Batteries are scaling up, but other things are driving prices more

TL;DR Utility batteries are now generating about 1 GW on average every day at peak output and by definition charging a bit more although that is spread out. Still, despite that and more wind and rooftop solar, spot prices aren’t really moving. That’s because there is about 5 GW of coal generation off line, including a whopping 42% of capacity in Victoria (2 GW). That said on the face of it there are about 3.3 GW of operating battery capacity in the NEM but a significant portion of the early capacity is devoted to system integrity, transmission support and frequency management. As the rollout continues it’s still reasonable to think peak battery output will grow quickly. Much of the remaining capacity being built and under construction is notionally devoted to daily trading. Its a watch this space opportunity.

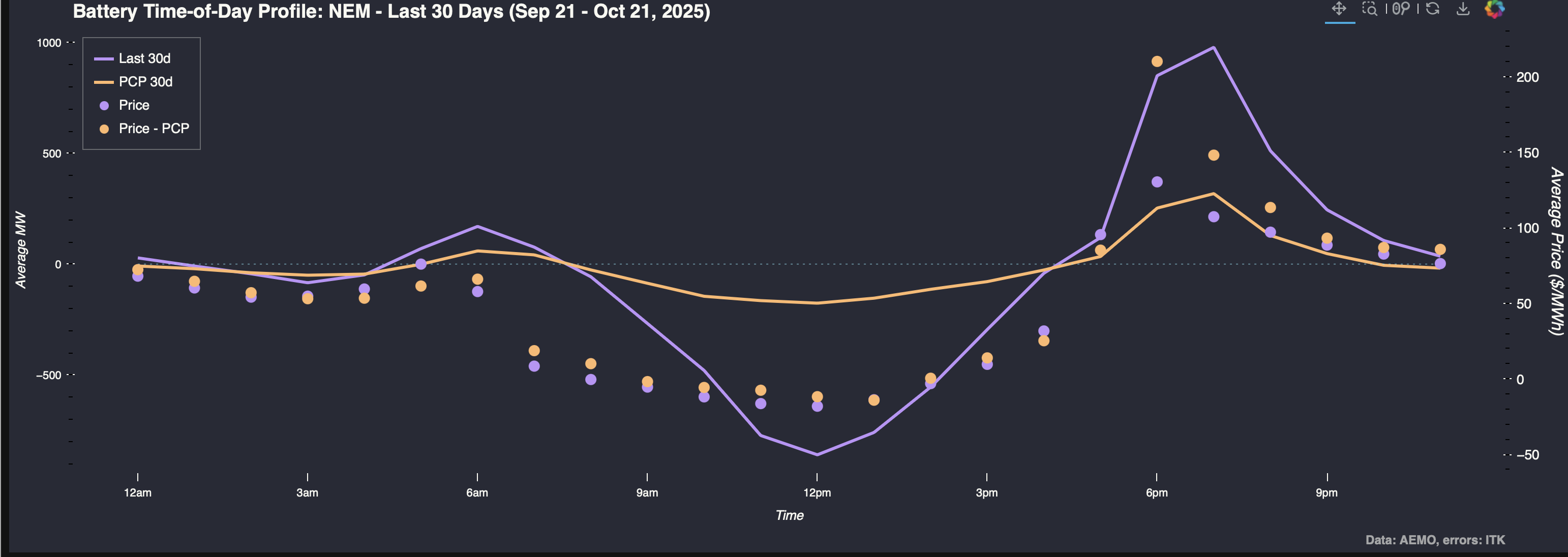

Of course the big deal in news is all the utility batteries that are coming on line. Unfortunately home batteries are invisible to AEMO and nor will estimating their output and input be as easy as rooftop solar was. Nevertheless the utility battery story is in any event much more important in terms of MWs and MWhs and what we see is batteries are already a 1 GW factor in the market at peak charge and discharge. And we ain’t seen nothing yet. 1 GW of peak battery output on average is quite a bit but it’s not that much relative to the 16 GW that will be operating in about 2 years time. And yet neither is 1 GW of peak output that much relative to the 3.3 GW in operation and a further 3.9 GW in commissioning. The gap between installed capacity and peak output exists because much of the early battery capacity is being used for ancillary services rather than energy trading.

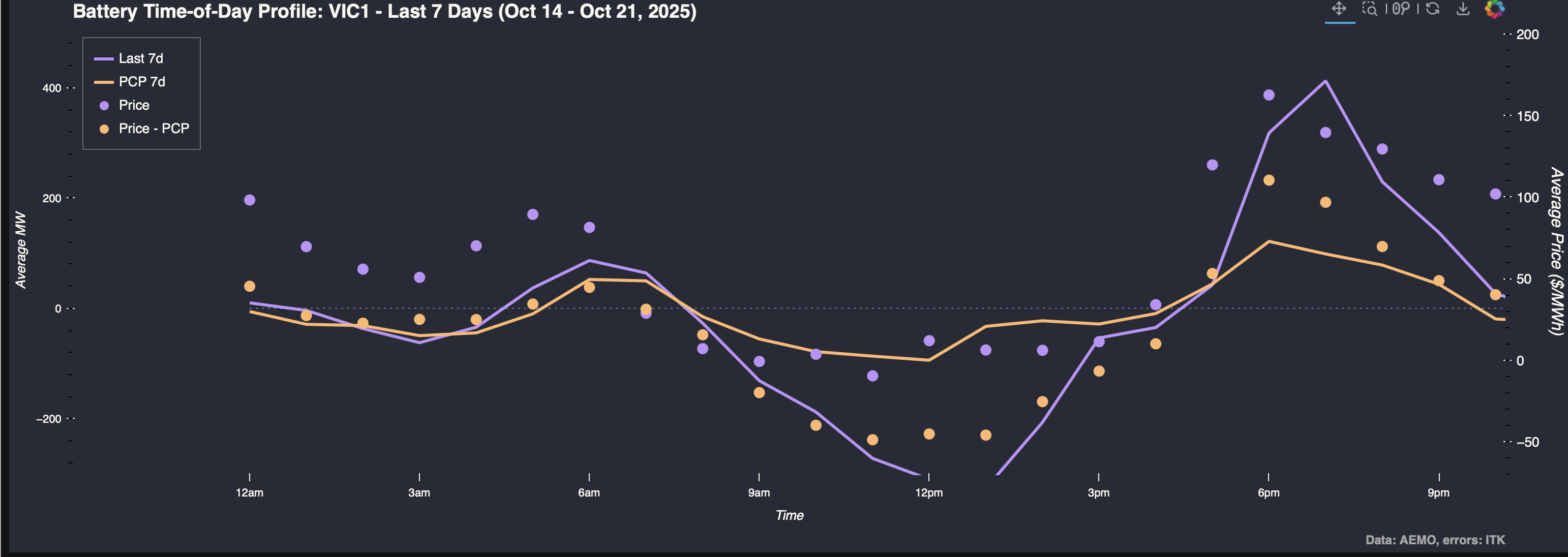

But as the plot also shows over the past 30 days, and more particularly over the past 7 days the battery price effect is masked by the many other factors. So prices in the middle of the day are lower than last year despite the increase in charging demand.

Equally what I think one of my big learnings over 2025 has been is its not what happens most of the time that matters, its what happens in the spikes.

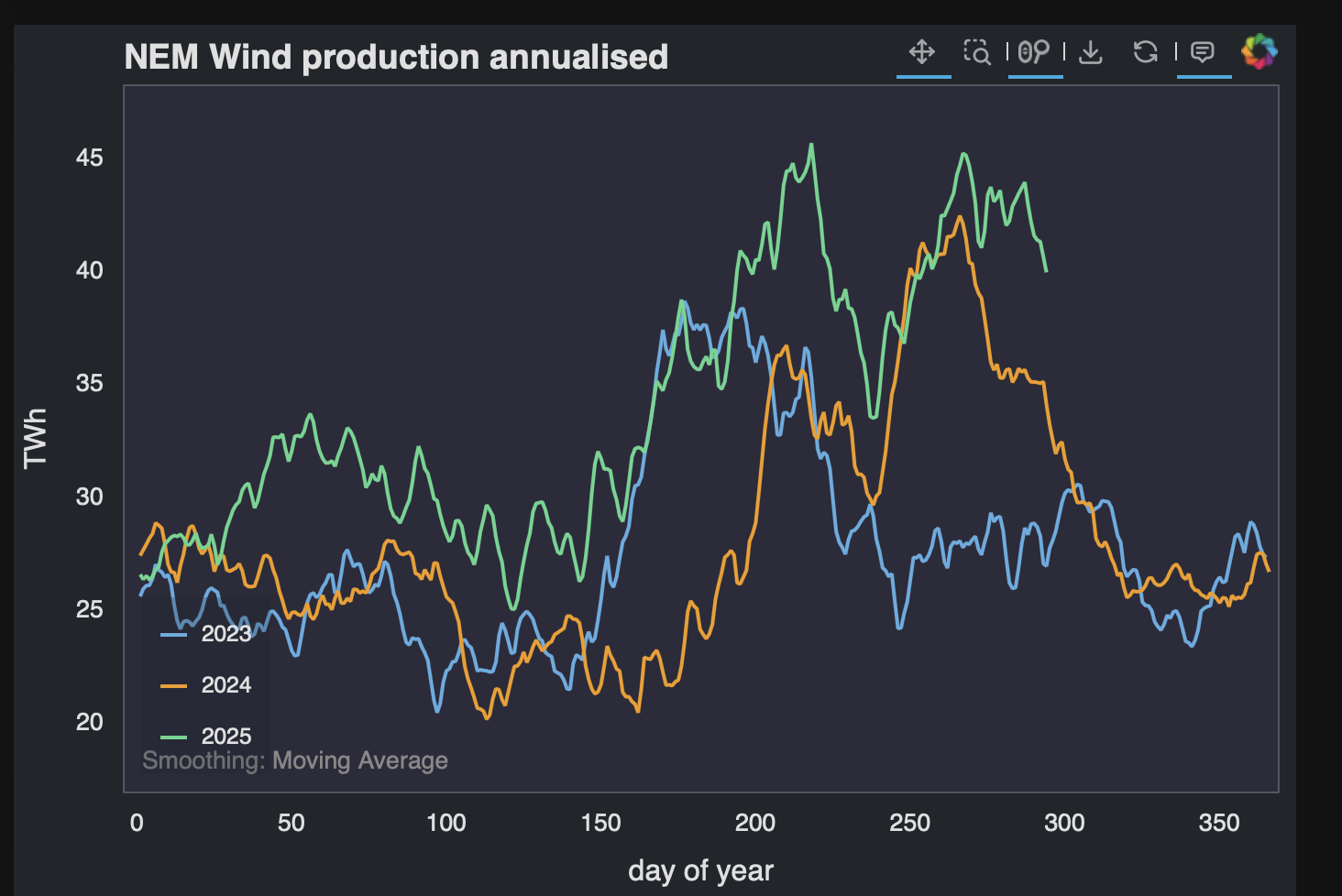

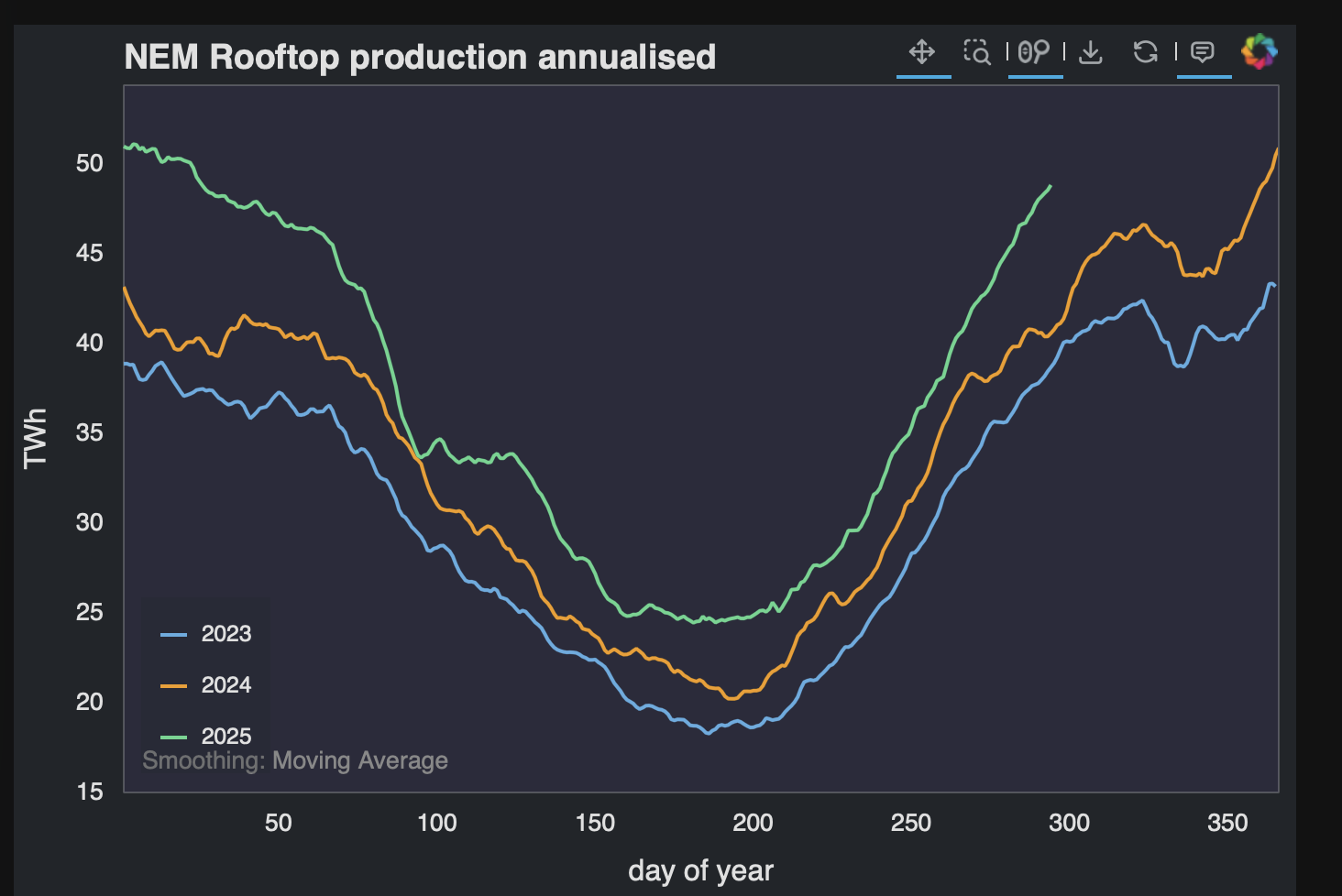

In Spring, most of the time demand is relatively modest and renewable generation is high, this year wind has been higher than usual. The variability of wind from year to year is well illustrated by:

And Rooftop production is always strong this time of year

Rooftop solar output as estimated by AEMO is gross output, that is household battery charging isn’t subtracted. Household battery charging notionally shows up as an increase in operational demand, but so many other things are going on there I don’t have a good handle on it yet.

Coal stations go offline in Spring and this can make prices spike

It’s still a bit early in the calendar year but as we get close to Christmas it’s not surprising to see price spikes. That’s because a number of coal generation units are taken off line for maintenance. And then if something happens, other units break down, wind stops, there is a super hot day and demand surges, then all of a sudden there is a generation shortage and a price spike.

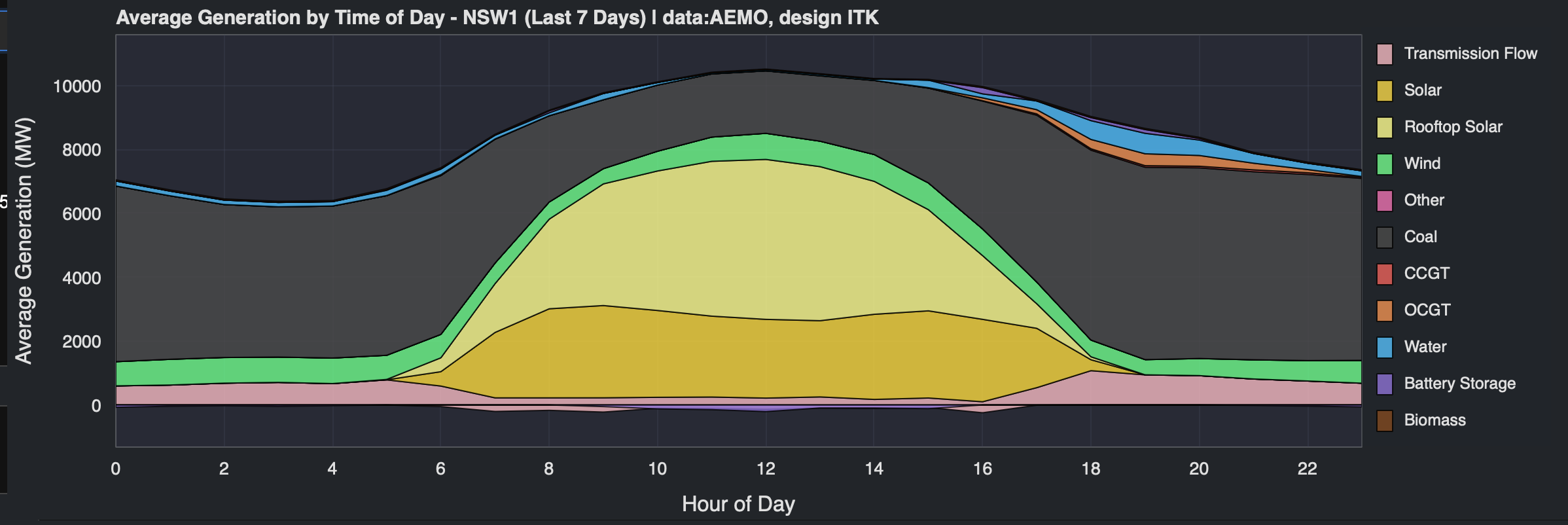

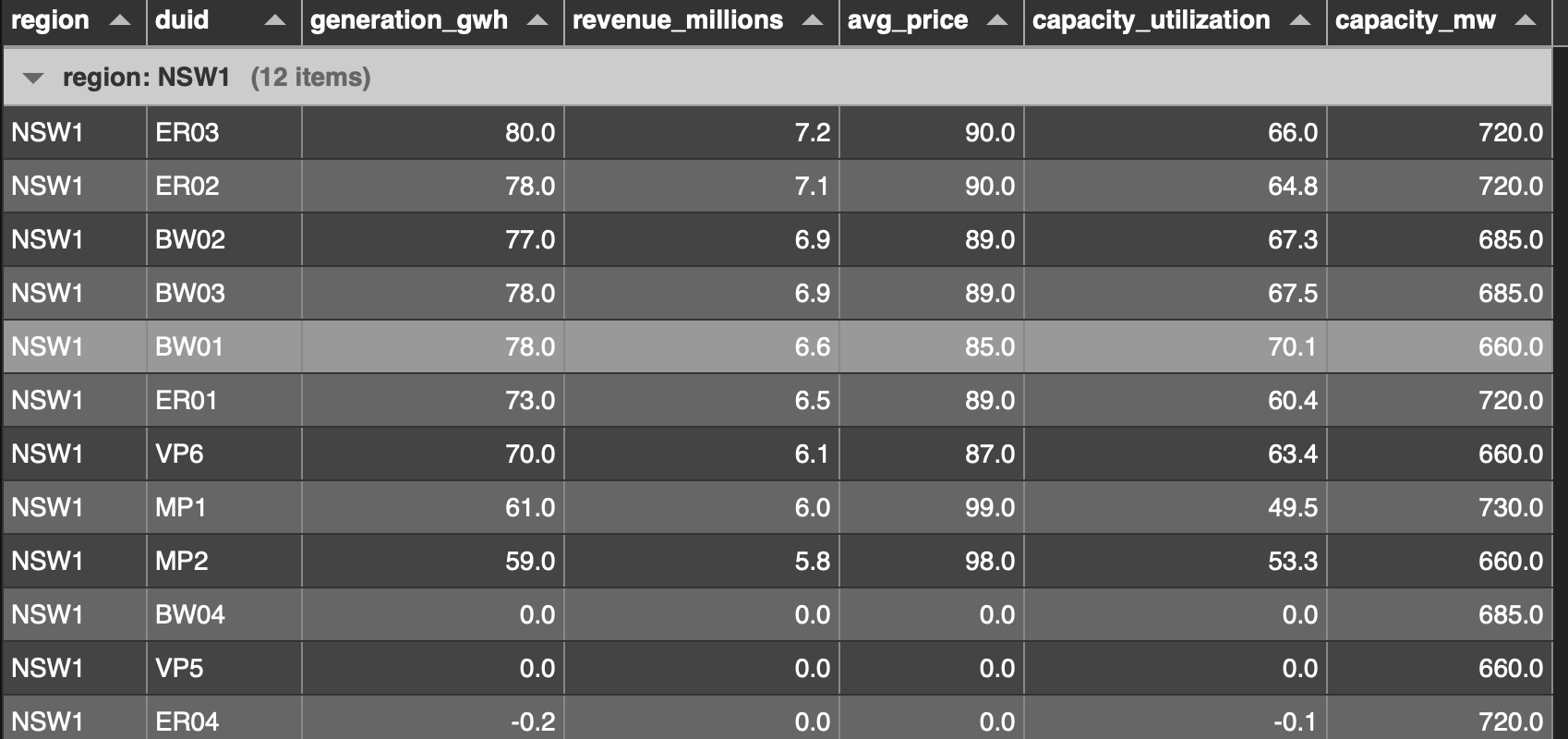

In NSW 23% of capacity (about 2.1 GW) is offline in the past week.

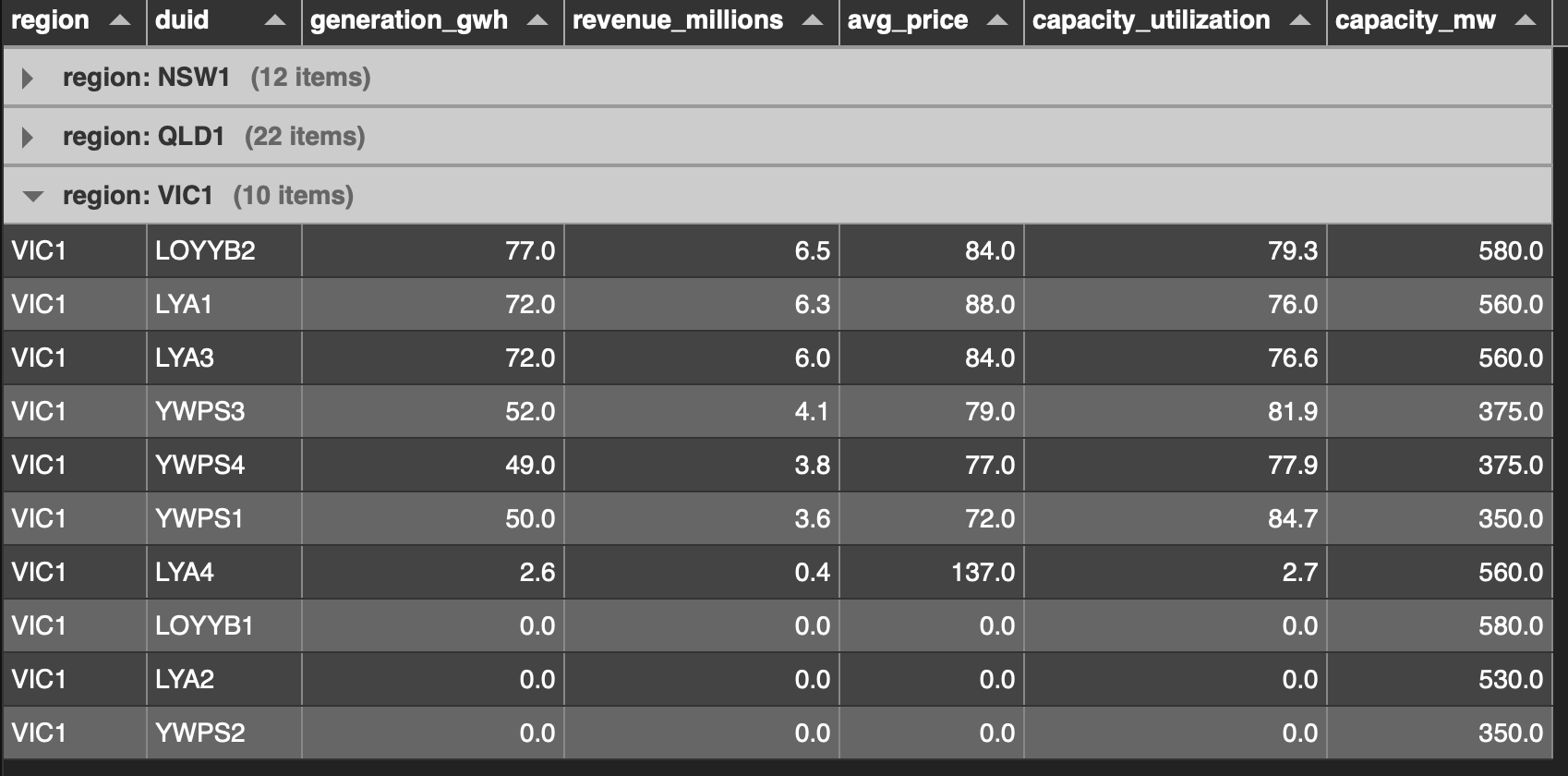

About 1 GW (12% ) in QLD. Less wind in QLD so less pressure. But in Victoria about 2 GW or 42% of capacity is offline and despite all the wind that puts pressure on.

On top of that the coal units are having to ramp up and down in some States, not so much in Victoria where right now the online units are needed, but look at the ramp last week in NSW

In Victoria at peak there is about 400 MW of battery output double that of last year but not near enough to fully compensate for 2000 MW of coal going offline.