2026 ISP represents a steady course

The ISP has been under development and refinement and iteration since 2018. So it’s not surprising this exercise is largely a refinement of previous versions. This consistency of approach is to be applauded. If there is one thing that will help the transition, it’s consistency of planning and policy. In my opinion the ISP remains easily the best planning document stakeholders could wish for. Its weakness is it’s only a planning document, someone else has to implement it.

Transmission is being built, private sector running out of excuses

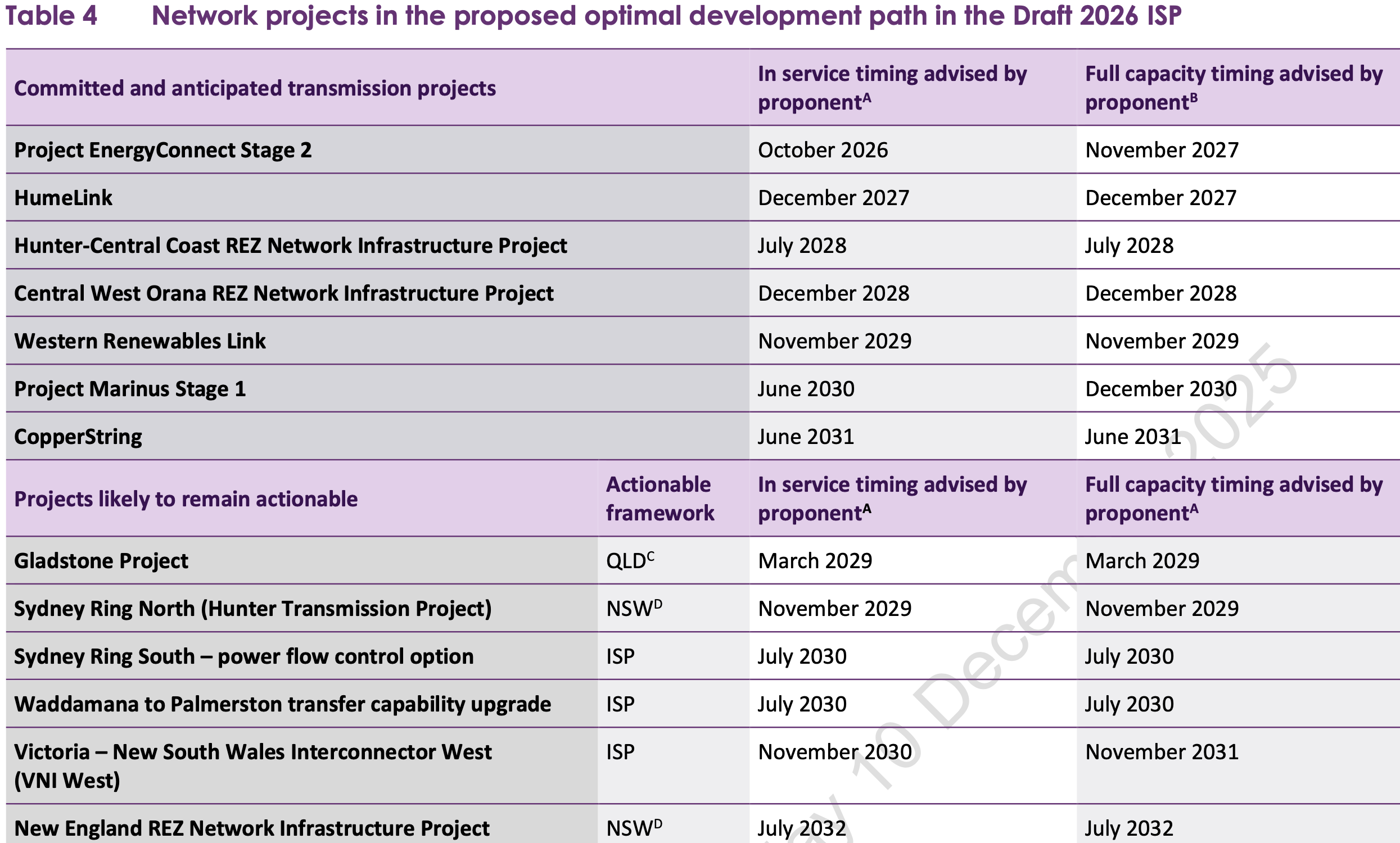

There can no longer be any real doubt about transmission being available in NSW and Gladstone.

Humelink has steel being delivered for the towers as I write this. Long lead items were ordered years ago. It’s happening.

Project EnergyConnect Stage 2 is also getting closer. It will in fact be ready long before any new generation is ready to connect to it.

Ground has been broken on Orana transmission. I get that ground being broken doesn’t equate to delivered on time but so much effort has been invested in this project by so many parties I can’t see it not being on time.

I’m also sure the smaller Hunter project will be ready

Even in Victoria the Western Renewables link will, I am confident, progress. Now that offshore wind is at least a little deemphasised the priority moves back onshore.

Renewable developers, constantly complain that there is too much risk in committing to develop today. First it was transmission and then they also complain that without certainty on coal closures there may be too much supply. In fact it’s the reverse until the big renewable development commissioning dates are certain coal generation cannot close and Australia’s energy security is at risk.

In my opinion the onus is very clearly on the likes of Tilt, Spark, Sommeva, Origin, Iberdrola, Acciona and whatever platform super funds are timidly supporting to actually commit and get the generation built. It is now the big wind and to a lesser extent solar developers that are holding up progress. The simple fact is when the new generation is built its low variable cost will see most of it dispatched and coal generation will close. The ISP is the best plan we have, but in some ways it is as useless as my keyboard ramblings because AEMO has no power to operationalise the plan. For some reason that’s left to the private sector and the private sector has been in the toilet this year when commitment decisions were required.

As regards transmission I’d personally still like to see a doubling or tripling of VNI West and Western Renewables link capacity , more emphasis given Sydney Ring South, and a bigger emphasis on QLD - NSW interconnect.

ISP functions

In my view the ISP serves a number of roles;

It provides a consensus stakeholder view, from an admittedly small 26 strong group, of which development path is likely/preferred. The choices were slow, fast and faster. Over 70% of the 26 selected stakeholders went for fast or faster with 46% in the fast camp. In my personal opinion it’s the revealed stakeholder preference that is just about the dominant achievement of the ISP.

Associated with the above and ignoring costs and any implementation issues, AEMO’s detailed modelling shows that the lights will stay on in a VRE (variable renewable energy) based system despite demand growth and coal going away. The output of the ISP is a system that meets the reliability standard. Despite the best, albeit generally feeble, attempts of the anti renewable lobby, and their occasional scare campaigns about wind droughts no reputable modelling group has ever been able to show that the reliability standard will not be met if the Optimal Development Plan (ODP) is implemented. AEMO provides sufficient data for competent modellers to recreate the outputs using the global gold standard Plexos software.

The ISP identifies the required transmission for implementation of the plan following on from the history of the ISP as AEMO’s transmission planning document. AEMO doesn’t have any meaningful control over the execution of the ISP other than by identifying needed transmission. AEMO’s imprimatur of a transmission line will generally result in the transmission getting built. It’s not quite that simple but that’s where AEMO’s decisions really count.

Methodology

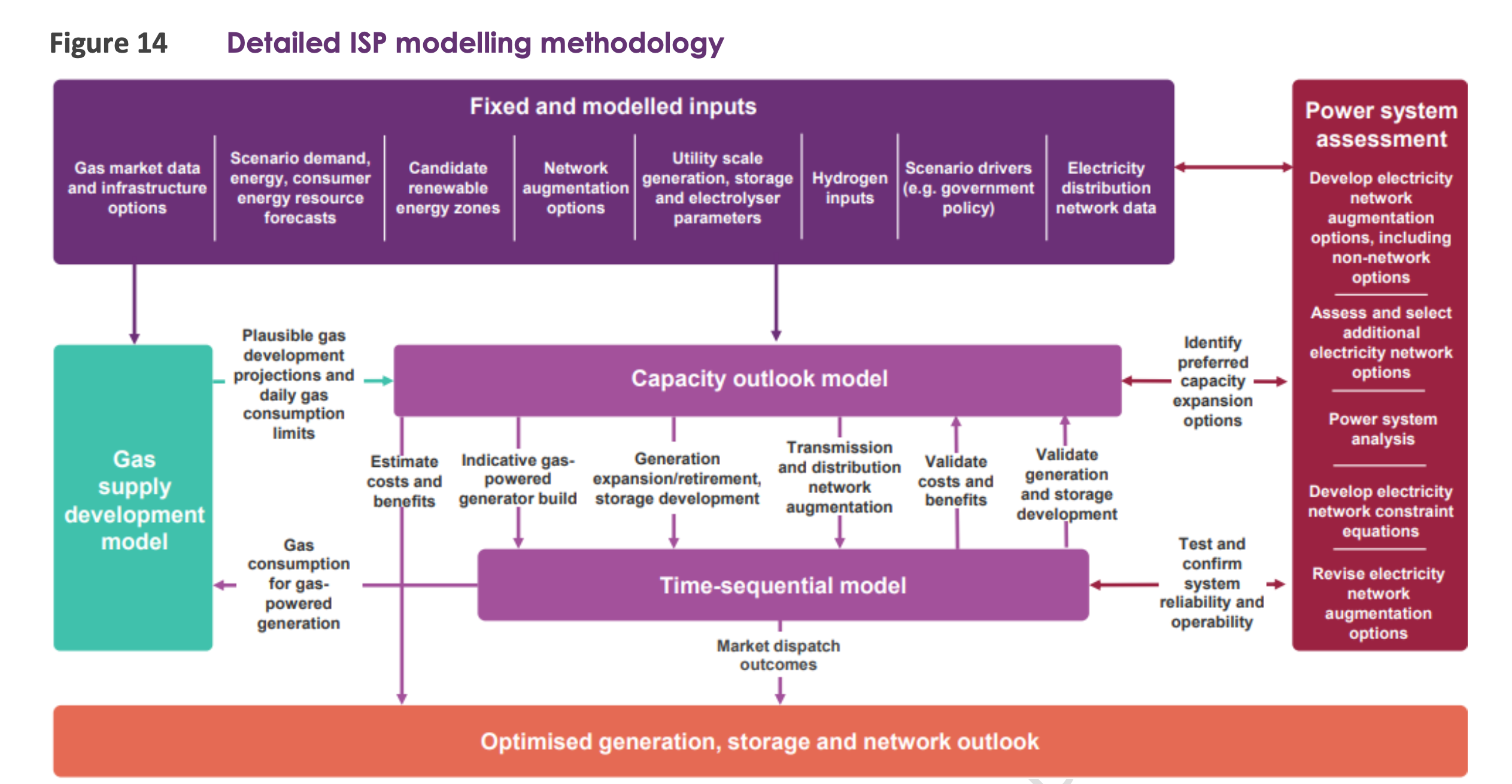

Never mind that this is the 3rd iteration of the ISP so represents cumulatively about 6 years of development and no doubt with under the hood refinements, the overall modelling process is represented below. What’s not shown is a completely separate but ultimately very important demand forecasting process. Demand is discussed in the ISP but here I will just observe that (i) demand and supply are related, sometimes supply creates demand and (ii) errors in demand forecasting will have consequence in over or undersupply with price signals indicating the errors.

Ultimately much of the discussion will be around the output of the capacity outlook model, that is the selected generation and fuels. Not much to say about that, except that given we have to decarbonise and hydro is not a choice it comes down to wind and solar with firming or nuclear. And it won’t be nuclear.

At the margin it’s clear that industry consensus has shifted to more solar and batteries and less wind, but personally I still think lots of wind is both the most economic and lowest risk option.

Less wind GW but capacity factors up.

This ISP models 32 GW of solar by 2030 and 63 GW by 2050, wind modelled is 26 GW by 2030 and 57 GW by 2050 down from 69 GW in the 2024 ISP. AEMO states this is mostly due to AEMO having raised wind capacity factors meaning more generation per GW. Giddy up. Unfortunately as at the time of writing the new wind traces were not available. However I’m pleased they’ve been updated but also note that MLFs and constraints often mean wind as well as solar doesn’t supply all it could.

Gas generations role is only a bit changed from today

My feeling continues to be that the further go down the decarbonisation path, and notwithstanding that gas provides insurance, that nevertheless the role for gas generation even as a power source will decline. In my opinion there is nothing that gas can do that batteries cannot do, provided some batteries were reserved for rationing supply.

Gas generation itself has limitations driven by the capacity of the gas transmission network and whatever the gas storage at generator site is available.

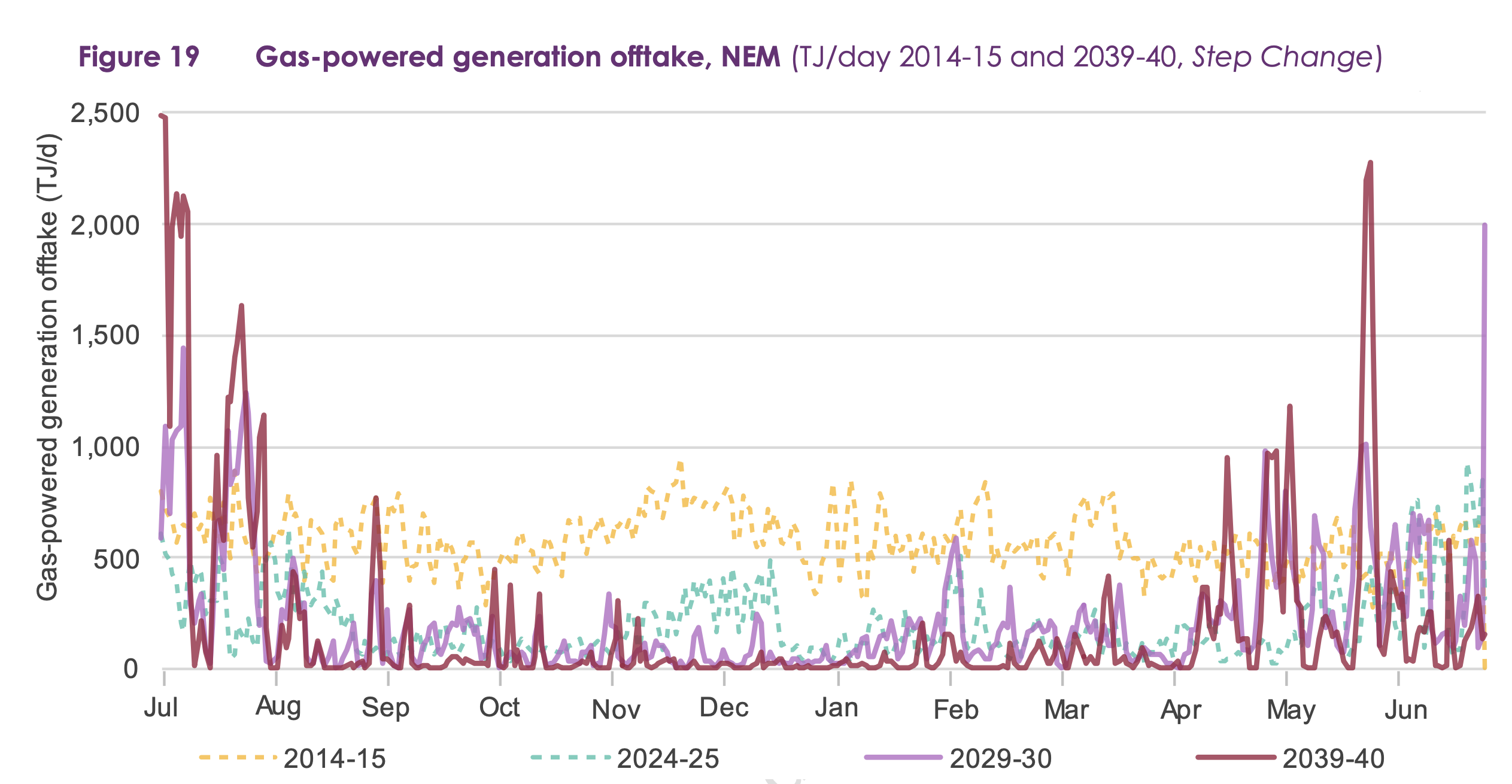

AEMO provided this informative chart.

Focus first on the dotted lines for FY15 and FY25 and notice how by and large how much less gas is being consumed for generation in FY25 compared to FY15, probably more than halved eyeballing the chart.

Then we can focus on the solid lines showing very high gas consumption relative to history for small periods of time in FY40 but most of the time gas generation is even lower than today.

So we have to maintain this great gas transmission network and build new gas generation all to provide power on a strictly limited number of of days. In my opinion it’s a job that could be done at lower overall cost by a reserve class of batteries, batteries that are only used when nothing else is available.

Meantime as we decarbonise and mostly electrify industrial heat the transmission network becomes ever less used and therefore more expensive for the remaining users.

Transmission

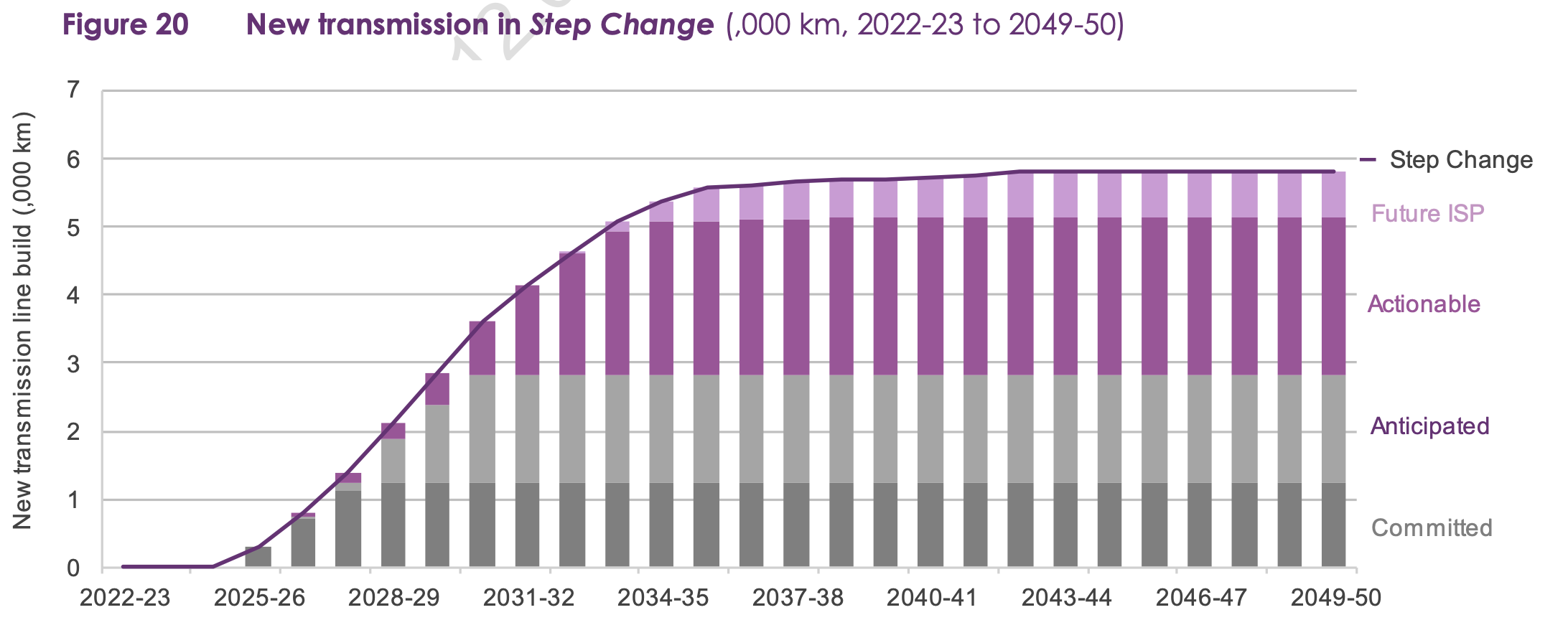

AEMO notes that as of 2022 the NEM transmission network was 43,350 km. All of which was built with hardly a complaint from the regions. Why? Because it meant regional Australia had electricity, something the National Party and its increasingly close ally One Nation, no longer seems to think is desirable. Think about it. 43,000 km built without a squeak. Or how about the distribution network of 764,000 km.

In any event the transmission to 2050, and really nearly all of it is built by 2025 is an additional 6,000 or 13%. Since when has a 13% increase in network capacity ever before been the subject of so much carrying on.

Capital costs and NPV

In my opinion when talking about investments spread out over many years and when you can identify many different costs and benefits and when you ascribing values and choose discount rates, any competent modeller can make the NPV (net present value) sit up and do a song and dance act. Certainly you can come up with the answer the modeller or the modeller’s boss wants to come up with. Done that many times.

That’s not to criticise the approach adopted by AEMO for the ISP in any way. Just to observe that there is a large selection of dials to tweak.

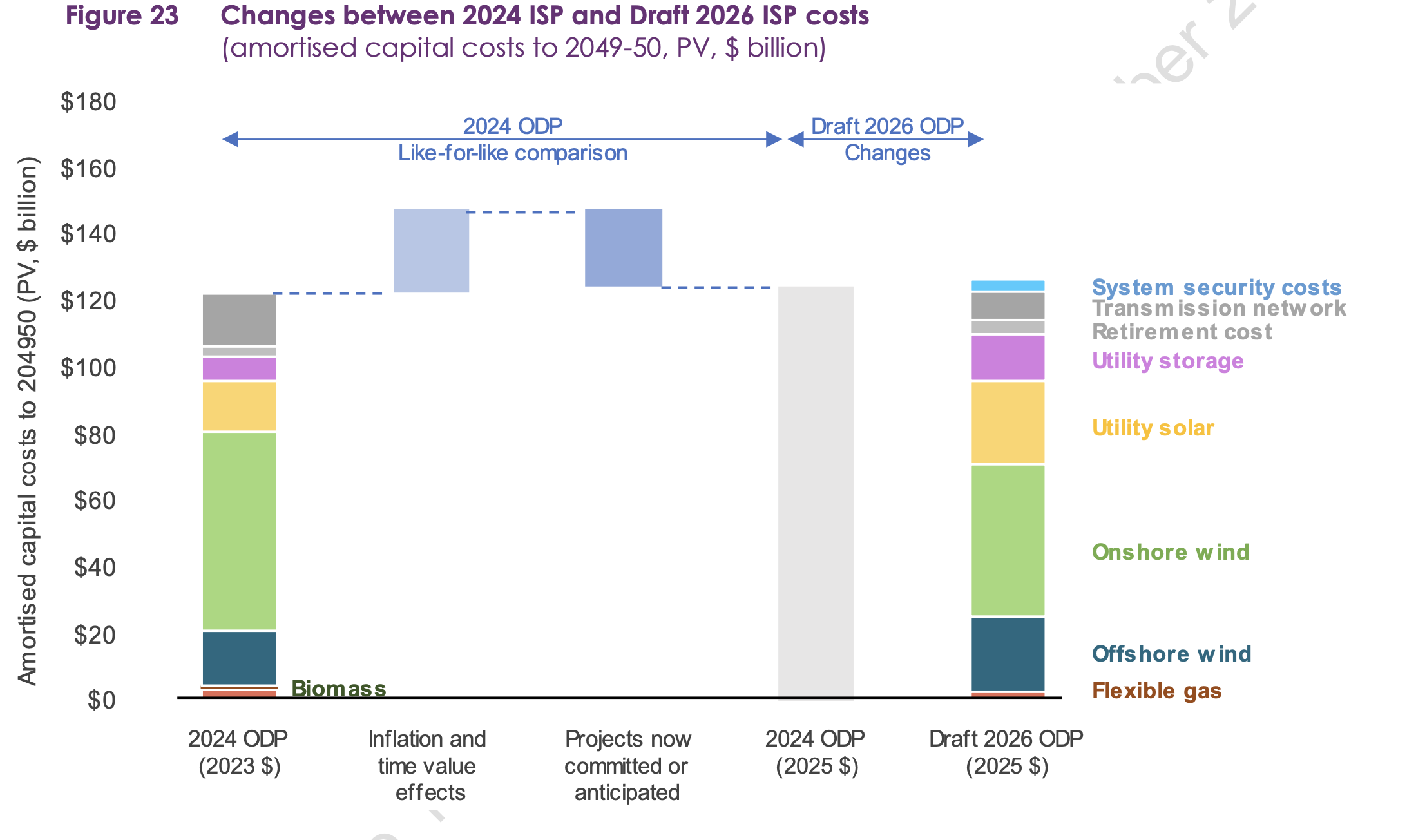

AEMO has done itself proud in putting together a classic management presentation of changes from one period to another via a waterfall chart. The chart shows the present value1 of all the future investment required to achieve the ISP.

The chart shows two things: (1) Inflation and time value raised the cost of the ODP but this was offset by some projects being shifted from “required” into committed or anticipated. In other words the money still has to be spent and consumers still have to pay but the decision has been made and therefore it’s what we analysts call a “sunk cost”2. (ii) the water fall chart breaks up the ODP by component. In this case we can see that offshore wind share of total investment has increased but transmission has gone down. That’s because some transmission is now committed as compared to two years ago and because the offshore wind is due to be built relatively soon and it’s expensive so its PV is high.

I guess the chart also shows that compared with 2024 there is more investment in solar and storage and less in onshore wind.

Demand

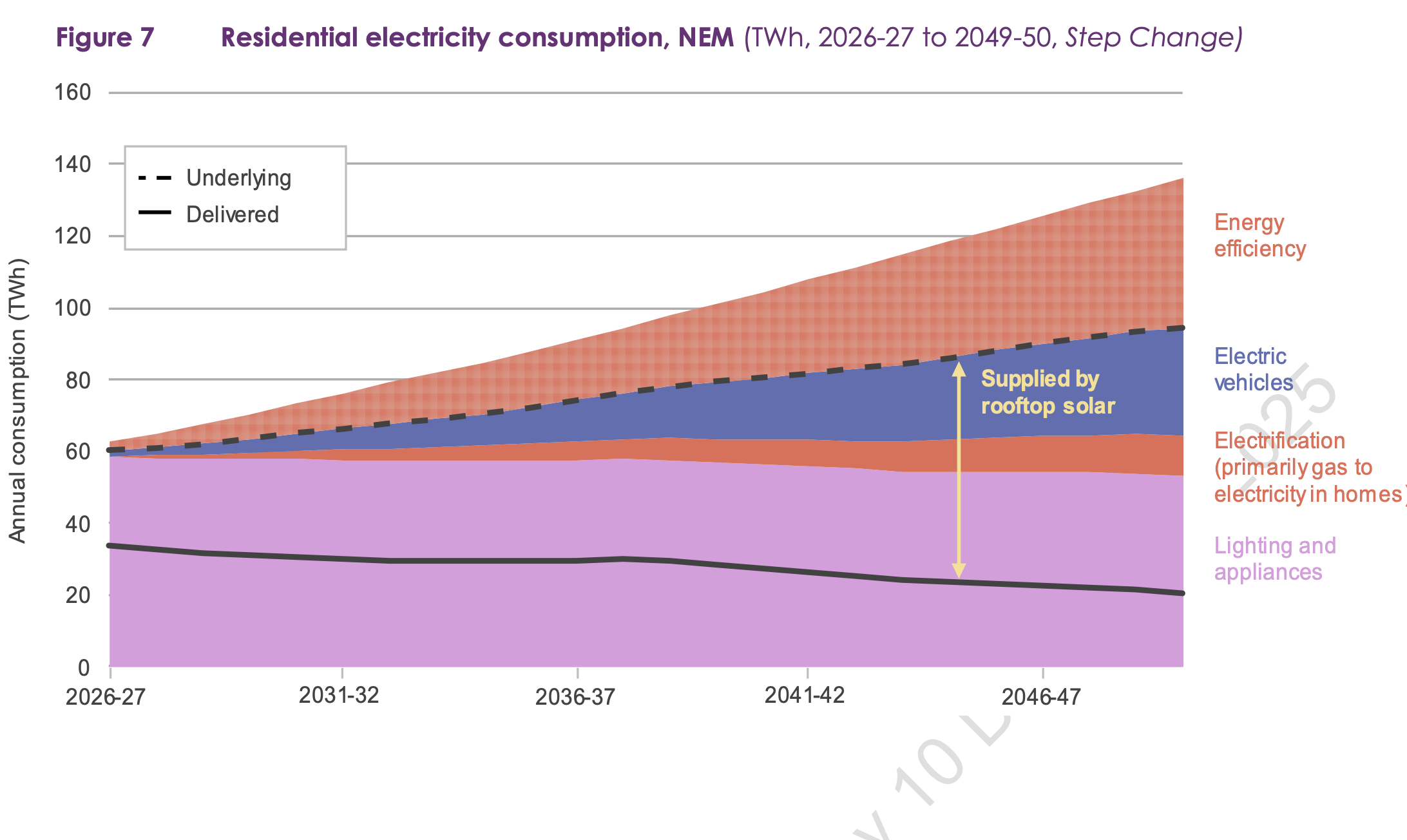

As mentioned demand is a key driver. It’s worth noting that both gentailers and distribution networks historically received the vast amount of their revenue from selling operational (grid generation) electricity to household and small business consumers. But as we all know already and as AEMO shows in the following chart, as likely as not operational volumes sold to the household sector are going to decline, even though households are going to consume more. EVs and household batteries will, as the chart shows, simply make these already massive trends even more so.

AEMO mostly produces excellent charts but unfortunately insist on showing Energy Efficiency on the consumption charts. Energy efficiency is electricity that is never produced or consumed and yes it’s a wonderful thing but it doesn’t belong on a consumption chart, any more than reactive power does.

Nevertheless. For Gentailers and Networks most of their revenue and profit has been derived from selling the black line in the following chart. Both gentailers and networks will have to substantially reorganise their business models to find a way to make money from rooftop solar, EVs and Electrification. They’ve had years to think about it but I haven’t seen a convincing answer.

Equally take a tip from an investment banking research analyst and try to focus on the next 10 years rather than what may or may not happen in 2050.

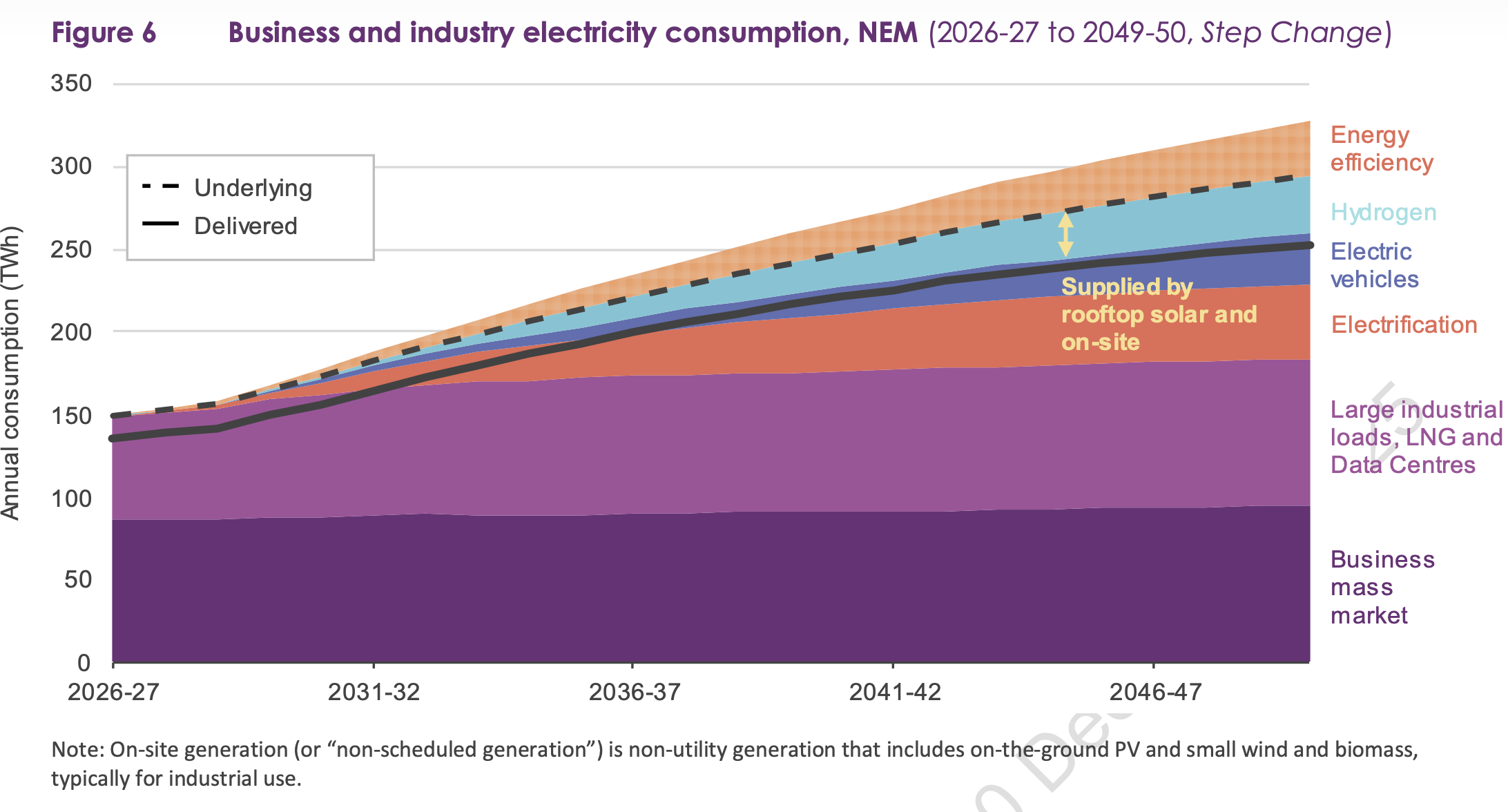

So maybe the focus has to switch to Business and Industry. However historically profit margins in that sector have been more like $5/MWh rather than the $25-$35/MWh or more that scale retailers make from the household sector. The same would go for wires and poles where households are charged at step-down voltage rates, business pays far, far less per MWh.

Even on the business side of things we here at ITK have pulled our hydrogen forecasts down and I am skeptical about some of the large loads. For every data centre yet to be built there is a smelter struggling to stay afloat. Even the LNG loads will wind down over time and, in my opinion, will be much less in 20 years than they are today. Equally coal mining is a relatively large electricity consumer and that is going to decline.

Still there’s plenty of population growth and we are a wealthy country so no doubt new loads will emerge over and beyond data centres.

Footnotes

Note that chart is in PV (present value terms). Present value converts $1 received in the future to $ today based on some discount rate. Eg if the interest rate was 10% what would you pay today for $1 to be received in a year’s time. Answer 1/1.1 =0.909 . You would pay $0.91 because you could invest that today and get $1 in a year’s time. By extension money you will get in 25 years time, that is in 2050 will not be worth much today. It’s why in financial terms claims that the long life of nuclear or pumped hydro plants means they should be worth more, are nonsense. EG $1 received in 60 years time when the discount rate is 10% is worth $0.003 today↩︎

Sunk costs are irrelevant to future decisions. You’ve spent or committed the money and no decision will undo that. The only things relevant to decisions are future costs and revenues. That’s finance 101 as basic as it gets but still we cling onto spending more money because we already spent some.↩︎