The CIS will be a failure if projects awarded a CIS contract aren’t built

It’s a pretty obvious criterion. We can go further and say the scheme is a failure if the projects aren’t operating by 2030. The Government has been reasonably explicit that the CIS was designed to assist Australia in reaching the 80% by 2030 target. A target that most of us agree is more essential than desirable for the benefit of the future generations.

The CIS looks more like a participation certificate than a policy.

At this particular moment the CIS is looking like a paper tiger, a typical example of the road to hell being paved with good intentions. Whether the CIS should support equity as well as debt can be debated. In my view equity support is needed if projects are to proceed in a timely and steady fashion. Nevertheless whatever the specific aim is, the program needs to be well executed if it’s going to help. And in my opinion the evidence to date is that execution is weak.

Equally it is fully proven via Agency Theory that disclosure reduces risk and tends, in my opinion, to be associated with good long term performance. Corporate Law, means that good and increasing disclosure is compulsory for listed companies . When you are flying high and results are fantastic investors will overlook many things. When things turn sour and friends are hard to find then good disclosure, diligence and efficiency become a lot more important.

The Goverment though seems to regard disclosure as bad. But in the end the same rules apply. If things go well efficiency and disclosure are irrelevant, when things go badly the fact that the Government has executed poorly and discloses as little as possible makes things worse.

Of course there is a time for secrecy when developing new products or making big changes but that is completely different. Disclosure though is only one area where the CIS falls short. The second area (and I didn’t realise this when it was announced as the replacement for the RET, so I plead guilty) is it doesn’t create any demand. The RET created demand. It turns out this really matters. The CIS leaves all the onus on suppliers to take the risk of building. Gentailers can and do sit on their hands.

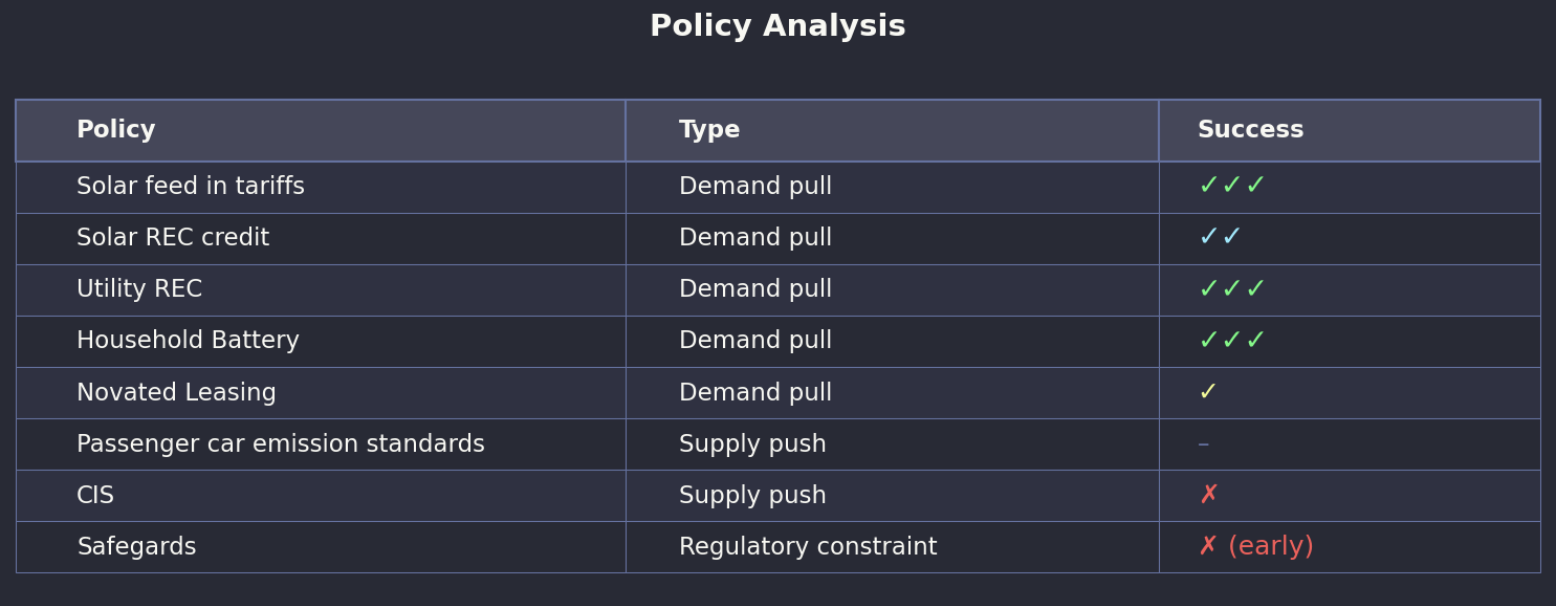

And when I analyse the decarbonisation policies in Australia, or at least those that don’t involve say the CEFC and low cost financing, what I see is that policies I label “demand pull” have been successful.

Politically of course demand pull policies are also successful as definitionally they pull people towards the policy.

CIS criterion - does it lead to projects getting built

So I only really have one success criterion for the CIS: does it result in projects getting built. Other goals are important, social acceptance, value for money, first nations and so on and so forth but in the end none of the other goals have any relevance unless the project actually gets built.

Coal plants can’t close, we can’t decarbonise the electricity system, or electrify everything unless new supply gets built.

The Federal Government can’t meet its 80% renewable by 2030, a scant 5 years away, unless new supply is built.

Electricity prices won’t fall until supply exceeds demand, and suppliers compete to be dispatched.

It’s why I don’t really care about “solar soaker”, it’s why there is no point in doing much analysis or writing anything. All the talking has been done, but there is nothing happening.

In particular CIS awards are handed out like participation certificates at the primary school athletics carnival. Developers spend endlessly long hours submitting bids but whether they win or don’t win it makes no difference. Still nothing happens.

As a reminder for the two CIS energy tenders a summary of the awards is:

Of that total two solar projects are in construction or operating totalling 500 MW.

We have to have wind

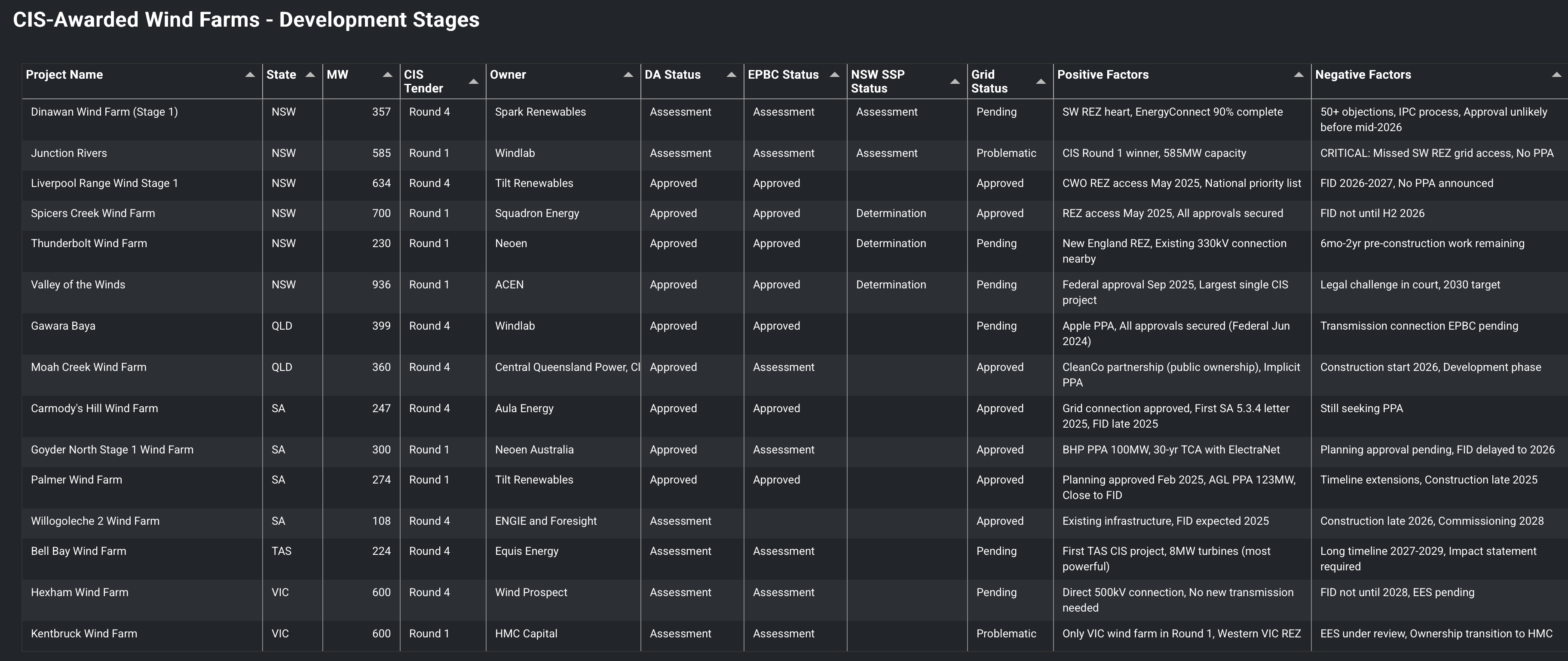

As I and anyone else interested in wind projects knows, they are slow to get going with only Palmer set fair. I did an updated desktop update of the 15 wind projects so far awarded a CIS, half of the capacity is in NSW, and vital for replacing the NSW coal stations.

Unsurprisingly the conclusions are unchanged from prior analysis. You still need faith because there is nothing in the actual table to inspire confidence.

CIS issues

There are a number of problems with CIS execution in my opinion. However they boil down to my own simple view that lowest price is often not best value. My guess is that the CIS projects winning awards are mainly winning on the basis of price. However in my opinion the awards should mostly be done with a view to the timely building of high quality projects and providing sufficient support to be confident that the projects will be built. My perception is that the idea of getting projects built has been completely lost in a bureaucratic fog of form filling and a selection team obsessed with cost over value.

A poorly advised and damaging lack of price disclosure

However none of us really know what criteria the Dept is actually using or indeed what the prices are because no price data is disclosed. That’s just plain dumb. Below is a summary, and yes I used an LLM to assist, of why not disclosing price info after the auction is regarded as inefficient. Essentially the market keeps operating in a fog. There is quite a bit of academic literature on auctions, but apparently people in the Dept either haven’t read the literature or don’t understand or are too scared of doing the wrong thing and thus end up doing it anyway.

Over and above the summary presented below, blind Freddy should understand that when you disclose information you build trust and when you don’t disclose you build mistrust.

And if the CIS doesn’t even get the basic point about price disclosure and market efficiency it sure as heck increases my mistrust in the entire process.

Overview

In repeated sealed-bid tenders with no post-event disclosure—such as the Australian Government’s Capacity Investment Scheme (CIS)—bidders receive no information about winning bids or competitive intensity. This absence of feedback affects strategic behaviour in subsequent tenders and leads to outcomes that differ significantly from transparent auction systems.

Key Effects of No Post-Event Disclosure

Limited Price Discovery

Without information about previous winning bids, firms cannot update their expectations about the competitiveness of their offers. This maintains wide uncertainty about rivals’ cost structures and bidding behaviour.

Higher Expected Prices

Uncertainty encourages bidders to maintain larger risk margins, resulting in higher bids on average. In transparent auction systems, publicly disclosed winning prices tend to push bids downward over time through competitive convergence.

Limited Learning Across Rounds

Bidders do not learn whether they were close to winning or far from contention. This prevents strategy refinement and results in each tender being treated as effectively independent.

Reduced Entry or Sporadic Entry

New entrants lack benchmarking information, increasing perceived risk. Existing bidders may also alter participation unpredictably because they cannot judge whether their bid strategies are effective.

Inhibited Convergence Toward a Competitive Equilibrium

Transparent repeated auctions often converge toward an industry-wide expectation of competitive pricing. In opaque tenders, there is no market-wide signal that disciplines bid levels.

Comparison With Systems Using Disclosure

United Kingdom – Contracts for Difference (CfD)

The UK CfD scheme publishes bidding statistics and clearing prices after each round. Over time, this transparency has produced:

- Significant convergence in offshore wind strike prices

- Increased confidence among new entrants due to clear benchmarks

Of course prices have now gone up because that is the lived experience but the data is still available

Brazil – Energy Auctions

Brazil’s transparent descending-clock auctions reveal information during and after the auction. These auctions have demonstrated:

- Rapid price discovery

- Strong new entrant participation

- Substantial reductions in renewable energy contract prices over multiple rounds

European Renewable Auctions (Germany, Denmark, Netherlands)

Most European jurisdictions disclose winning bids and, in some cases, full bid distributions. These systems show:

- Progressive price reductions

- Stable, predictable bid clustering

- Lower risk premiums demanded by investors

Implications for CIS and Similar Tenders

The absence of post-event disclosure in the CIS maintains strategic uncertainty and reduces bidders’ ability to learn. This typically leads to higher bid prices, wider dispersion in submitted prices, and less efficient competitive dynamics when compared with transparent international renewable procurement systems.

CIS design is one issue but the market isn’t clearing

I’ll come back to the CIS because it will be a failure if most projects that get a CIS award aren’t constructed. It’s like a war you kill or be killed. Build or fail.

The issue is why a CIS was needed in the first place. And the answer is it was needed because wind and solar projects weren’t getting built.

For years the problem was a lack of transmission. At least in NSW one way or another that issue is I think fixed, or at least sufficiently fixed via Project Interconnect, Humelink, Oranalink so it’s not the immediate barrier.

Another problem is getting the Regional Communities lead the renewable development rather than have it pushed on them, but though that may raise costs it doesn’t generally stop development without the Government stepping in, as it’s done in Queensland.

In my view the real problem is that the increase in capital costs has made wind look expensive to off takers and since they aren’t forced to buy, they are simply staying home.

Again I’ve been through the capital cost data, such as it is, previously and see little point in revisiting it again. My summary: wind costs have increased a lot, particularly in Australia.

Equally we are doing wind development in a stop-start fashion which is completely sub optimal. It seems obvious to me that we should develop wind farms sequentially, perhaps two or three at a time in parallel with a fully employed work force that just moves from one project to the next without pause. Over time this would increase productivity.

I retain a view that overall there is good scope for wind development costs to fall in Australia. In my view a well executed program could see average costs for the remaining task at say $3.5 m maybe less per MW. Thats in contrast to what some quote as high as $4.5 m/MW. The latter figure is completely out of line with global averages even allowing for an Australian premium, and so far no wind farm has the go ahead with those kind of costs.

Appendix: Foundational work

Meantime some foundational work is being done that should help the industry in NSW: logistics.

This article draws very heavily on a piece by icecubed

I start with an extended quote:

Typically, a wind farm deploying 5 or 6 MW units will require the delivery of about 5,500 tonnes of materials per turbine, or 925 tonnes per MW of installed capacity. The internal access road network is typically in the range of 1.5km per turbine and is built to cater for mobile cranes operating on axle loads of up to 36 tonnes. Of these constituent materials, approximately 20% of the vehicle mass moved is turbine componentry. The remaining constituent materials are consumed or utilised during the construction of the balance of plant.

The balance of plant elements for a wind farm refers to the roads, footings, crane hardstands and electrical infrastructure needed to connect generating units to the power grid. Electrical infrastructure comprises approximately 10% of the freight task. The vast majority of this is the thermal bedding sand needed for underground cables. Pavement materials for the construction of roads and hardstands is the largest contributor to offsite road impacts at 35% of loads and the remaining 30% is associated with concrete and reinforcement for foundations. Construction water is the most significant variable, approximately 5% of the freight task is used for supply needed for the processing of earthworks, dust suppression and concrete production. Despite their significant size and weight, the primary impact on road infrastructure is not due to the transportation of turbine components. They only occupy a small proportion of the overall freight task.

So for 1000 MW about 1 million tonnes of materials. And 20 Mt for 20 GW across the NEM moving say on average 300 km (wild guess). Reading the Icecubed piece alerts me to the water requirement something I’ve not previously thought about, and talking around the industry alerts me to the hard stands required for crane pads.

Problem - Wind turbines are hard to move from port to site.

Modern 6 MW wind turbines are oversized and overweight (OSOW) arguably much like most of us. This presents significant logistical challenges. So the wind turbines and blades are only a minor amount of the freight task in terms of tonnage but they are a big part in terms of the permitting and road management. Not the only one though, movement of the crane and other heavy machinery also requires OSOW transport arrangements.

Rotor & Blades

For example, the Vestas V150-6.0 MW has a rotor diameter of 150 m (i.e. each blade is about 75 m)

Other 6 MW / near-6 MW designs use rotor diameters in the range ~140–160 m (or sometimes slightly less, depending on site constraints or segmented blades)

So you might expect:

Blade length: ~70–80 m (for a 150 m rotor)

Blade weight: on the order of 20–40 t (depending on design)

Rotor hub / hub + blade assembly combined is also considerable mass (hub, bearings, root attachments, etc.)

Tower

The towers are usually tubular steel (or hybrid) sections, often delivered in segments (e.g. base, middle, top) because of transport constraints.

- The hub heights for 6 MW turbines are often in the range 100–160 m, depending on the design, site wind regime, and constraints. For instance, the V150-6.0 offers hub heights of 105 m, 125 m, 148 m, 155 m, 166 m (i.e. depending on site variant)

- The bottom (base) diameter of the tower can be quite large (several meters). Because of road transport constraints, towers larger than ~4–5 m diameter become difficult to move in one piece.

- Tower sections can be very heavy; individual sections (especially the base) may weigh tens to over 100+ tonnes each, depending on size and thickness. The entire tower (all sections) may weigh a few hundred tonnes or more in modern large turbines (for 5–6 MW scale)

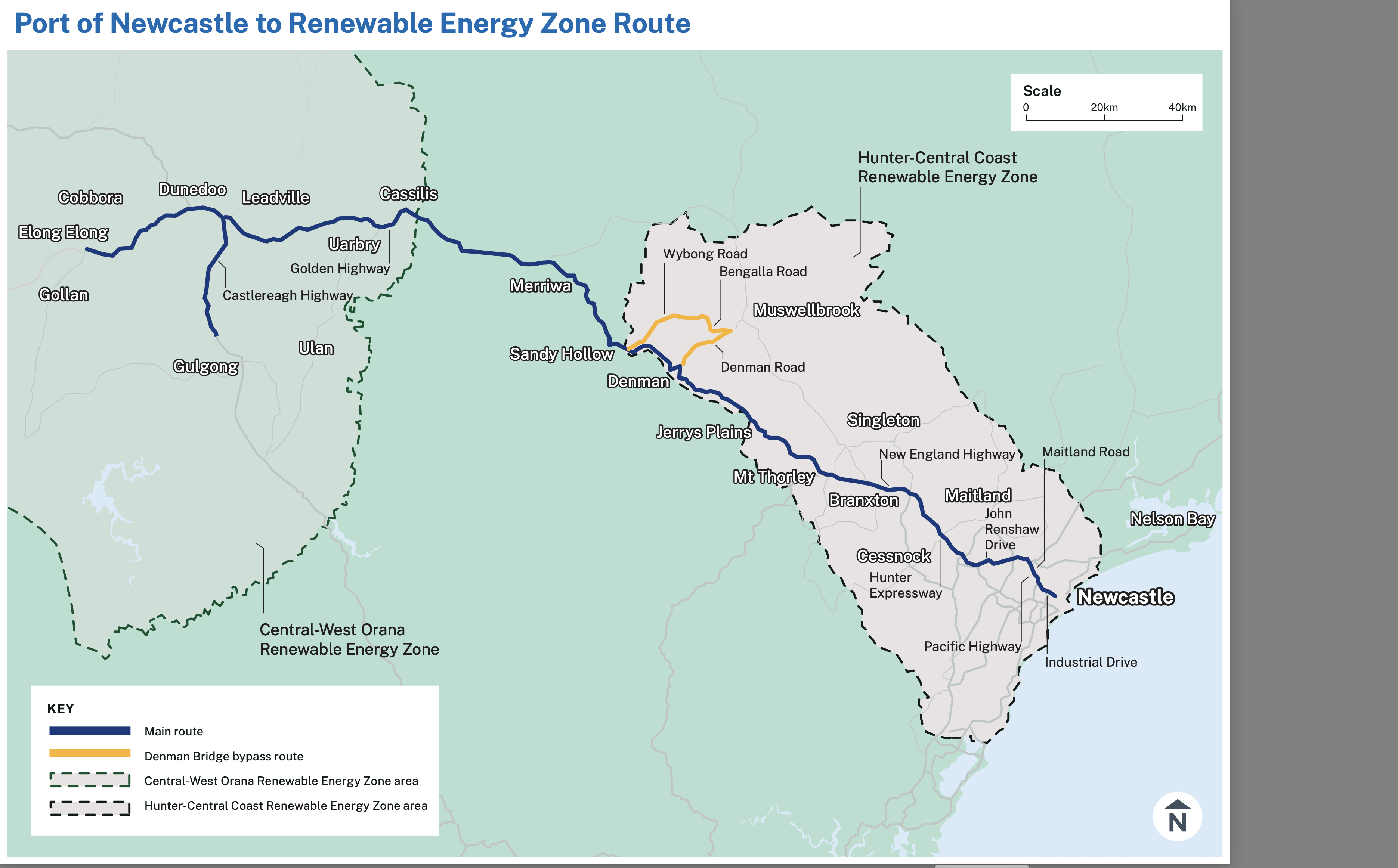

NSW

In NSW the State Government in its usual fashion has stepped in to address the issue and perhaps one of the first benefits of the Orana REZ is a coordinated route access from the port of Newcastle to the zone. This requires port, road and a bridge upgrade. However the Denman bridge upgrade is maybe not going to happen. Energyco states:

Our initial investigations show that Denman Bridge can support a majority of OSOM vehicle movements without upgrade. Some construction components will need to be transported around the bridge such as wind turbine base tower bodies and high voltage transformers. An alternative route using Denman Road, Bengalla Link Road and Wybong Road is currently being investigated.

Queensland

The main issue in Queensland, different to every other State, is the requirements for police escorts. And I have been told by various people that the Queensland police are essentially only available for 1 turbine per week. So that means that only about 300 MW of turbines can be delivered in Queensland per year and naturally escorts are pricey.

And in fact I believe the one time a turbine blade got stuck under a bridge was on the Warrego Highway near Ipswich in Queensland, police escort or no.

So this is a standard form of official racket, no different to any other union.

Without wanting to rant about it, on that basis it takes over 3 years to deliver the turbines for the Bungapan wind farm alone. In my view this is entirely unacceptable. It’s like the Government forcing the industry to be unproductive, thereby forcing costs up for consumers. Cut off the nose to spite the face.

Flat land v slope construction

In Queensland wind farms are typically erected on ridge lines, and although not germane to this piece, the ridge lines do have conservation values to be accounted for.

Many existing wind farms in NSW are also built on slopes, perhaps the most recent of which is Rye Park

Apparently “Lattice-boom crawler cranes” are the go for the heavy work and these need 1. levelling via crane pads and 2. assembly, disassembly to be moved. I read, but have no knowledge that tower cranes working with say a lattice crane might be used. Tower cranes require smaller “hard pads” apparently. A brief video of the sort of equipment I believe was used at Rye Park can be found at https://www.facebook.com/watch/?v=717366028922630

Building on flat ground is said to have two advantages (1) much less of a pad is required if the ground is already level (2) less disassembly and reassembly is required. Note that I am just reporting here what I have been told, I have no actual knowledge.