Summary

I take a look at AGL’s medium term prospects. In the process I conclude that the CIS will lower electricity prices by shifting risk from the private sector to the Government and additionally will provide a much needed lifeline to the Gentailers to help them extract themselves from the mess they have made for themselves.

That mess is mostly likely to show up in the case of Eraring which I think cant close in 2025, not because there isn’t enough replacement power and energy but because ORG hasn’t contracted anything and there now is nowhere near enough time to procure the power and energy. ORG’s only alternative would be to abandon its large customer business and I don’t think that likely.

AGL’s cash flow and gearing support more investment, particularly over the next two years when AGL will receive the benefit of the high power prices in 2022. However once that benefit falls away AGLs free cash flow will be more under pressure and coal generation volumes and revenues will also fall, perhaps replaced by hard to model battery earnings. There is an emerging view that electricity prices in Victoria will be structurally low at least until all the coal generation has gone. My own view is that the closure of Yallourn will lift prices somewhat. In NSW the consensus is that the closure of Eraring will be delayed beyond Sep 2025.

It pretty much has to be, not from NSW’s point of view so much as from Origin’s. ORG appears to have done nothing to replace Eraring energy and will have to write 15 TWh of replacement contracts at some point. It cant possibly build or sign PPA’s that will be operable by the end of 2025. At least I don’t think it can. ORG can’t for instance sell to customers spot electricity produced at lunch for zero even though it has a battery and knows the lunchtime rooftop energy is there. Its not contractable power to a customer’s standard. As a result Eraring will likely stay open and this will increase supply of both energy and power in NSW putting more downward pressure on Bayswater earnings beyond 2025 and until the Tomago contract expires in 2028.

AGL’s earnings are not defensive though and there is as yet no “story” that would be attractive to a fund manager other than “value” and low gearing.

Consensus earnings

AGL is forecast to earn $1.04 per share in the year to 30 Jun 24 and the same in the year to Jun 25. Although the market likely has no real idea ,EPS for the year to Jun ’26 are forecast to be similar again.

AGL’s most basic valuation metric, the humble but long lived PE ratio stands at about 8.5. Even with interest rates having risen companies that the market likes are on PE ratios of 20. The forward PE for the ASX 200 is something like 16 give or take.

The dividend yield at around 3.5% not that attractive for a value stock.

The argument I have made is that AGL’s customer services business is hard, if not impossible to replicate. Almost no small electricity retailers turn into large retailers. I have argued that a gentailer’s job is to buy long and sell short. For a large retailer this is a low risk strategy because the large number of customers means that there will always be demand even though the individual customer can cancel contracts within 12 months at consumer level and 3 years at industrial level. Because of this guaranteed load AGL, ORG and EA are well placed to take a longer term approach to building the generation portfolio. The can afford to write long term PPAs, to build generation and to manage a portfolio of projects in different stages of development.

All the above remains true but from an investor perspective it is also true that (1) retail profits are the smaller piece of the pie and (2) a significant part of retail profits come from gas retailing and that is not a good business, (3) the retail business has faced the major headwind of behind the meter generation. No Gentailer has so far found the key to making major money out of behind the meter. Indeed ORG reported that its industry leading VPP remains loss making for the moment. Finally on the negative side of things was EA writing down its retail good will.

AGL’s investible cash flow is hampered by Tomago and maintenance

AGL appears to be going through one of its quiet phases. Historically the company has attempted many changes of direction, but ultimately nothing of substance has changed since ex CEO Michael Fraser (now Chair of APA) and Jerry Maycock (now Chair of Transgrid) locked AGL into coal generation via LYA and Macquarie generation investments.

As the EPS chart shows those decisions were successful in the short term but ultimately they condemned the company to failure.

Not only have the cash flows from LYA and Macgen not been reinvested in replacement capacity, the cash flows are likely a lot less than initially contemplated due to the $400 m or more that has to be invested each year to keep the plants running. Indeed forced outages at LYA continue to be an issue.

AGL’s investible cash flow is hampered by Tomago and maintenance

AGL’s free cash flow depends on:

Price received by LYA and Bayswater, but this sensitivity is lowered due to half Bayswater output sold at fixed price to Tomago smelter. Essentially there is around 22 TWh of coal generation exposed to market prices such that a $1/MWh price change is say a $22 m change in ebitda. The sensitivity to currently low Victorian prices is about double the sensitivity to NSW prices.

Volumes: AGL makes close to $50/MWh from every MWh at Bayswater in NSW sold at spot and maybe $40/MWh from every MWh at LYA in Victoria. But actually the sensitivity to hot weather might be doube or treble that because prices at dinner time are so much higher but costs don’t change. Another 1 TWh at dinner time might add as much as $200/MWh or more and that’s $200 m of ebitda. For the six months ended Dec ’23 Bayswater volumes were, surprisingly, down 4% over PCP, but LYA did manage a 10% increase but that just represented a catch up on the poor performance of the Dec ’22 half.

Coal cost change in NSW. Bayswater costs are around A$2/GJ or as little as $20/MWh using AEMO data (9.5 GJ/MWh). However this estimate must be based on old existing contracts and my sense is that over A$100/t implying closer to $4.50/GJ and over $40/MWh is a better number.

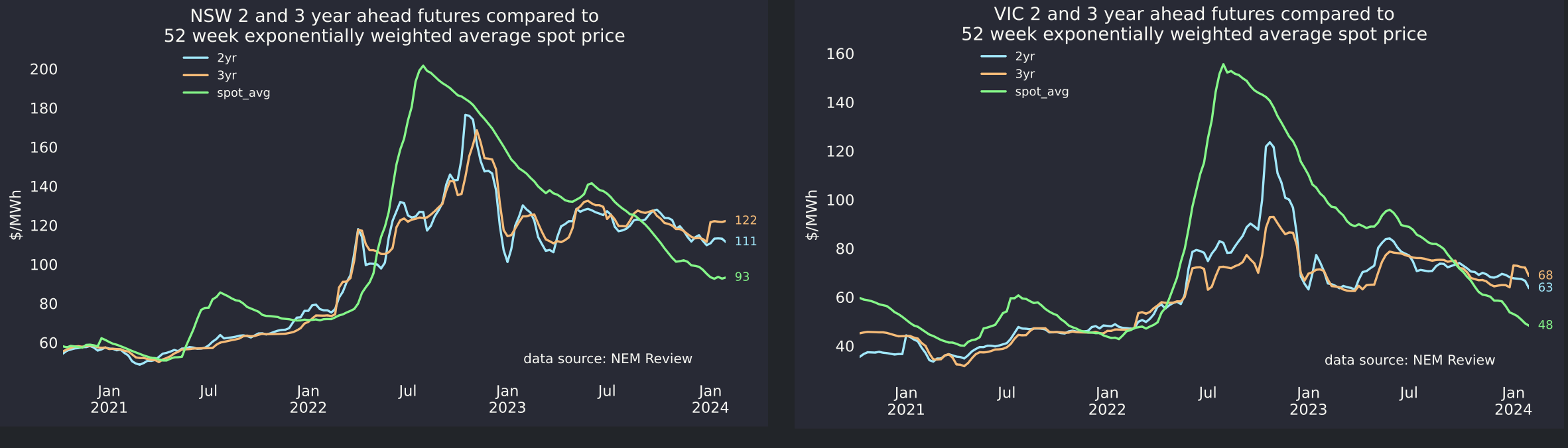

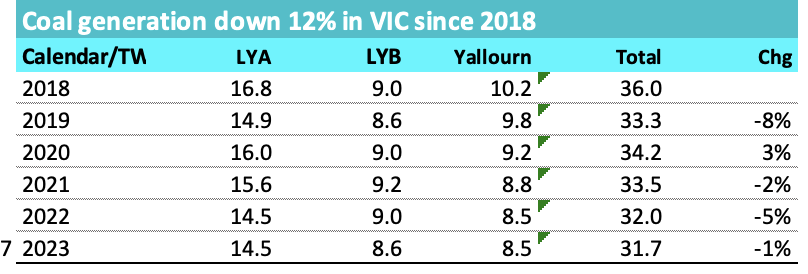

Over the past year coal gen has averaged $110/MWh in NSW and $62/MWh in Victoria. My expectation remains for prices this year to be a bit less.

Figure 1 Fuel weighted prices. Source: NEM Review

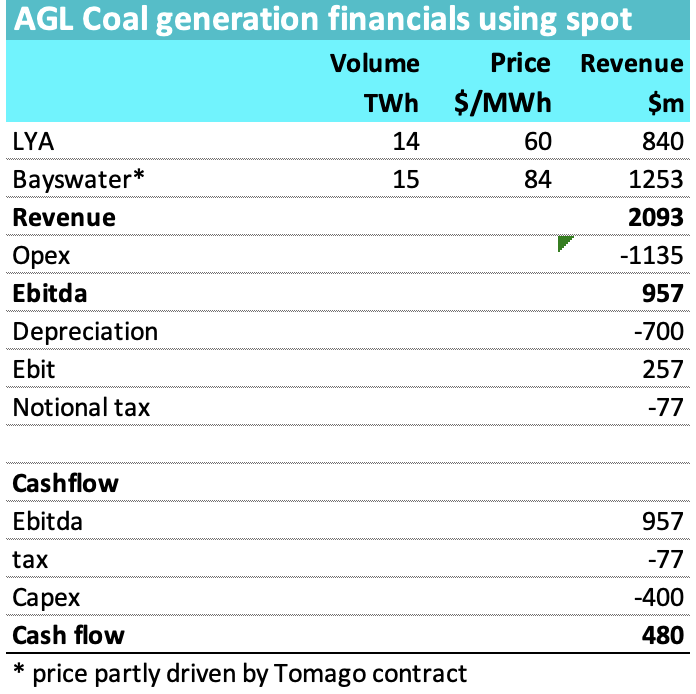

The following table shows an estimate of AGL coal generation financials using spot prices (and spot is a bit below futures in NSW and Victoria) but adjusted for the Tomago price.

I used $2/gj per AEMO for the Bayswater fuel costs and AEMO estimates of other variable and fixed costs.

Figure 2 AGL coal generation cash flow from 2026, Source: ITK

In FY2024 and FY2025 its likely that AGL coal generation cash flow will be about $500-$600 m higher than shown in Fig 2, as a result of contracts written during 2022 and 2023 which will flow into profits in FY24 and FY25. The Winter 2022 price spike can be seen in the following graph that compares spot prices to futures.

Figure 3 Spot and futures prices in NSW and Victoria. Source: NEM Review

Its worth recalling that in NSW significant output is tied up in the Tomago smelter contract which runs until 2028 and in Victoria where pool prices are in any event much lower, some output is tied up with Portland smelter. Those contracts although at much lower than futures prices, nevertheless are stable. In any event barring an always possible system shock such as a major outage, flat load prices will likely remain low in Victoria until Humelink is complete and Yallourn closes. Humelink will, in my opinion, raise prices in Victoria by shifting some South Australian load into NSW, but it’s true that the reverse can happen.

In NSW there is also the obvious possibility of an outage but more supply from QLD should ease pressure even over 2024. Then in 2025 Eraring is still due to close putting pressure back on. Also in NSW it’s unclear whether thermal coal prices will continue to be controlled. Once Eraring closes there is less need for control at least around volume. Equally a slowish China and very strong Chinese domestic coal production point to a stable market. At this stage. Things change quickly.

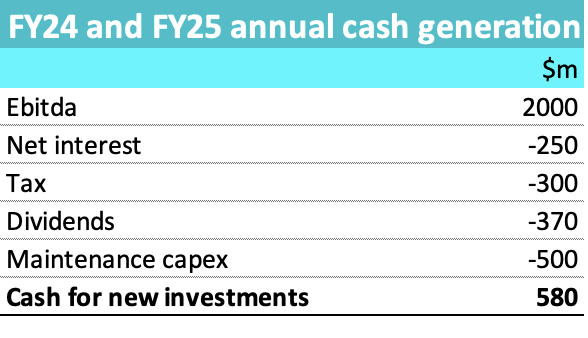

AGL likely has $0.6 bn to invest after dividends in each of the next two years.

Consensus EBITDA is about $2 bn for each of FY24 and FY25. That is higher than my medium term forecast. It does mean that AGL will have perhaps $600 m per year for at least this year and next to invest in replacing coal generation.

Figure 4 Near term AGL cash flow. Source: ITK, Factset

Actually a good part of that, say $400-$500 m is going to the Torrens Island battery.

Conclusion. OK for the next two years but medium term cloudy

At the moment I don’t see there is enough medium term cash flow for AGL to retain its current generation leading position in the market. Nor is it clear that there is a good earnings growth path once contract prices fall back to the futures level and volumes come under more pressure. There will be earnings from the Torrens Island battery but not that much else right now.

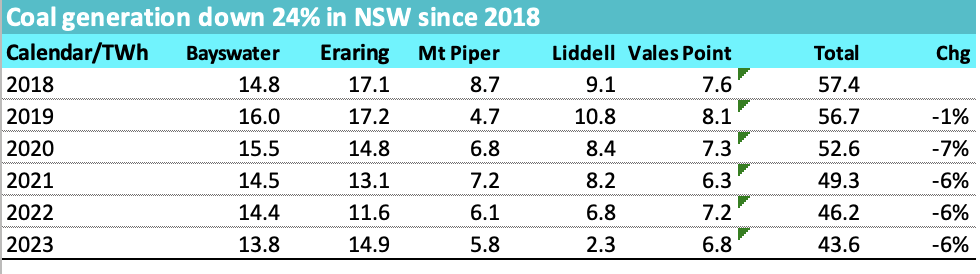

NEM coal volumes keep dropping leading to generation closures

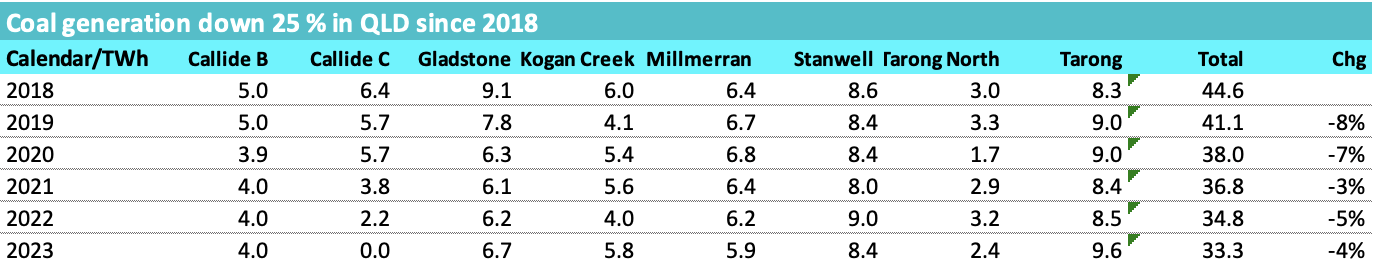

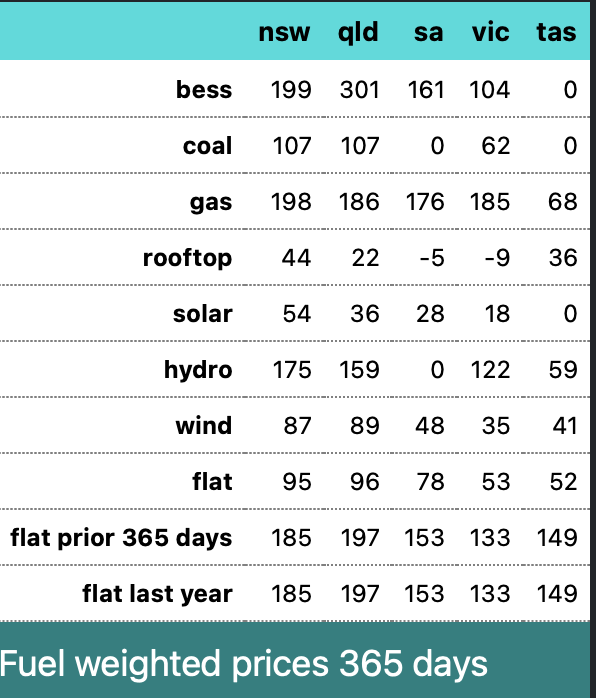

Volumes in NSW and QLD are down 25% from 2018 and 12% in Victorica

Figure 5 NSW coal generation. Source: NEM Review

Figure 6 Victorian coal generation. Source: NEM Review

Figure 7 QLD coal generation. Source: NEM Review

What stands out is the overall consistency of the volume decline. This is obviously because NEM demand has been flat and renewable supply has been increasing.

So for AGL the two great hopes in the next five years are the closures of Yallourn in Victoria and Eraring in NSW. The closure of Yallourn is more or less certain but Eraring much less so.

In fact I’d argue that Origin has basically created a situation where Eraring can’t be closed, and that’s because Origin has done

AGL and Tilt

Tilt has a new Chief Executive, with expirence and knowledge of AGL. Its possible that Tilt may therefore have some change of policy or emphasis. Nevertheless it’s expected that as Tilt develops new projects, project output will or must be offered first to 20% shareholder AGL. The 1 GW Liverpool Range project is likely the first of these to be announced. The project falls in the Orana REZ from which transmission is now secured or at leas the price for connection can be agreed. Liverpool Range capital cost is likely closer to $3 bn than $2 bn once construction interest and pre FID costs are accounted for.

Even so AGL’s share of the equity is likely to be well within its annual free cash flow capability.

From its role as Liverpool Range’s off taker a 1 GW wind farm with a capacity factor of 34% is going to produce about 3 TWh of energy, and at $70/MWh that’s $210 m of commitment per year and over 15 years thats a $3 bn gross liability, maybe half that in present value terms.

Liverpool Range, even if committed in FY24, as is possible, won’t be in operation until FY27

AGL needs 18-24 TWh representing around 8-10 GW of wind and solar to replace LYA and Bayswater. Likely there will be some loss of generation market share along the way. It’s hard to see AGL continuing to be the sole supplier to Tomago. It’s not an arrangement that seems to suit either party particularly and has become more problematic for AGL post the closure of Liddell as Tomago notionally represents more than 50% of Bayswater output.

AGL and and the Capacity Investment Scheme

It’s no secret that lots of new wind and solar is and will be built. The question is what does that mean for AGL.

In the first instance it likely means that Bayswater and LYA revenue will fall and unit costs will rise. That’s because the new supply will see volumes falling to the minimum viable level during solar hours and prices also very low. Competitors with higher costs, Yallourn and Eraring will close sooner and may relieve the volume but not the midday price pressure.

In any event my conclusion is that the CIS provides a pathway for the Gentailers to get out of the mess they have made for themselves, and they should, but probably won’t, be grateful to Chris Bowen.

The CIS will put downwards pressure on electricity prices

The most fundamental feature of the CIS is that the Commonwealth and State Goverments will bear more of the risk of building new generation. Because they will guarantee a minimum floor price, developers will not low or negative price risk. That means that the cost of capital for the project can be lower because the risk is lower. Because the cost of capital is lower the required price to earn the cost of capital is also lower. In this way the Commonwealth will both be taking on risk on behalf of producers and consumers but acting to put downward pressure on electricity prices. Likely this will take some time to become clear.

Taking some risk off the table will tend to increase supply and this will be evident in responses to the CIS tenders the first of which is due mid calendar 2024.

The new supply will be sold to the Gentailers including AGL, ORG and EA and that in turn will enable them to close their coal stations with more certainty. In AGL’s case it will also likely mean some loss of relative profitability as its cost base is unlikely to be any better than that of its competitors.

Eraring cant close in 2025 (fiscal 2026) because ORG hasn’t replaced its energy

ORG recently invested $530 m increasing its stake in Octopus to 23%. This may or may not be a good move for the shareholders but its $530 m that won’t be invested in its Australian energy markets business.

Eraring provides around 14 TWh of energy and as yet ORG management have made no formal statement of how the energy from Eraring is going to be replaced. It’s very clear that it cant be replaced by new build in NSW if the station is to be closed in September 2025. Equally it’s not clear whether the energy in NSW can be bought from other parties. It is possible that ORG management have already bought over the counter contracts with other generators. However there is not much visibility around this and I regard it as unlikely.

The NSW Govt is possibly negotiation some capacity payment with Eraring but in my opinion its of insurance value only. Market forces will ensure that Origin management keep Eraring open long enough to ensure that most of its energy can be replaced. Origin is not a fly by night operator and has strong obligations to its residential and commercial customers. Since it has done nothing to buy or build replacement supply it therefore wont close Eraring.

From AGL’s perspective if Eraring closure is delayed then the extra supply will intensify the pressure on all players and average prices in NSW will be lower.

Similarly in Victoria EA has done little to replace Yallourn’s energy. In common with AGL and ORG its strategy appears to be based around buying energy and providing the firming required. In Victoria though there is more visibility on new supply and prices are low. Its presently a buyers market.