NSW coal spot profits set to fall 30%-40% thanks to batteries

As discussed below, the volume impact is bigger than the price impact. There are a number of gross assumptions in the note below but I don’t think they detract from the message. Batteries are going to kill coal generation profits as well as gas. They may do more damage to coal than gas.

Although I illustrate this with NSW, the impact in QLD will be just as big most likely.

Batteries take volumes, not just price

In the previous note, I discussed the history and recent coal generation outcomes with a particular focus on NSW. A comment was made—and I paraphrase—that batteries wouldn’t change average prices very much, because they only impact at peak.

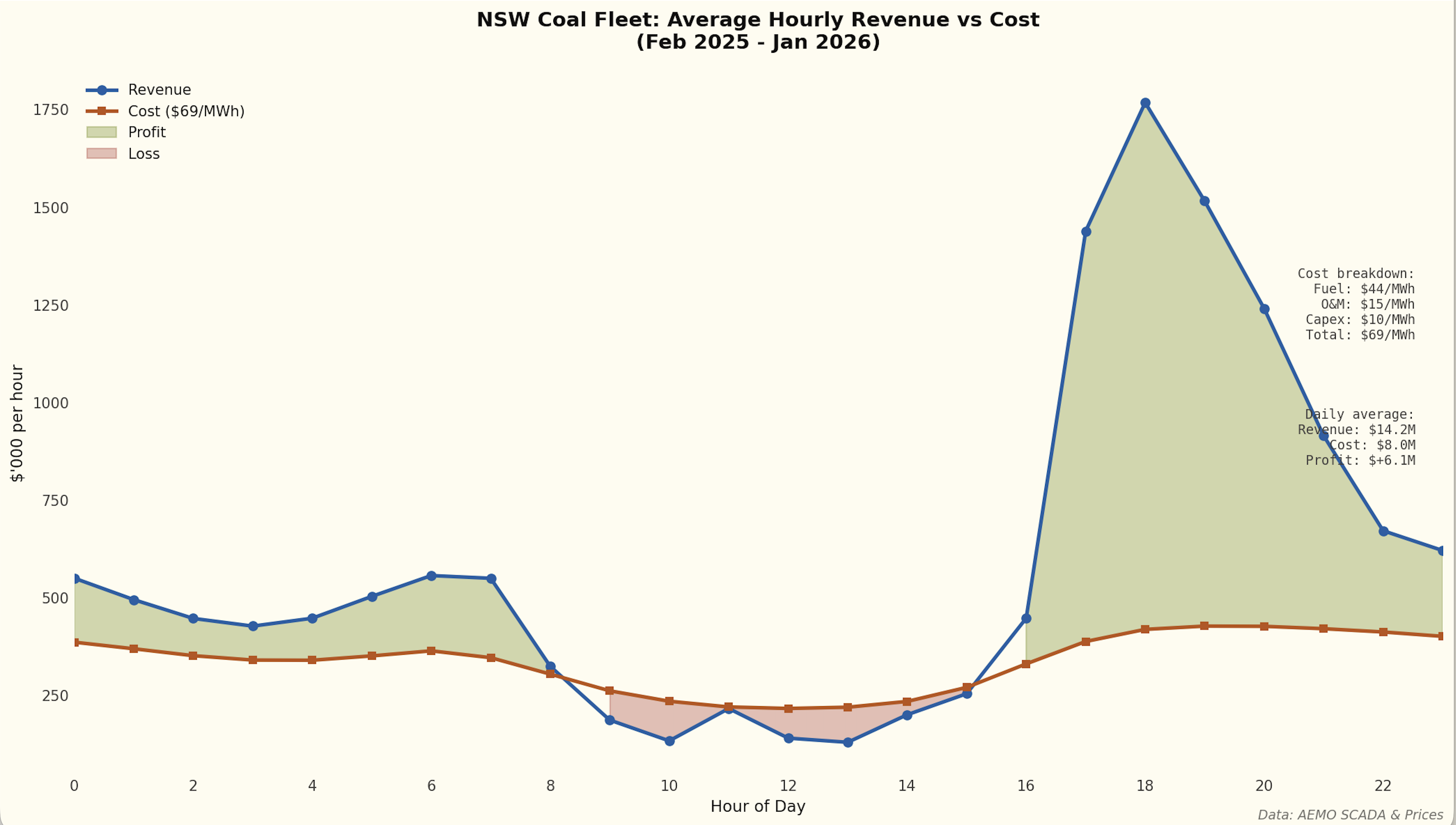

A plot from yesterday’s note illustrates this.

Futures prices are sitting at around $100/MWh and even if that’s a natural contango, it still suggests plenty of price for coal generators.

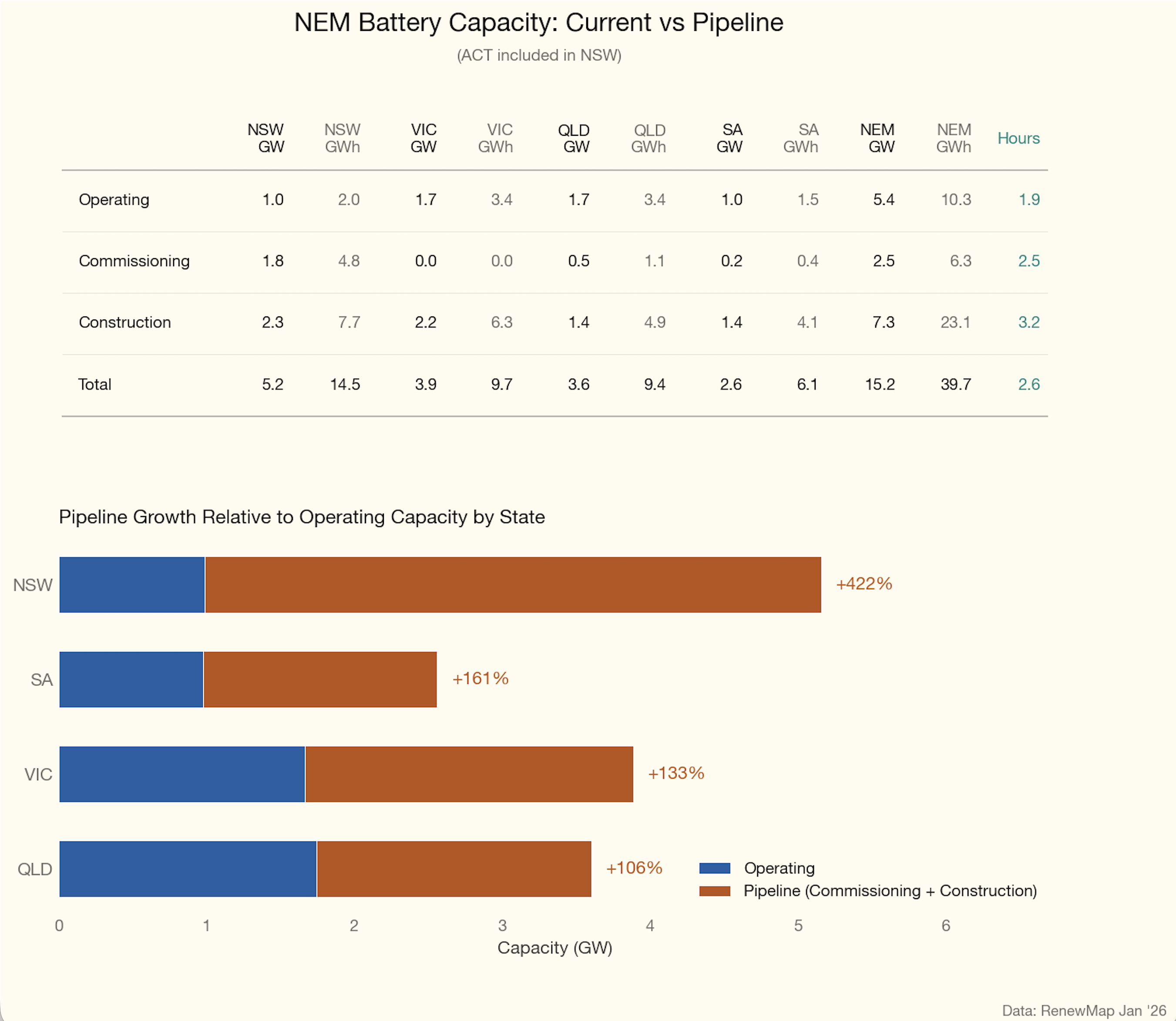

We do know that about 3.5 GW of new batteries are coming to NSW or even more.

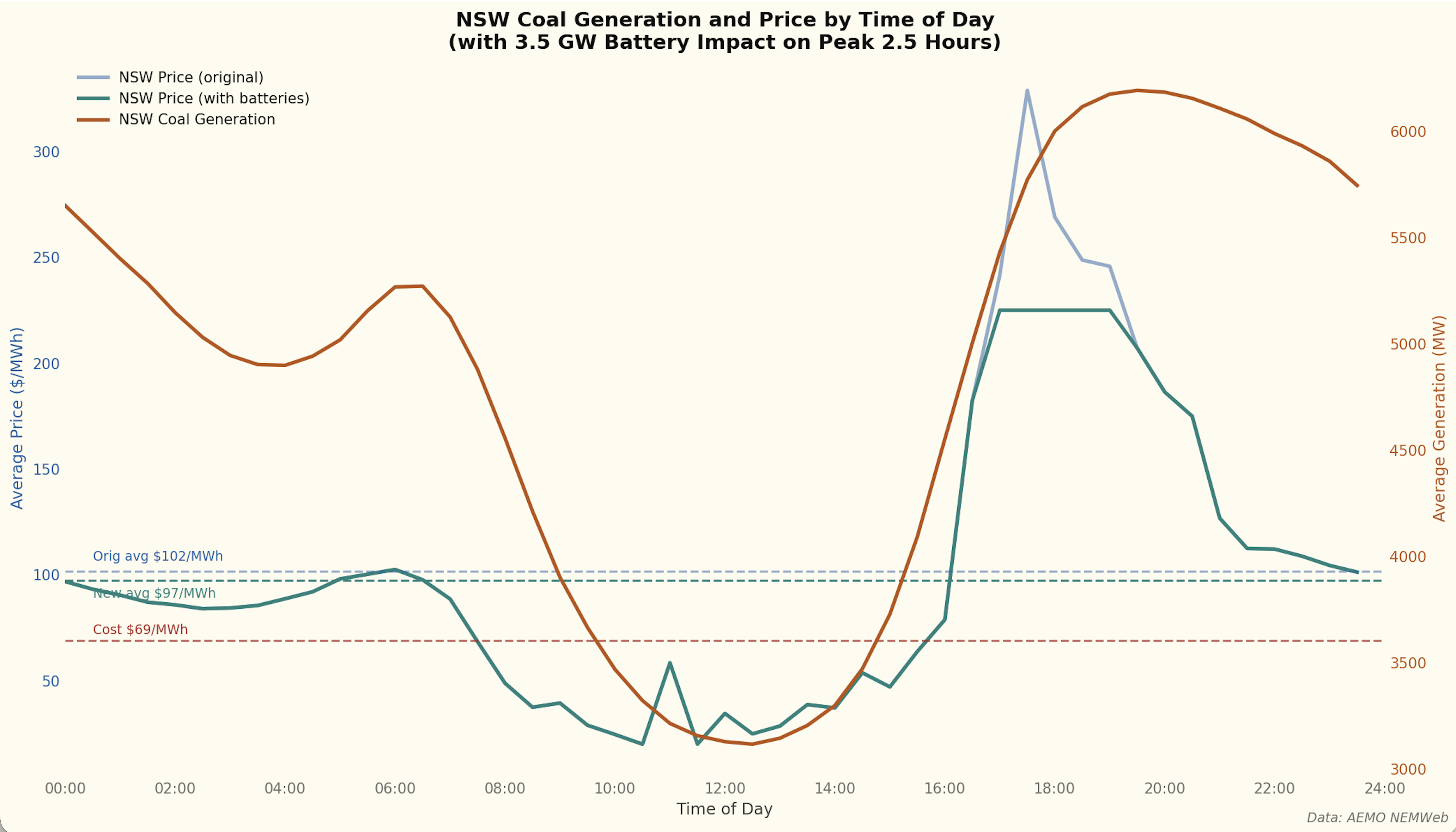

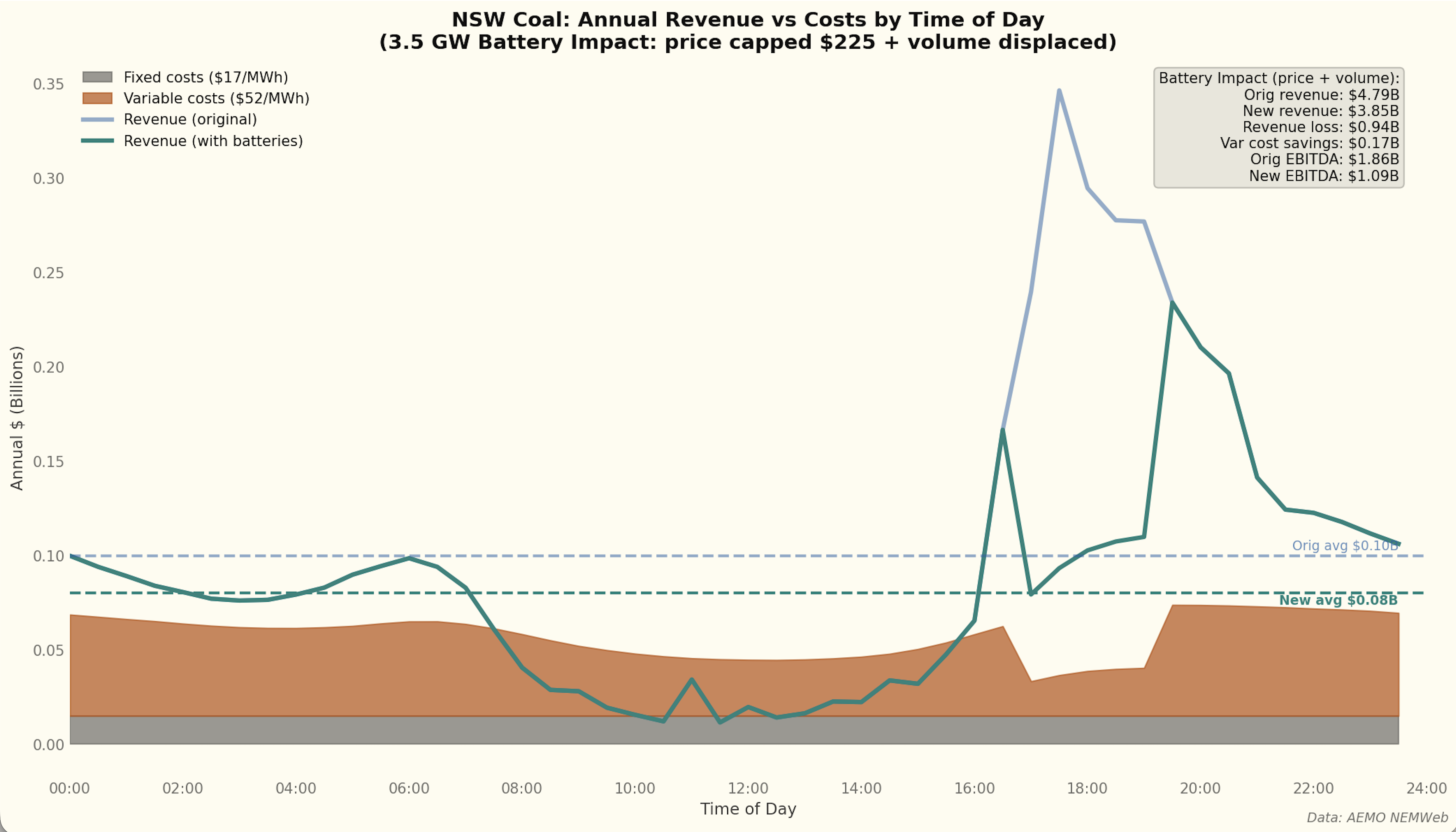

So how will that impact profits? The first step was to think about spot prices. I assumed that this amount of batteries would be enough to see average evening peak spot prices in NSW no higher than $225/MWh but you can make your own number up. This only reduces average price by about $5-7/MWh.

However, if we assume that coal bears all the volume loss, and it won’t—hydro and gas will lose some as well but let’s put it all on coal, then notional spot profit in $bn can take up to a 40% hit.

If you also take account of depreciation, fairly high as end of life approaches, accounting profits are not looking so good.

Of course it won’t work out like this; the idea is just to sketch out the impact of batteries in broad strokes. Although we think about price, it’s the impact on volumes and revenues that matters more.