As Matt Baumgurtel noted at the Enhar battery day PPAs may be scarce

Other than the big gentailers who is going to be your battery off taker? The QLD Govt has probably ruled itself out of new agreements, Shell/ERM might buy some more stuff. Alinta maybe somewhere in the battery market but given that the CEO is recommending we all read Chris Uhlman’s substack I doubt if they are really ready to go hard on batteries.

It is still possible for someone like an Engie, or a Shell or actually gentailer with the most to gain would be Snowy to decide it wants a major position in the market, and has the balance sheet to underpin say a 3 GW PPA, that is to underwrite $2-$3 bn of investment but the choices are going to be fewer.

I don’t think a lack of counterparty availability is bad from a consumer point of view. If battery owners, particularly those with solar farms don’t have PPAs they will compete and if there is one thing consumers should ask their Goverments to do for them, it’s to ensure competitive markets.

But again this market is developing so quickly, mistakes and misjudgements in my analysis are even more inevitable than usual.

Is competition in the battery market over already?

One of the many ways for thinking about the NEM and its suitability to energy only markets is its competitiveness.

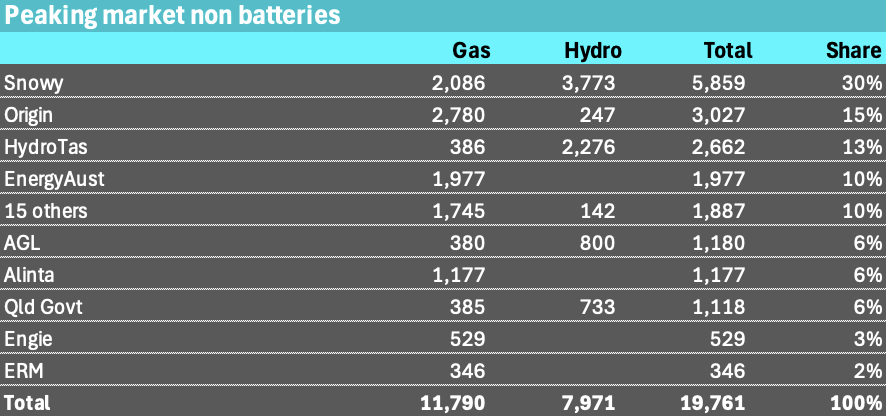

Before batteries became a thing the market was setup for Snowy and Origin to dominate the dispatchible power market. As coal generators closed the need for hydro and gas to keep the lights on would ensure high returns on capital for those assets. Gas scarcity and hydro scarcity and the market structure of the existing players would continue to juice returns for this segment.

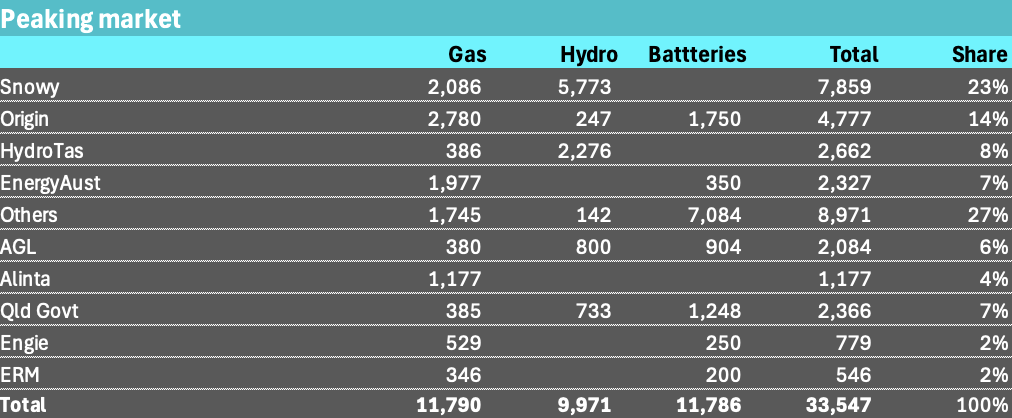

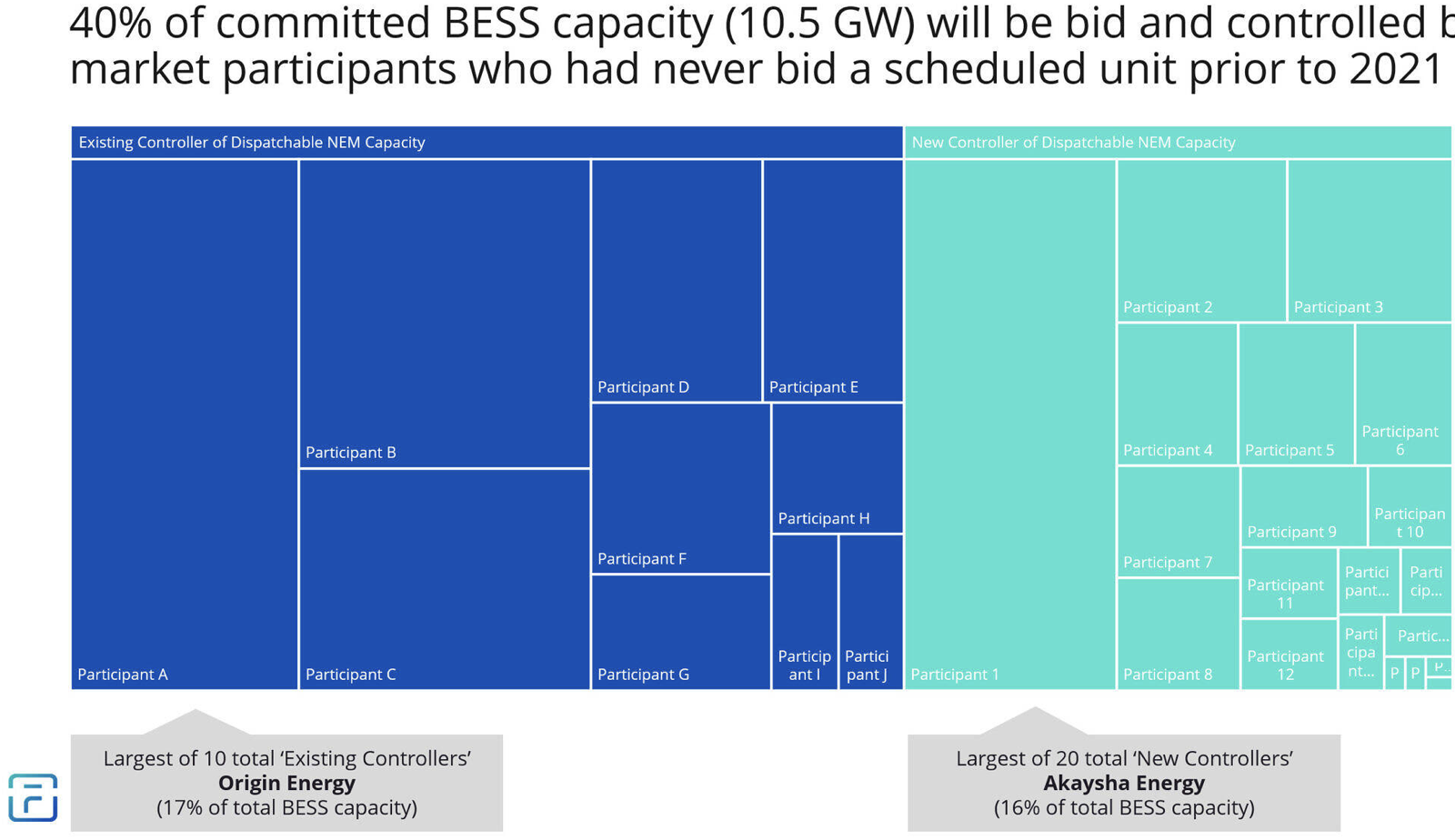

What we see now is that existing players already have 60% of the battery market. 60% already and that’s before most of the batteries are even operating.

About the only thing batteries are likely to do is reduce Snowy’s dominant position and that’s because either under instruction or through ignoring the possibilities Snowy has not so far entered the battery market. But its not too late there are still some independents or it can build its own.

To reiterate even when coal generation is still a large part of the peak market its still the case that’s where gas and hydro make their money. As coal retires the implicit market share and pricing power of the remaining players increases.

Another point is that the real dominance occurs in the NSW-Victorian-South Australian “mini nem”. Qld has very little influence on the broader price level and although Tassie hydro can be important in Victoria Hydro Tasmania’s function is really to supply Tasmania.

So before considering batteries and including QLD:

:

:

And for what I regard in some ways as a more realistic view let’s take QLD and Tasmania out and Snowy’s market share is close to 50%. Not only that but the other players are small by comparison.

When the coal generators are running of course the Gentailers don’t have to worry so much about Snowy’s market share but once the coal generators go away and before batteries that’s what retailers were looking at.

11.7 GW of Battery MW now equal gas and diesel MW in the NEM

There are 11.8 GW of gas and diesel generation that AEMO shows in its generation information page this includes Kurri Kurri the newest gas generator to enter the fleet.

There are now 11.7 GW of batteries in the NEM, operating, commissioning or under construction according to Renewmap. The vast, vast majority of those batteries will have been built over the 5 years from 2022-2027. This is the same explosive growth as we have seen globally where the amount of battery power in GW is roughly equal to global pumped hydro power.

Renewmap does not presently report project by trader and even when they do I doubt it will necessarily fully reflect the way things work.

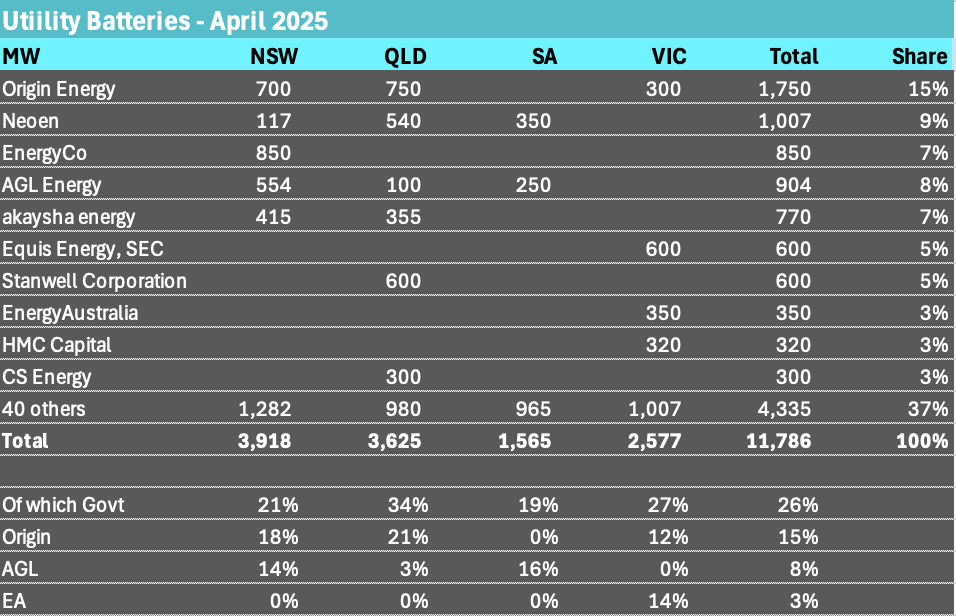

The following table shows reasonably clearly the size of the utility battery market as I write, and it will certainly be more than this because its grown about 1 GW in the past 6 weeks and because this version of my table ignores CIS contract winners that have not yet committed to construction.

Where the information in the table is likely to be wrong is in my estimate of market shares from the point of view of influence on spot prices. Govt includes for QLD all the Govt owned generators. Space does not permit me to say how short term the new QLD Govt thinking is and thereby managing to snatch defeat from the jaws of victory. They were developing a fantastic battery and renewable position but are going back to coal, gas and therefore diminishing relevance and control. I have included all of the 750 MW that Supernode is developing in QLD as Origin’s control. It’s a big bet by Origin on QLD where they also own Darling Downs and a diesel peaker.

Equally Origin may be slow to get going but in my view senior management and the Board are increasingly showing more purpose and drive than AGL. And it’s showing up in the share prices. That’s because AGL suffers from the incumbent’s problem so much more and lack the courage of their convictions. AGL has announced planning for 200 MW battery at LYA but planning is like dreaming in this space. AGL has signed a 70 MW off take agreement with HMC in Victoria but 70 MW? AGL sees no need for batteries in Victoria because it does the job with coal and also has a position in South Australia, but the result is to cede pricing power in the peaking market both in Victoria and in the overall market.