to the job and can take the initial losses. So that means either Europe, Japan, China or the USA. The USA, at the moment, seems to be going through a “decline of the Roman empire” phase so I just can’t see it. Japan doesn’t really know whether its arthur or martha but, in my opinion, the country doesn’t get it just yet. China has a lot on its plate but a huge investment in traditional steel making so for once it’s the incumbent. Still China might do great things. On the other hand Europe is good at sophisticated manufacturing where know how matters more than cost. Europe, by and large, remains committed to the decarbonisation journey and so there is not only the technology capability, and the finance capability but also the customer willingness. And so that seems to partly explain why Thyssenkrup Nucera is almost an order of magnitude bigger than anyone else in the electrolyser business. And in fact the only company I can identify that is building kit at a scale relevant to the Australian iron ore industry.

700 MW of Stegra electroyser capacity would be 35 of the Thryssenkrup Nucera units. There are 300*35 or about 10,000 cells, so the lads aren’t mucking round.

Electrolyser Cost Trends 2024-2025

Electrolyser costs have experienced significant increases throughout 2024 and 2025, contradicting earlier market expectations of declining prices. BloombergNEF reports cost increases exceeding 50% across major markets including China, the United States, and Europe. This price escalation results from multiple converging factors including global inflation pressures, ongoing supply chain disruptions, delays in hydrogen-related government subsidies, and underutilized electrolyser manufacturing capacity leading to higher per-unit production costs.

Major International Projects

Despite challenging cost conditions, several large-scale electrolyser projects continue advancing, particularly in China and Saudi Arabia, demonstrating sustained commitment to green hydrogen infrastructure development.

Chinese Project Portfolio

China maintains its leadership position through substantial investment in multiple large-scale facilities. The Sinopec Ordos Project in Inner Mongolia represents a ¥20 billion investment (approximately $2.8 billion) targeting 100,000 tonnes of green hydrogen annually, with distribution through a dedicated 400 km pipeline to Beijing.

The CEEC Songyuan Hydrogen Energy Industrial Park in Jilin Province exemplifies integrated chemical production with investment exceeding $4 billion. This facility targets diversified output including 110,000 tonnes of green hydrogen, 600,000 tonnes of green ammonia, and 60,000 tonnes of green methanol annually.

The Huadian Weifang Hydrogen Project in Shandong Province features a 25 MW electrolyser system producing 3.6 tonnes of hydrogen daily as part of China’s “Hydrogen Into Ten Thousand Homes” program, demonstrating distributed hydrogen infrastructure development.

Saudi Arabian Development

The NEOM Green Hydrogen Project represents significant Middle Eastern investment through a partnership between NEOM, Air Products, and ACWA Power. This $8.4 billion facility targets 600 tonnes of green hydrogen daily production by 2026, establishing major export capacity in the region.

Production Capacity Analysis

Electrolyser Sizing Requirements

To achieve 100,000 tonnes of annual green hydrogen production requires substantial electrolyser capacity based on current technology parameters. Using standard efficiency assumptions of 50 kWh per kilogram of hydrogen and 8,000 annual operating hours, the capacity requirement calculation yields:

Energy requirement: 100,000,000 kg × 50 kWh/kg = 5,000 GWh/year

Required capacity: 5,000 GWh ÷ 8,000 hours = 625 MW

Therefore, 625 MW of electrolyser capacity is required to produce 100,000 tonnes of green hydrogen annually under standard operating conditions.

Direct Reduced Iron Production Potential

A 625 MW electrolyser system can support significant DRI manufacturing through green hydrogen supply. Using standard hydrogen consumption of 50 kg per tonne of DRI, the production capacity becomes:

Annual hydrogen production: 100,000 tonnes H₂

DRI production capacity: 100,000 tonnes H₂ ÷ 50 kg H₂/tonne DRI = 2,000,000 tonnes DRI/year

Strategic Implications

A 625 MW electrolyser system can enable production of 2 million tonnes of DRI annually, representing substantial green steel manufacturing potential. This capacity demonstrates the industrial scale achievable through integrated green hydrogen and steel production systems, supporting global decarbonization objectives despite current electrolyser cost challenges.