IronOre

Global Iron Ore Market: Production, Quality, and Strategic Analysis

Iron Ore Fundamentals

Iron ore is a naturally occurring rock or mineral from which metallic iron can be economically extracted, serving as the primary raw material for steel production. The most commonly utilized iron-bearing minerals include hematite (Fe₂O₃), which is typically high-grade and easier to process, and magnetite (Fe₃O₄), which is often lower grade but can be upgraded through beneficiation processes. Iron ore requires processing to remove impurities and concentrate iron content before utilization in blast furnaces or direct reduction processes.

Global Production Landscape

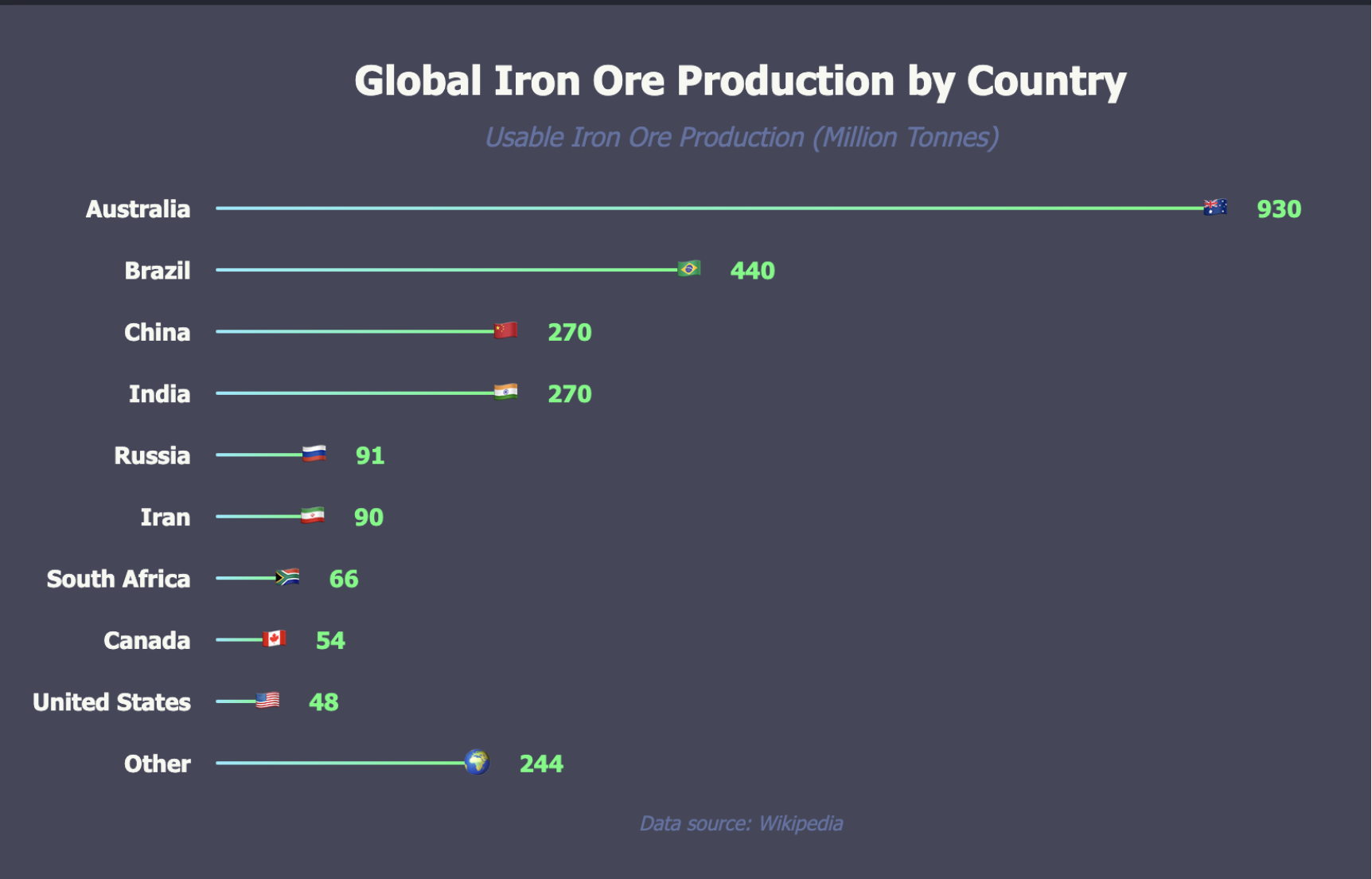

The global iron ore market produced approximately 2.6-2.8 billion tonnes in 2023, with production concentrated among several major producing nations. Australia leads global production and exports with approximately 930 million tonnes annually, primarily serving the Chinese market. Brazil follows as the second-largest producer at 430 million tonnes, known for high-grade hematite ore and significant export volumes.

China produces approximately 270 million tonnes annually but relies heavily on imports due to predominantly low-grade domestic ore. India contributes 260 million tonnes with high domestic consumption and restricted exports. Other significant producers include Russia (100 million tonnes), South Africa (70 million tonnes), Ukraine (50 million tonnes), Canada (50 million tonnes), and the United States (40 million tonnes).

Iron Ore Quality and Composition

Iron ore grading is determined by iron content, with high-grade ores containing over 60% Fe and low-grade ores typically below 58% Fe. Hematite ores can exceed 65% Fe representing very high-grade material, while magnetite ores may contain 30-40% Fe in raw form but can be processed into high-grade concentrates reaching 70% Fe.

Iron ore contains various impurities and gangue materials that affect processing and steel quality. Silica (SiO₂) affects slag formation and is removed by limestone addition. Alumina (Al₂O₃) reduces furnace efficiency and requires careful control. Phosphorus and sulfur content must be minimized as they degrade steel quality. Trace elements including titanium, manganese, and vanadium may be present and sometimes extracted as by-products.

Regional Quality Comparison

Australia produces ore with average iron content of 58-62% in blended fines, with high-grade deposits in the Pilbara region exceeding 62% Fe. Australian ore is recognized for consistent quality and low impurities, making it highly favored by international steelmakers, particularly in China.

Brazil achieves the highest average iron content at 63-65%, with some deposits such as the Carajás mine operated by Vale producing ore exceeding 67% Fe, ranking among the world’s highest-grade iron ore. Brazilian ore requires less processing and produces less slag, delivering environmental and economic efficiency advantages.

China operates with significantly lower domestic ore quality, averaging 30-35% iron content. Chinese domestic iron ore is typically low-grade with high impurities including silica and phosphorus. Consequently, Chinese steelmakers depend heavily on imports of high-grade ores from Australia and Brazil to blend and improve feedstock quality for blast furnace operations.

Australian Iron Ore Strategic Position

Australia holds approximately 29% of the world’s identified iron ore reserves, representing the largest global share with estimated reserves exceeding 50 billion tonnes and economic demonstrated resources of approximately 25 billion tonnes. Most reserves are concentrated in Western Australia, particularly the Pilbara region, which accounts for over 95% of national production.

Operational Maturity and Challenges

Major operations including those of BHP, Rio Tinto, and Fortescue Metals have operated in the Pilbara for decades. Some high-grade deposits are approaching depletion or facing diminishing returns due to increased strip ratios requiring more waste rock removal, greater distances to infrastructure including rail and port facilities, and increasingly complex geology. These factors contribute to rising operational costs unless offset by innovation or new discoveries.

Development Trends and Cost Pressures

New mining developments such as Rio Tinto’s Gudai-Darri and FMG’s Iron Bridge projects face increasing challenges. Capital intensity is rising with new projects often requiring billions in investment due to remote locations, infrastructure requirements, and environmental and heritage compliance obligations. Ore quality in newer deposits is often lower, particularly magnetite projects with reduced iron content requiring beneficiation, resulting in higher energy use and water demand that increase costs and carbon footprints.

Quality Evolution

Australia’s traditional hematite ores have maintained high-grade characteristics around 62% Fe, but newer deposits increasingly include magnetite at 30-40% Fe requiring processing into concentrate. While magnetite can be upgraded to very high iron levels of 68-70% Fe, it presents higher production costs, energy intensity, and is less favored unless carbon reduction becomes a priority for supporting greener steelmaking processes.

Market Dynamics and Strategic Outlook

China remains the world’s largest iron ore consumer, driving import demand particularly from Australia and Brazil. Price volatility reflects steel industry demand fluctuations, environmental regulations, shipping logistics, and geopolitical factors. High-grade ores are increasingly favored for environmental reasons as they reduce emissions and energy consumption in steelmaking processes. Iron ore beneficiation and pelletization are growing as methods to improve lower-grade ores for industrial applications.

Environmental, cultural, and regulatory pressures continue intensifying, exemplified by stricter heritage protection measures following events like Juukan Gorge. The transition to green steel production and ESG considerations pressure mining companies to invest in lower-emission production and logistics systems, shaping future industry development strategies.