The road to 80% by 2030

80% renewable energy by 2030 is a national target. In this note we set out a definition, what will have to happen and develop some criteria. But the bottom line here is simple. If we are to achieve anything like 80% by 2030 a significant number of large wind farms will have to get notice to proceed or final investment decision over the next 24 months.

For this note:

Only electricity supply in the NEM is counted;

We set demand in 2030 at 225 TWh in the NEM net of losses, that’s an increase of about 6% over the next five years.

Only wind is included in this note. Of course some, maybe lots of the new supply will be solar supplemented by batteries. Leaving aside all other issues PV has a capacity factor of say 25% and wind say 40% (pre curtailment) so it’s basically 1.5 GW of solar for every GW of wind substituted.

Because we have enough solar to push prices to zero (no marginal demand) in Spring and Summer, and because new rooftop solar is coming every year, extra solar energy needs to be backed by batteries to be useful rather than just resulting in more curtailment. When you do the sums you will find that to absorb the output of a 1 GW solar plant you need 1.5 GW/4 hour battery. So another 10 GW of solar is 15 GW more of batteries. I probably see that as a similar challenge to building wind farms. Or to put it another way if 17 GW of wind is required for 70% renewables then about 25 GW of solar and say 30 GW of batteries would do the same job. Maybe that’s not the way to think about it. As the coal goes away some more midday headroom is created so a bit less batteries.

As discussed below I can see about 10-11 GW of wind getting to FID by 2027 leaving just enough time at Golden Plains rather than Uungula pace to be operational by 2030. Other projects are possible. I have to say the EPCB process reform will come too late. I don’t know what happens in that Dept but I suspect Kafka would have seen it as an inspiration for “The Castle”. Once a project goes in there it tends not to come out. As much as Regional wide reviews are indeed a good thing, defined timelines are a better one. The IPC in NSW has a six month determination period. That’s what’s needed for the EPCB in the “Climate emergency”. If there was a war on things would happen faster.

Targets

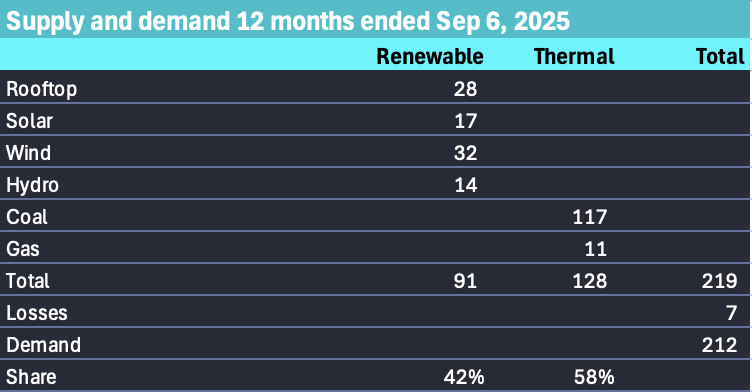

Over the past 12 months I estimate renewables share at 42% of total supply

From there we can estimate the GW of new supply required to hit 80% or 70% 2030 target

The 24 GW lines up quite well with the total of the CIS but is still a large ask.

The solar cumulative total was estimated as:

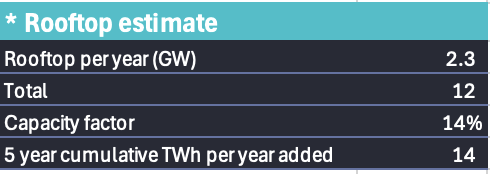

Summary: Twiggy Forrest and AGL are the key players over the next 12 months

The following table is bound to be somewhat incorrect. I am really unable to guess which projects might go ahead and in which year. Nevertheless my list includes 10.7 GW of projects some of which would in any case be delivered in stages. Unless a rabbit is pulled out of the hat in regard to one of the SW REZ projects I only see 650 MW of projects getting the go-ahead in 2025 and both located in South Australia. I’ve shown a couple of projects as having CIS support when in actuality its an LTESSA or PPA

However 11 GW identified in this table are clearly not enough. There are plenty of other projects in various stage of readiness as discussed above. If enough things went well I could potentially see another 5-6 GW by 2028. Projects such as Dinawan, Callide, Theodore, Middle Creek, Kentbruck even Winterbourne could be started in 2028, the last possible date for wind that is going to count into the 2030 achievement.

More will be learned from results of the next 6 GW of CIS tenders to be announced in October.

The owners with the greatest number of projects potentially able to go ahead over the next 12 months are Twiggy Forrest related and AGL related. Clarke’s Creek and Uungula are both Forrest-related entities and are two of the small number of wind farms under construction. Once clear of first nations issues Clarke Creek has gone well.

Wind projects that could go ahead

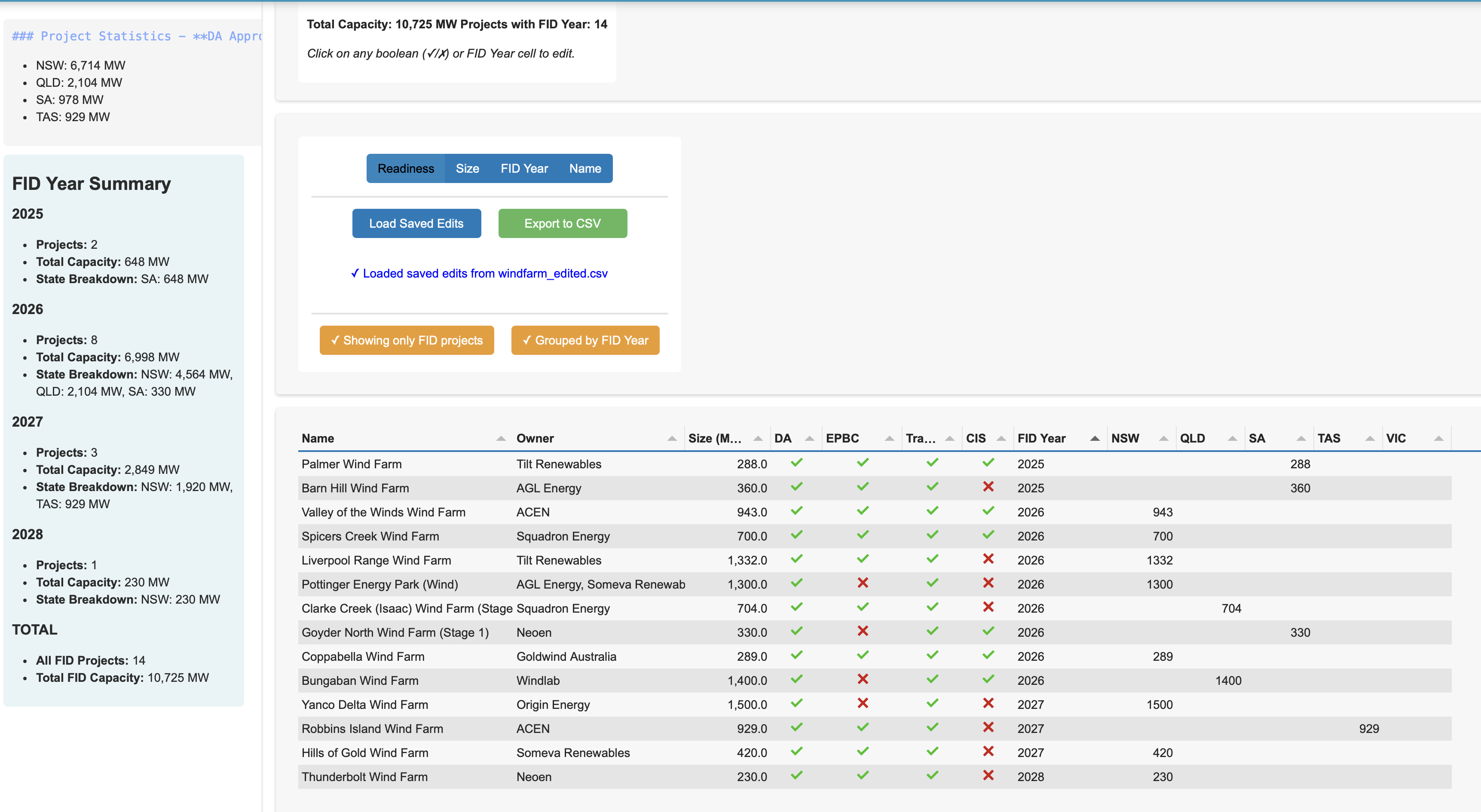

NSW

There are about 8 GW of NSW projects that could potentially get to FID in the next 12-18 months.

However not all those projects have connection agreements for all of their capacity. In particular projects in SWREZ only have some capacity approved.

Despite everyone’s focus on the CWO as the first big REZ to get off the ground in NSW, and as had to be pointed out to me by Alison McLean the next tranche of available transmission is in the Riverina once the NSW leg of project Interconnect is up and running in 2027. Wind farms with access rights to that transmission should really be under construction right now, but none of these big projects actually have all of their planning approvals. In particular, the Dinawan Windfarm should really be further along than it actually is.

To be operational in 2027 when the transmission is available large wind project would need to be have had FID already. Maybe not the best example but Uungula wind farm hit FID in Dec ’23. Here we are in Sep ’25 and the first components for the turbines have just arrived at Newcastle. No concrete has yet been poured. At this rate the project will be lucky to be commissioned by 2030. A better example might be Golden Plains where stage 1 reached FID in November 2022, construction started in Q1 2023 and is basically complete now. So 750 MW of stage one from FID to commercial operations in about 3 years.

On the assumption that Westwind Golden Plains is the benchmark then a project hitting FID this year would be operational late 2028. Making 2027 the latest date for 2030 targets.

Liverpool Range may get to FID towards the end of 2026. Anthony Fowler CEO of Tilt said on the Energy Insiders podcast he hoped to have two projects get to FID this year, one of which will be the Palmer Wind Farm in South Australia and I think the other is the smaller Waddi Waddi project in WA. The latest Liverpool Range community newsletter from June 2025 stated:

“Detailed project planning is an iterative process, which is informed by various technical studies, stakeholder feedback and internal reviews. This work is expected to continue for the next 12-18 months.”

I’d also expect Valley of the Winds to get the go ahead once its nuisance court case is resolved.

Spicers Creek possibly will get the go ahead next year. At the moment its owner Squadron is in the early stages of building Uungula wind farm and may want to have that process well bedded down before proceeding with a close neighbour.

In my opinion BayWa is more capital constrained than some of the others in the above list and in my opinion I think it will be one of the later projects to go ahead on the above list.

The Dinawan Power Hub by Spark Renewables has yet to get its environmental approvals. The NSW Dept has made a request for more information with final date in November 2025. Since there are more than 50 objections, mostly what I describe as anti renewable objections from people located more than 100 km away including interstate, the project will end up at the IPC and therefore is unlikely to be approved at the State level prior to the end of June 2026. So I can’t see Dinawan getting to FID prior to the September quarter next year.

Yanco Delta, which did have approval, has submitted modifications including a worker camp for about 700 people and also relocation of various turbines for various reasons. I don’t know the law well enough but my guess is that it won’t need to go to the IPC over these modifications. The problem with Yanco Delta is it’s owned by Origin and Origin will likely want to unsell the project rather than fund the development themselves. At least that is what they did with their last development many years ago, Stockyard Hill. Again all of those process and sale means FID no earlier H2 of 2026 although that is pretty much a guess.

So in short:

- Not one of the above projects has a PPA;

- Spicers Creek and Valley of the Winds has a CIS and a connection agreement and planning approval from both NSW and Federal and even it is subject to a nuisance court case. Spicers Creek needs to be fitted into the Squadron schedule given that Uungula is in early construction. However the ITK theory is that costs will fall due to learning rate impacts by going from one project to another. So the team that works on Uungula should be able to go onto Spicers creek. One construction camp will do both projects. Turbines for both projects can arrive sequentially. Conceptually the concrete pours could occur sequentially etc. The two projects are only 35 km apart.

- Not that it’s relevant to the discussion but the Orana zone actually already contains coal mines and coal mining communities including Ulan and Mt Arthur. A number of those mines are old.

- The projects in the SW REZ will have first access to transmission because Project Energy Connect and Humelink are due in 2027, but none of the projects there has all the planning approvals and a CIS award.

South Australia

If there is one State with a good record on wind development it’s South Australia. Per head of population South Australia has way more wind than any other State. And clearly it’s not a problem. As AGL’s guest back in the day I have taken helicopter flights over the early wind farms in South Australia and got up close and personal to a turbine. I didn’t see then, and still don’t see what the fuss is about. Never mind, despite already having a lot of wind, development and new projects continue in South Australia. Looking ahead an optimist could see 1 GW of Sth Aust. wind projects going ahead over the next 12 months.

Palmer Wind Farm is probably the most prospective wind farm in the NEM in terms of getting to FID in 2025. But its less than 300 MW.

Goyder North also has a CIS and needs an EPBC tick

Carmody’s Hill is described as being in advanced development needing a a PPA and grid connection approvals.

AGL also has the Barn Hill wind farm with both State and EPBC approval. AGL’s web site states that the wind arm FID is expected in late 2025.

In short, Palmer and Barnhill, representing a combined 680 MW, should get to FID this year. The question in my mind is with Tilt being 20% owned by AGL whether AGL will want to write a PPA over both projects.

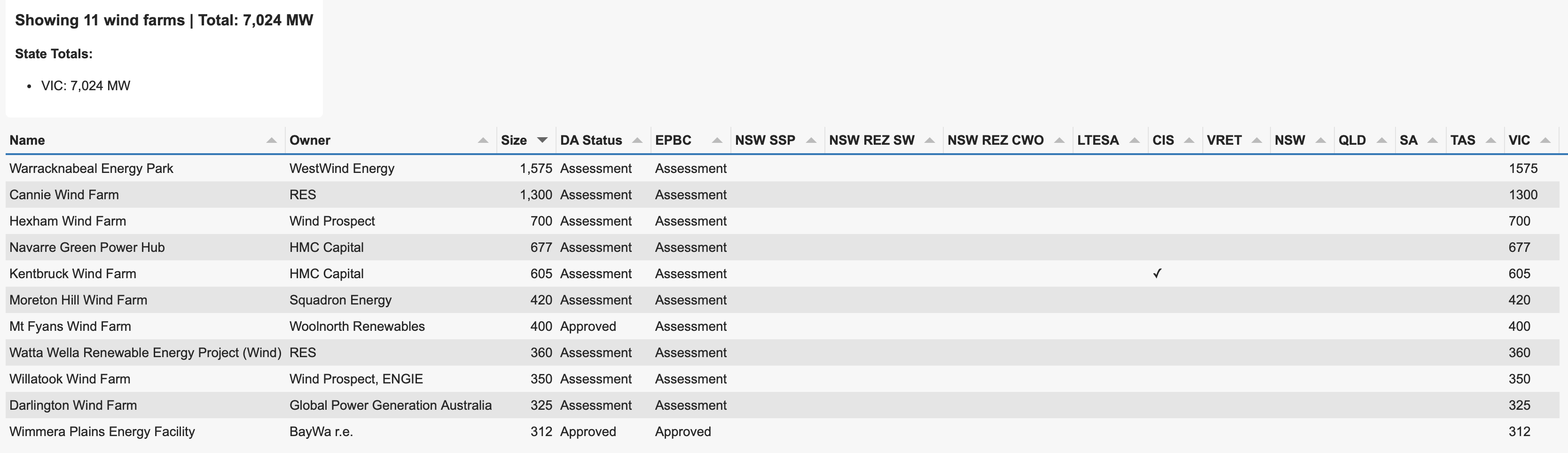

Victoria

In my opinion Victoria has done a poor job recently at developing onshore wind. And that is despite the State’s strong and proud record in renewable energy.

Development is also made difficult by the slowness of transmission development, the lack of coordination around ensuring replacement generation being built before Yallourn closes and the white elephant offshore wind.

Leaving aside my largely irrelevant personal opinions the onshore wind farms in development in Victoria include:

Only the Wimmera Plains facility has both planning approvals and only Kentbruck (located in a pine forest near Nelson) has a CIS. Kentbruck is owned by HMC and HMC has had significant management and financial turmoil over the past year. HMC’s energy transition fund is run by Gerard Dover who does have some wind development experience from his time at Infigen, but otherwise all the expertise would be in any Neoen people who came across. At the moment I think its reasonable to have some reservations about the ability of HMC to fund and build this project in a hurry.

Recently Mt Fyans received state approval and it should be able to connect into the 500 kv line at Mortlake. It may well be first cab off the rank in Victoria.

Cannie wind farm is planned to connect to VNI West and the website states construction will start in 2029.

The Willatook wind farm has been held up by Brolga debate however recent guidelines from the Victorian Govt may allow Willatook to proceed in due course, not this year though.

The long and the short of it is, because Victoria has taken so long to get Western Renewables Link and VNI west to progress and because of the focus on offshore wind there are few if any onshore wind projects likely to get to FID in the next 12 months. Maybe Wimmera although I doubt it and maybe Mt Fyans.

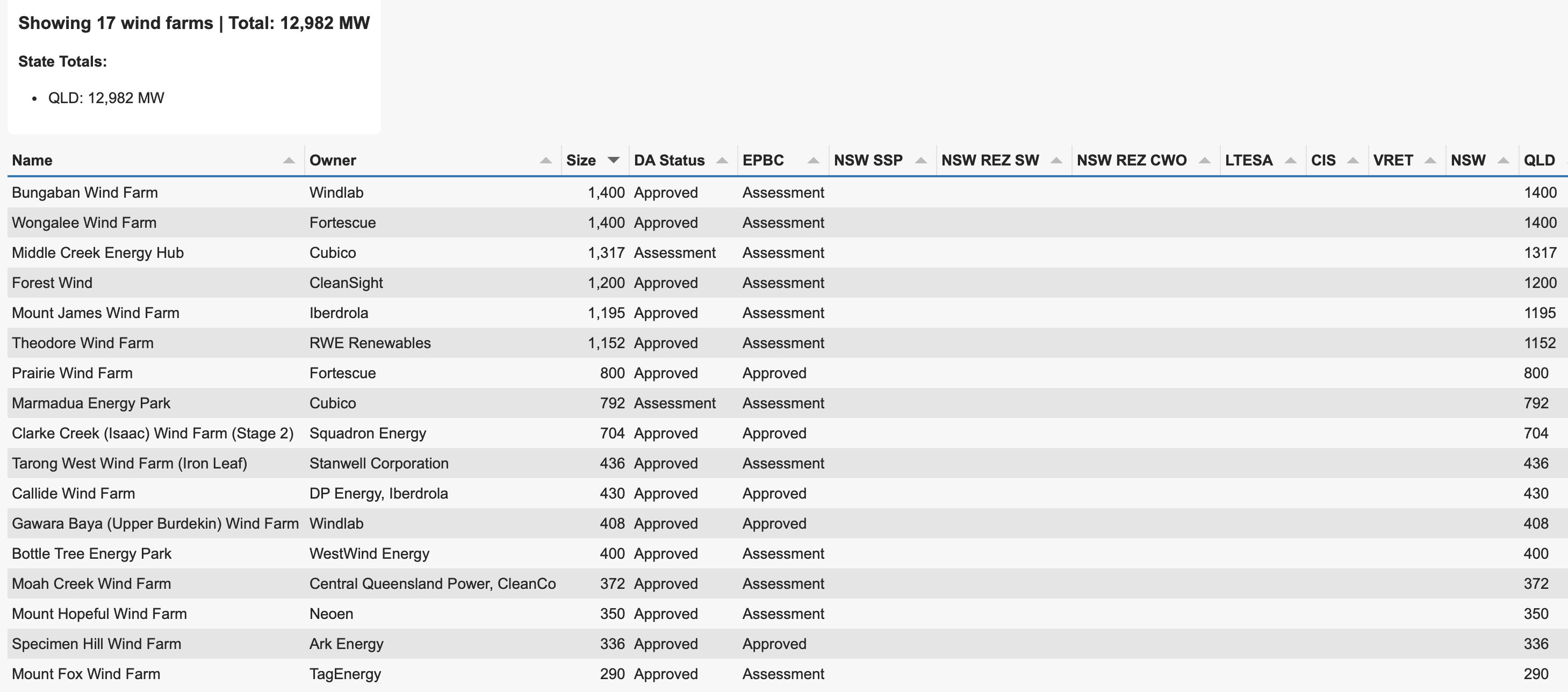

Queensland

First up I need to make a correction. On Energyinsiders I said that Forrestwind had economic issues. Now I don’t think that is the case. The problem with Forrestwind is insufficient security of tenure, to allow the project to be financed. Forrest Wind is located in a State owned forest. Legislation for tenure security passed by the previous State Govt was ineffective and the current Govt has repealed it in any case. The economics remain good, good wind resource, relatively low cost construction, transmission access, but land tenure is a show stopper.

QLD has over 12 GW of relevant wind projects and 2.6 GW with both state and EPCB approvals including Prairie, Clarke Creek stage 2, Callide and Gawara Baya. Despite that I think Bungaban by virtue of its PPA with Rio remains the top and possibly only contender to get to FID over the next 12 months.

Notably, Twiggy Forrest-related entities (Fortescue, Windlab, Squadron) are strongly represented in the list.

Windfarm development in QLD faces a few issues (1) the transmission links are long and thin, what this means is that if wind farm turbines go off line there can be network stability issues including with the QLD-NSW interconnect, (2) there isn’t much load in the North of the State, (3) most QLD wind farms have to be built on relatively high conservation value ridge lines.

Twiggy Forrest related entities have a number of projects capable of proceeding in both NSW and QLD. As such I find it hard to believe that any Forrest related project in QLD except Bungaban and maybe Clarke Creek stage 2 could get the go ahead.

Equally Iberdrola is such a cautious developer that I just have trouble believing they would sanction Mount James with the current Queensland Govt.

Callide Windfarm is well advanced and the project website says that construction is planned to start in mid 2026.

Middle Creek wind farm was “called in” and the determination on that calling in will take time. If you are interested to read what I regard as aggressive language towards Middle Creek check out the request for more info signed by Jarrod Bleijie. I quote an extract.

“Further, the *Planning (Social Impact and Community Benefit) and Other Legislation**Amendment Act 2025* (to be commenced) demonstrates the importance of local government engagement and input for the assessment of wind farm development.

The application does not currently demonstrate the local government’s agreement on the measures and commitments to manage and counterbalance social impacts.

Action:

Provide evidence of the local government’s agreement on measures and commitments to manage and counterbalance the social impacts identified in the requested social impact assessment report”

It’s unusual to require local Government agreement on developments. As someone whose mum was a mayor I have the utmost respect for Local Government and fully believe that getting communities onside is important. But generally developments are not determined by whether local Government supports them or not. They are generally driven by what is in the State interest as determined by the State Govt of the day. Local Government interests should, and generally are considered but are not determinative.

But the bottom line here is Middle Creek is mostly likely going to be delayed and there is no certainty it will even get through Bleijie’s aggressive review. As things stand Bleijie on his own is likely to prevent many renewables going ahead in QLD. Bad luck for his two daughters and their children who will thus be exposed to that much more adverse climate change effects. Bad luck to QLD GDP growth, bad luck to RIO and its decarbonisation goals. Bad luck for Gladstone the leading precinct in Australia to demonstrate precinct and industrial decarbonisation. But good luck to Bleijie and achievement of his personal agenda.

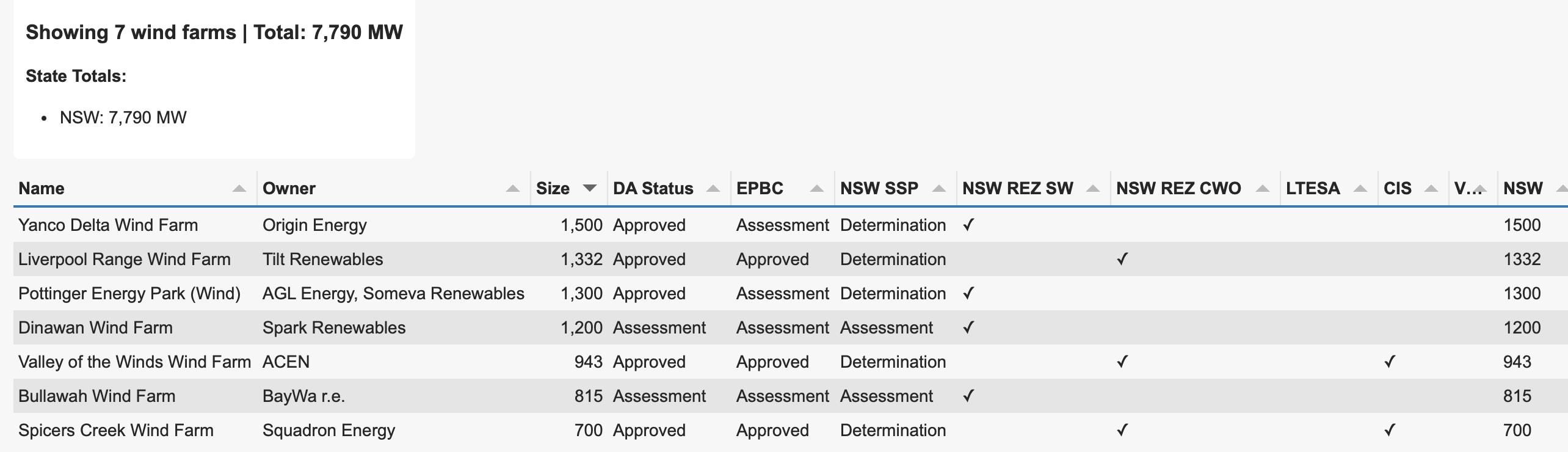

Methods

Windfarms were identified using www.renewmap.com.au project list. Renewmap has a bunch of filters and I included DA, status, EPBC, NSW transmission rights, CIS, LTESSA awards to develop a list of 92 wind farms.

Claude Code then wrote some code to enable the list to be filtered by State and sorted on how many criteria needed for FID had been achieved. To get to FID at a minimum you need DA approval, EPCB approval, and a transmission contract. In my personal opinion you don’t need a PPA or revenue underpinning because the market needs more supply however for many owners either an LTESAA or CIS or other form of credible revenue underpinning is required.

Having screened and sorted the projects on my criteria I then looked at broader evidence or data often but not entirely based on project websites.

Transmission

I’ve expressed my frustration with transmission access to the Riverina REZ enough times. However some of the transmission augmentations relevant to this note are:

The cost of the transmission is way higher than I would have said a few years back and is a surprise to me. It’s an old technology and costs shouldn’t be changing that much. I’ve been calling for extra transmission since 2017 based on reading about how the renewables rollout was started in Texas. But it’s taken 8 years to get the process properly underway.

Despite the long line of critics saying that the cost increases were inevitable and predictable, a comparison of the South Australian and NSW sections of Project Energy Connect would likely show South Australia was much cheaper. The reason is that South Australia beat the global rush. Victoria delays and delays, with every delay pushing the cost to Victorian taxpayers up and increasing the risks around closing Yallourn before replacement capacity is built.