Frontier Economics and its “base” or “biased” case

Frontier Economics has a strong reputation as a microeconomics consultancy particularly in issues concerning economics and the law. I have been following the work of Danny Price, the Australian principal of the firm for many, maybe 20 years, and have rarely seen him be on the losing side of a case where he is called as an expert witness.

However over that same period I personally have observed that Mr Price appears no friend to the renewables industry. I personally wrote to a then CEO of the AEMC probably 15 years ago questioning some of Frontier’s advice on the cost of renewables. I sat opposite Mr Price at a dinner for institutional clients of my investment bank in Melbourne about 12 years ago and heard him say that he’d been informed that there were no more cost reductions in solar. You can find Mr Price on record in the AFR talking about the wonders of coal generation to bring Indians out of poverty.

Space does not permit but in short if you want someone to tell you how good coal, gas and now nuclear is Frontier is your consultancy. Equally if you want a market defined to suit your case Frontier is your consultancy. On the other hand if you want fair and independent advice I would argue that Frontier should not be on your list.

Thus it’s clever of the LNP to have Frontier to do the advice on nuclear at Frontier’s cost. Frontier are far more skilled and far more deeply knowledgeable than say the advice Brian Fischer might have offered.

So it’s somewhat of a relief to find that Frontier’s arguments hold no more water than any other nuclear advocate.

Frontier’s advice was released in two parts. In part 1 they released a “base case” which I am tempted to call the “biased case” which is their version of a straw man against which their nuclear costs are put.

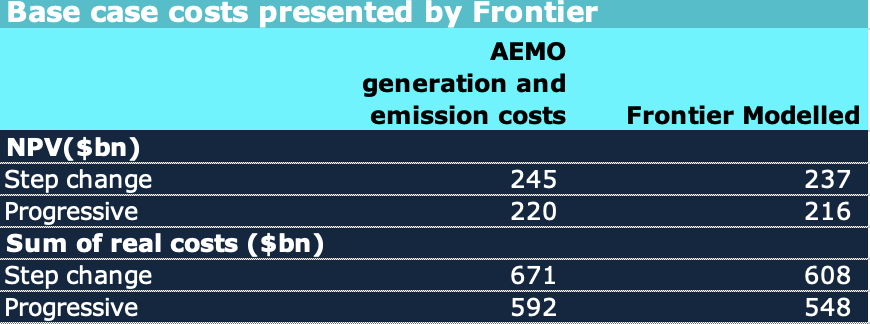

The base case made use of the costs presented in the ISP for the “step change” and “progressive case”

However the base case fell below the standard I expect in professional reports when in addition to reporting its NPV estimates of the ISP numbers which in the first instance accord closely to those of AEMO it went on to present the “real” that is the undiscounted costs. There is no theoretical justification for using undiscounted costs for decision making. Quite clearly the reason for presenting such costs is that they result in a big number over $600 bn in the Stepchange case as opposed to $237 bn on NPV.

It is quite likely that the average person in the street doesn’t understand present value, but I can assure such people that every student of finance, and economics at university does. Without the idea of present value there would not be a rate of interest, which most fundamentally is a measure of the tradeoff between present and future consumption. I don’t propose to go into theory here.

What I will say is that Frontier’s presenting “real costs” when they know better is a clear indication that their base case is just a red herring, like the entire nuclear debate. Perhaps red herring is the wrong phrase; their base case is just a few of the cards they have strung together in a card house.

The NPV cost included in the ISP is $122 bn. Frontier’s numbers include operating costs including AEMO’s estimate of carbon costs. From an NPV perspective I have no argument with that. The ISP number is only the capital costs. The basic argument is that avoided fuel and carbon costs will outweigh the capital costs in the NPV analysis.

The other thing asserted in the “Base case” is that transmission costs have increased a lot and therefore “nudge nudge, wink wink” they will continue to increase a lot. And that’s the thing about Frontier, they are clever. Transmission costs have increased a lot, but I don’t think it means they will continue to do so, although I don’t know.

Australia has just started on its transmission building program and as we get on with it, the experience in most industries including transmission, and no doubt nuclear, is that we get better at it, come down the learning curve.

But Frontier wants to reduce transmission to a simple $transmission cost per MW of renewable capacity. I don’t think that’s how it’s going to work and reflects the old fashioned nature of Mr Price’s thinking from the days of coal generation.

Right now there are significant advances just starting to be made in transmission. These include dynamic line ratings, monopoles, improved conductors and perhaps the use of batteries to provide virtual transmission. ITK has discussed several of these ideas with local and international guests on Energyinsiders and Paul Simshauser, CEO of Powerlink for instance has written on Linkedin about dynamic line ratings. But these ideas don’t rate a mention in Frontier’s analysis because the objective seems to be to show the ISP in a bad light.

A third assertion in Frontier report, one commonly made, but as often the case in fact wrong, is that all the CER resources will require substantial net upgrades to distribution networks.

There is an alternative view that batteries and EVs will, at least in urban areas, result in less network capital expenditure. Essentially houses with solar and EVs will basically only be using the grid as a last resort. I would argue that the available evidence on substation capacity utilization is that so far there has been no pressure on distribution networks.

Further and better analysis than I can do on Frontier’s “base case” was provided by the Clean Energy Council

Nuclear costs

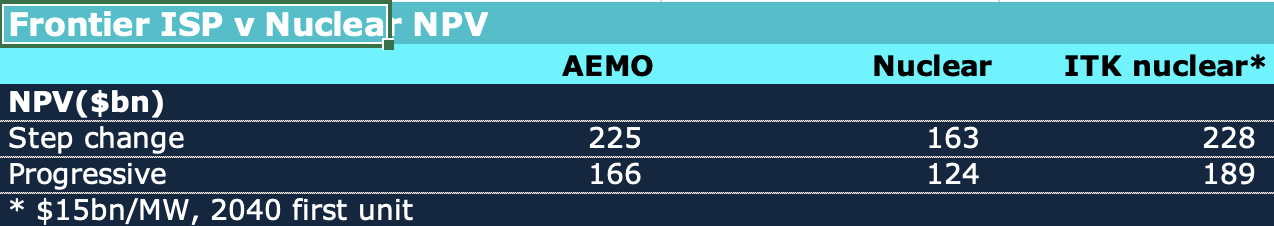

Frontier have assumed that reactors in Australia can start coming on line in 2035 at a capital cost in today’s $ of $10 bn/GW and opex of $30/MWh. I very much doubt that any private sector Board, would sign off on such numbers. I don’t profess to be an expert on nuclear costs. After all I have never needed and believe I still don’t need to know. I refer readers to Tristan Edis’s articles at Reneweconomy which I think conclude that $15 bn/GW is a better estimate.

The ITK numbers in the table below did some extremely crude NPV analysis on the fuel, carbon costs of a 5 year delay and also used $15 bn/GW. The approximate NPV of these changes was added to the Frontier numbers.

Still I don’t think the NPVs are the way to evaluate the system although they are the correct way to compare costs properly calculated.

That Frontier has the gall to criticise transmission cost blow outs but assumes there won’t be any in nuclear is again an example of the house of cards that has been constructed.

Equally the idea that the plants can start operating by 2035 will be questioned by most and certainly questioned by me.

Frontier’s NPV estimates do, I assume, take account of the higher carbon costs associated with keeping coal plants open until 2035 but you have to read a long way through the report to get to the NPV estimates. Most of the numbers presented are based on “real” costs which as I state above are just garbage from the point of informed decision making. You have to read right to the end of the report to get to the NPV numbers. No wonder Frontier did this work at their own cost.

I haven’t been through Frontier’s numbers in detail; the following are just random jottings.

I don’t believe that Frontier reported their capacity factor assumptions for nuclear directly but since they have 102 GWh from 13 GW by 2051 it’s about 90%. I.e. the fact is that nuclear produces right through solar production and on average achieves little or no flexibility in capacity utilization.

Note that the AER values carbon emissions at close to $200/t by 2035.

So a 5 year delay, somehow managed by magically keeping coal stations open even longer results in say 5 years at an optimistic 0.8t/MWh *13 GW