Global electricity trends

The IEA releases a .csv file of global electricity data every month. It lags a bit due to its comprehensive nature, the latest data runs to November 2025. I maintain a dashboard on my website that updates the data every couple of months and looks at the trends.

The database doesn’t capture every country, Russia and North Korea are missing, but it is pretty comprehensive.

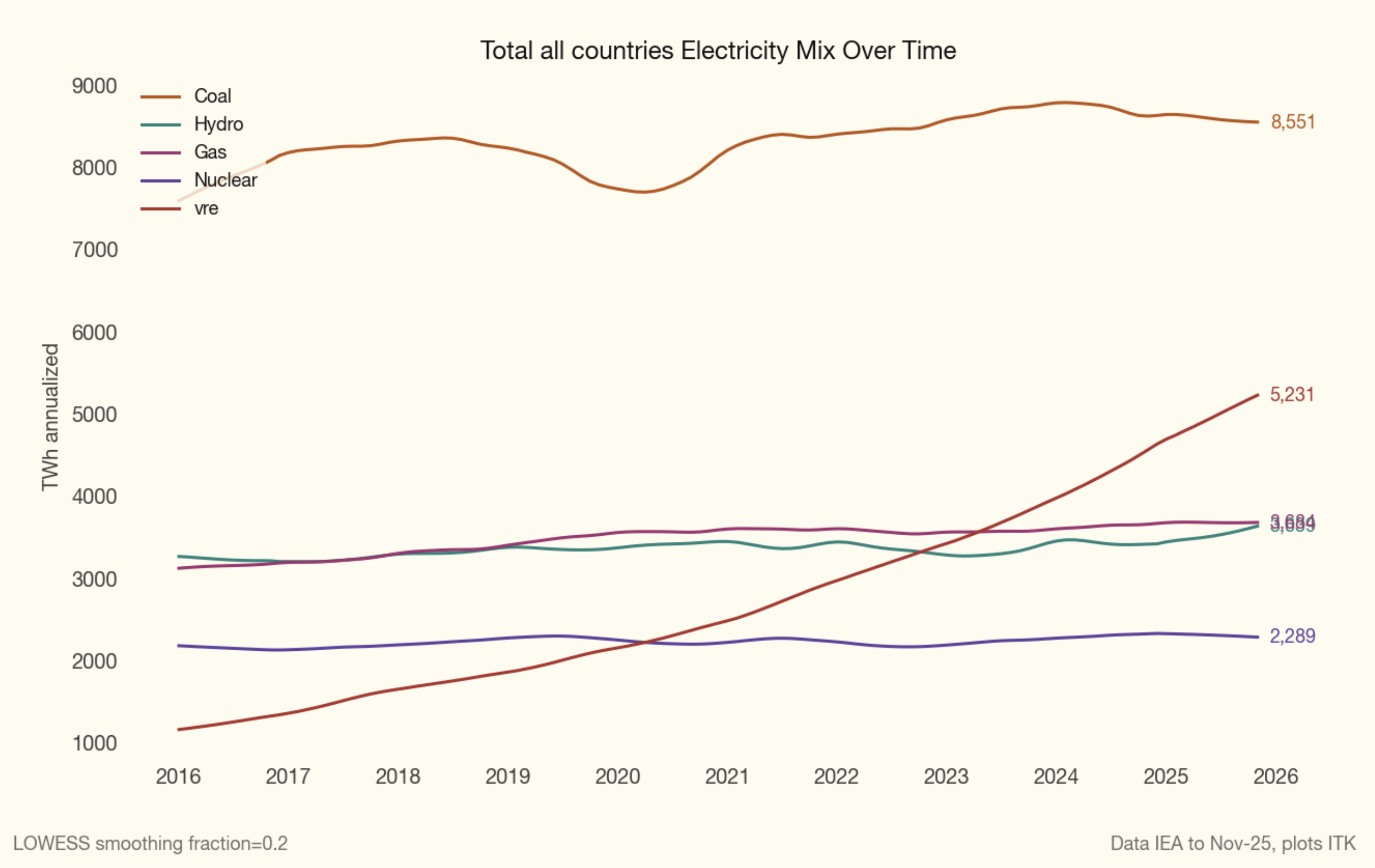

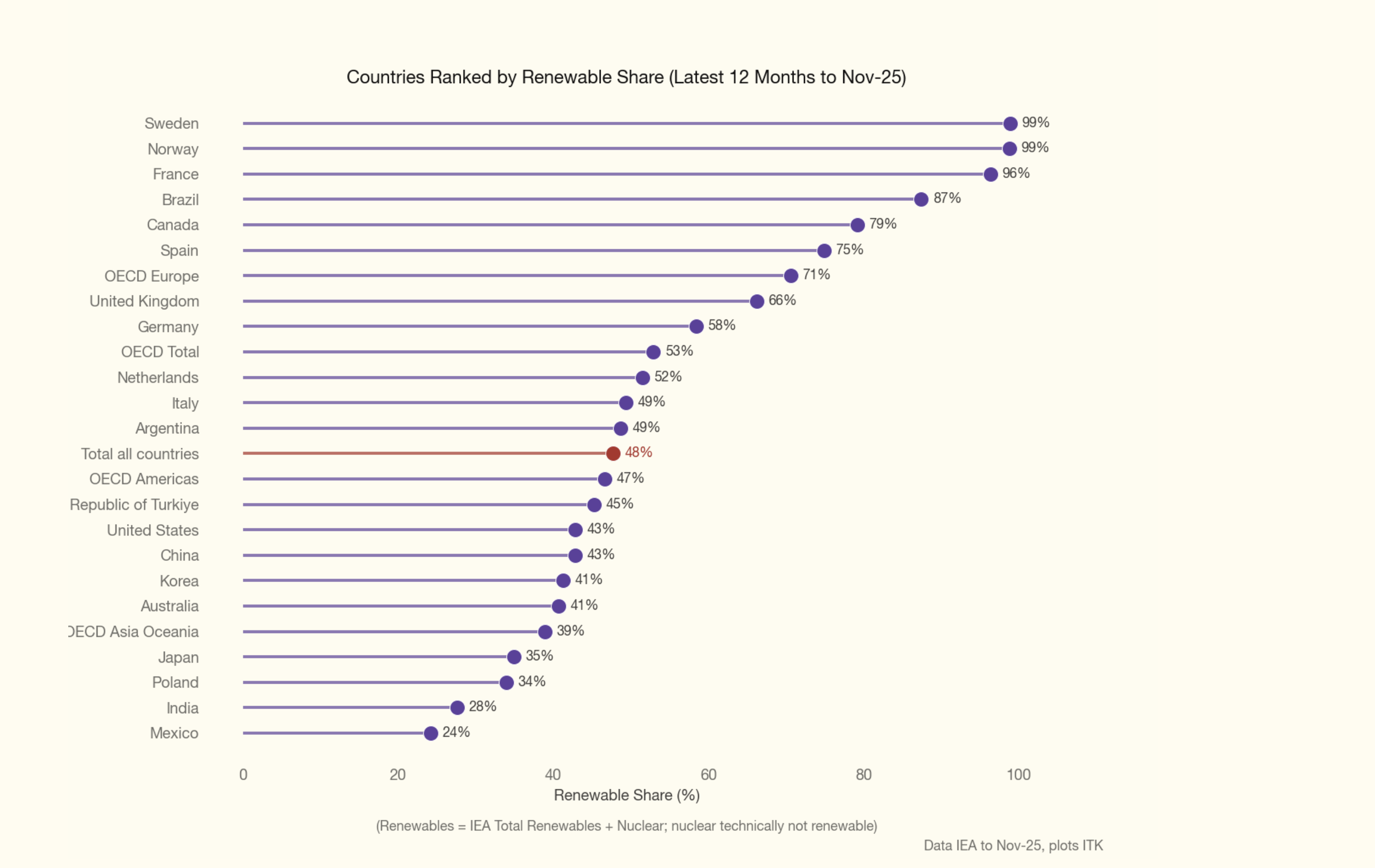

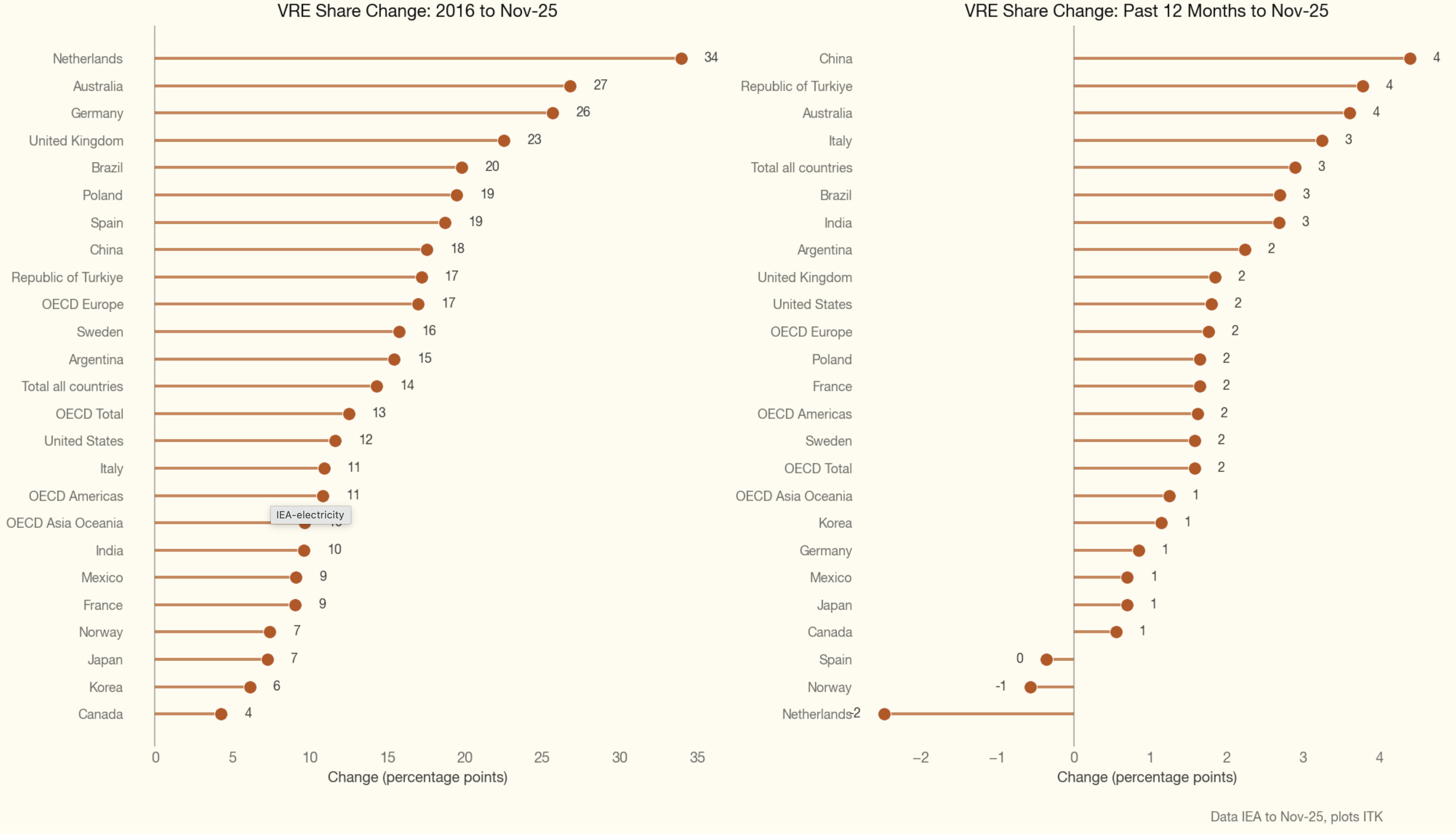

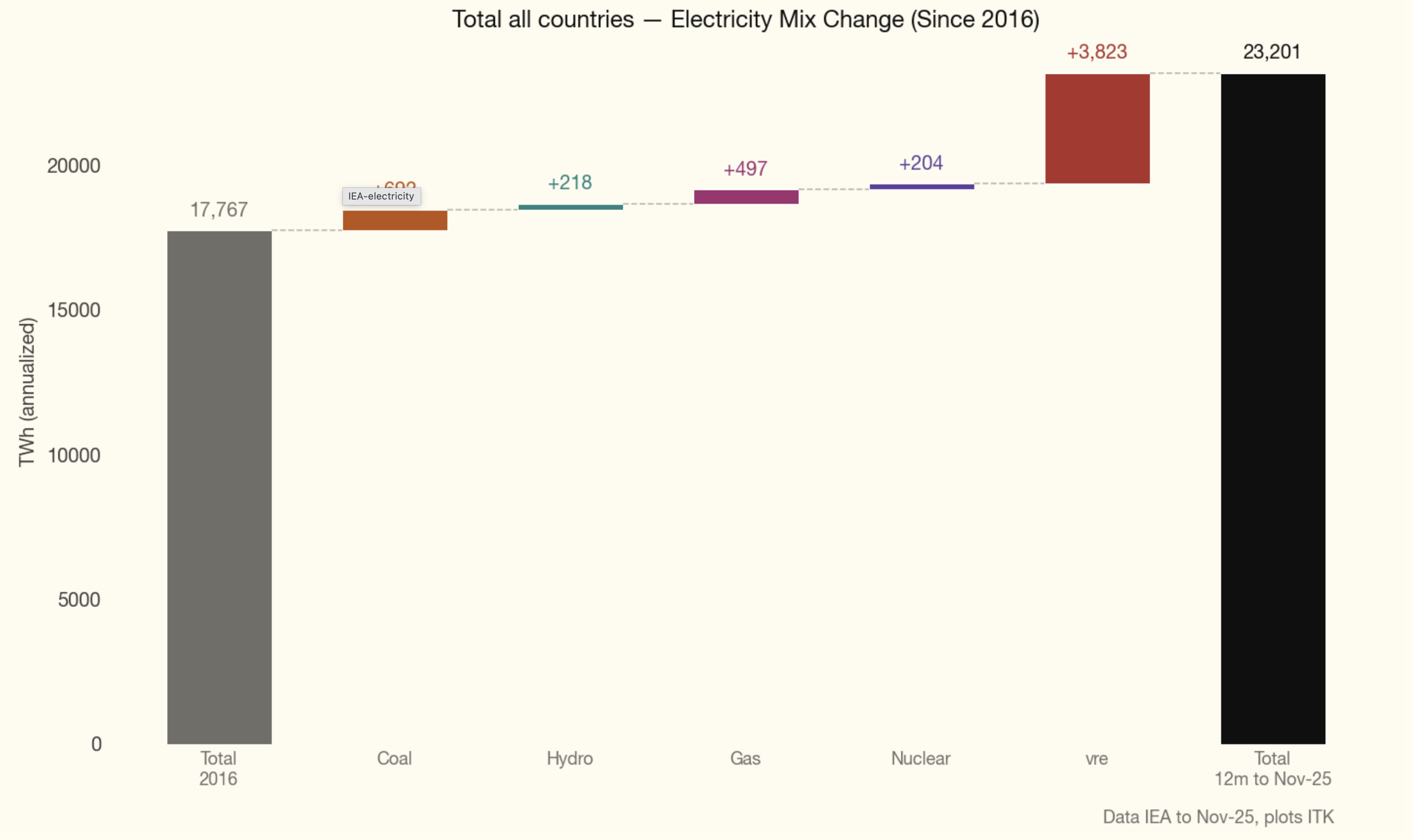

The first four plots show:

Renewables dominate the growth in electricity consumption since 2016 and in the past 12 months

That’s not just because big countries are growing their renewables share, although they are. Perhaps the most important feature of the data is that every country is doing the same thing.

In the last 12 months globally coal-fuelled electricity was very marginally down and renewables captured all the growth. At the risk of chart overload I don’t show that plot.

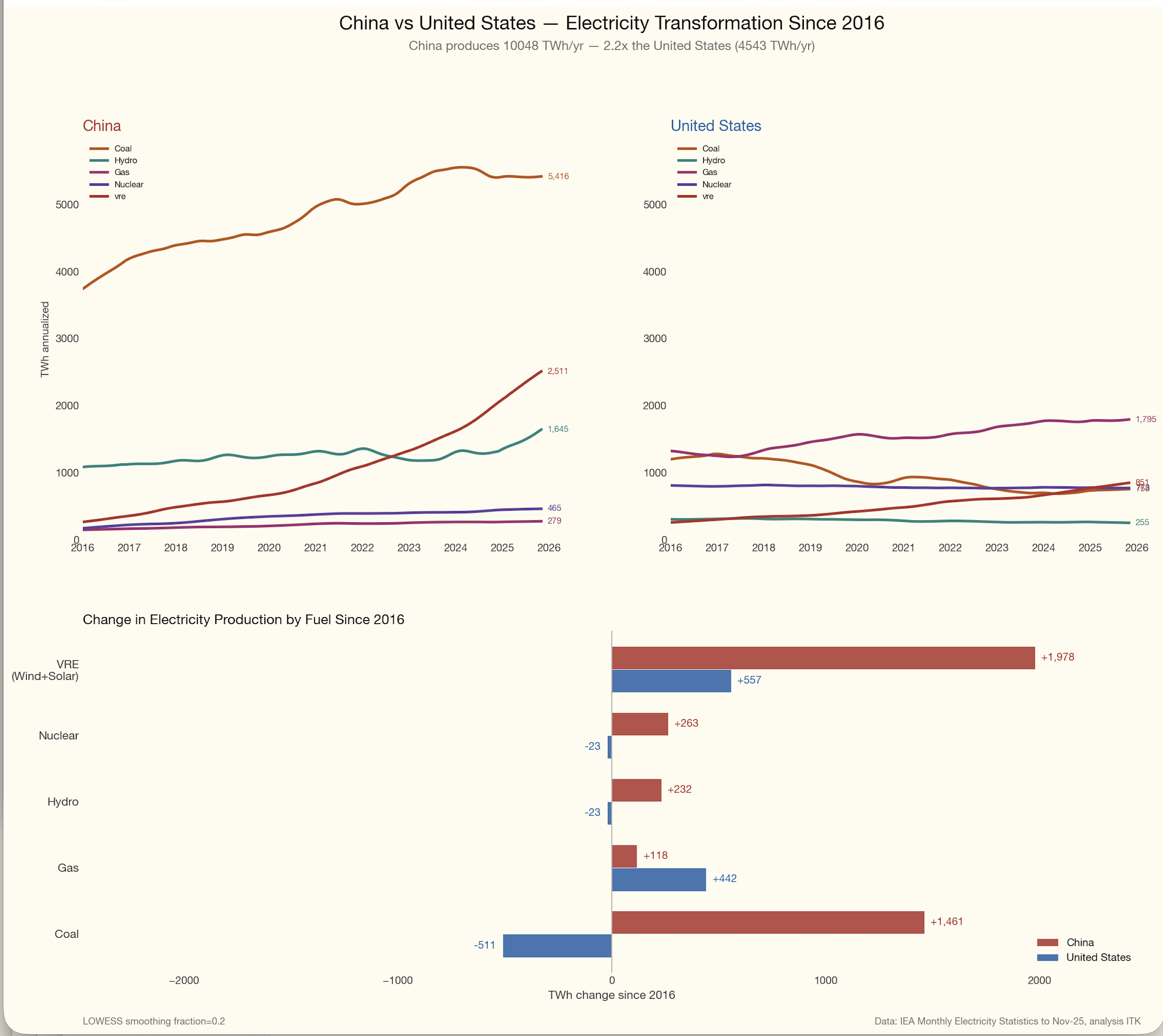

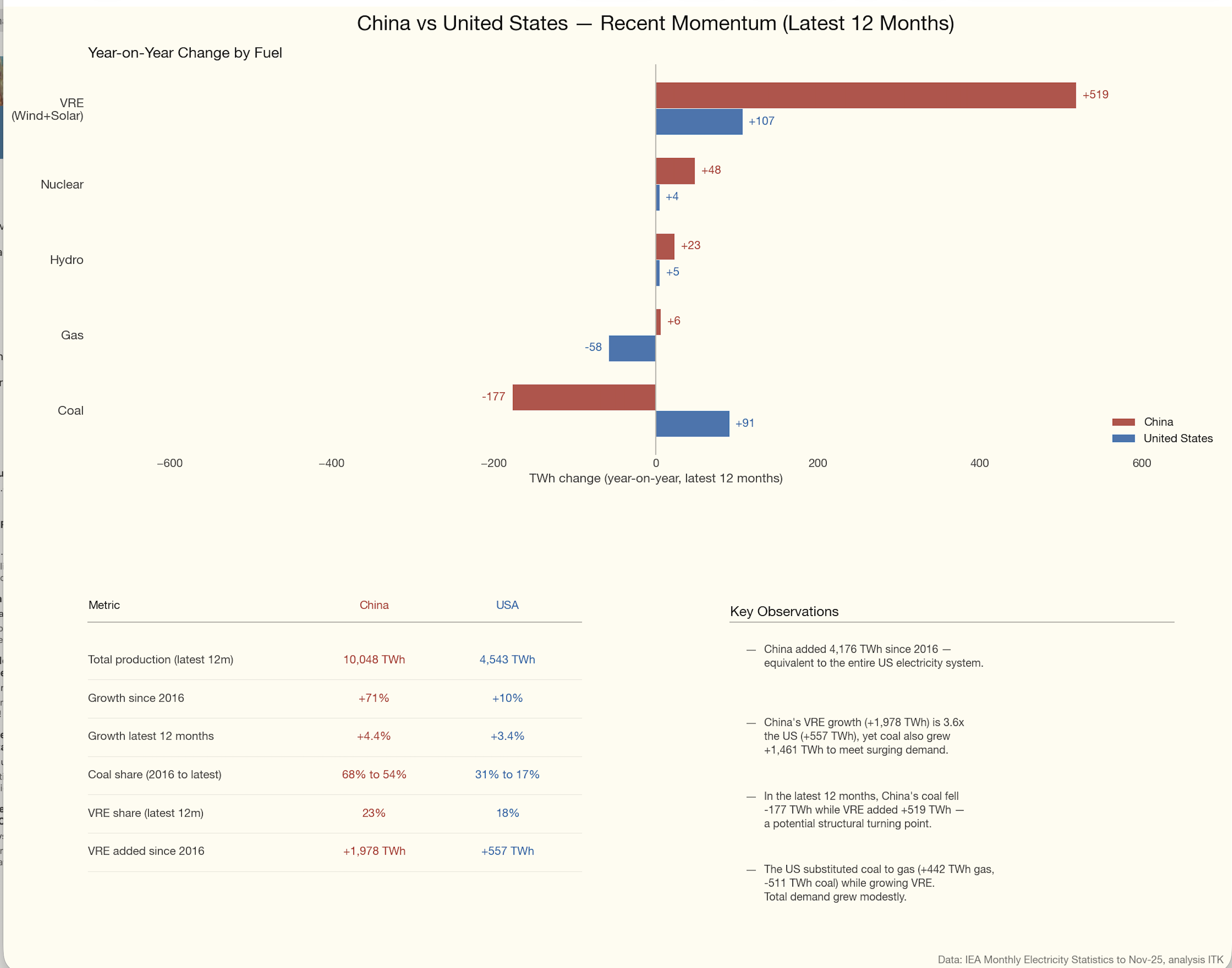

USA and China

Note that looking at what has happened, even recent trends, is not necessarily a guide to what will happen. For that we need to look at investment. Maybe next time.

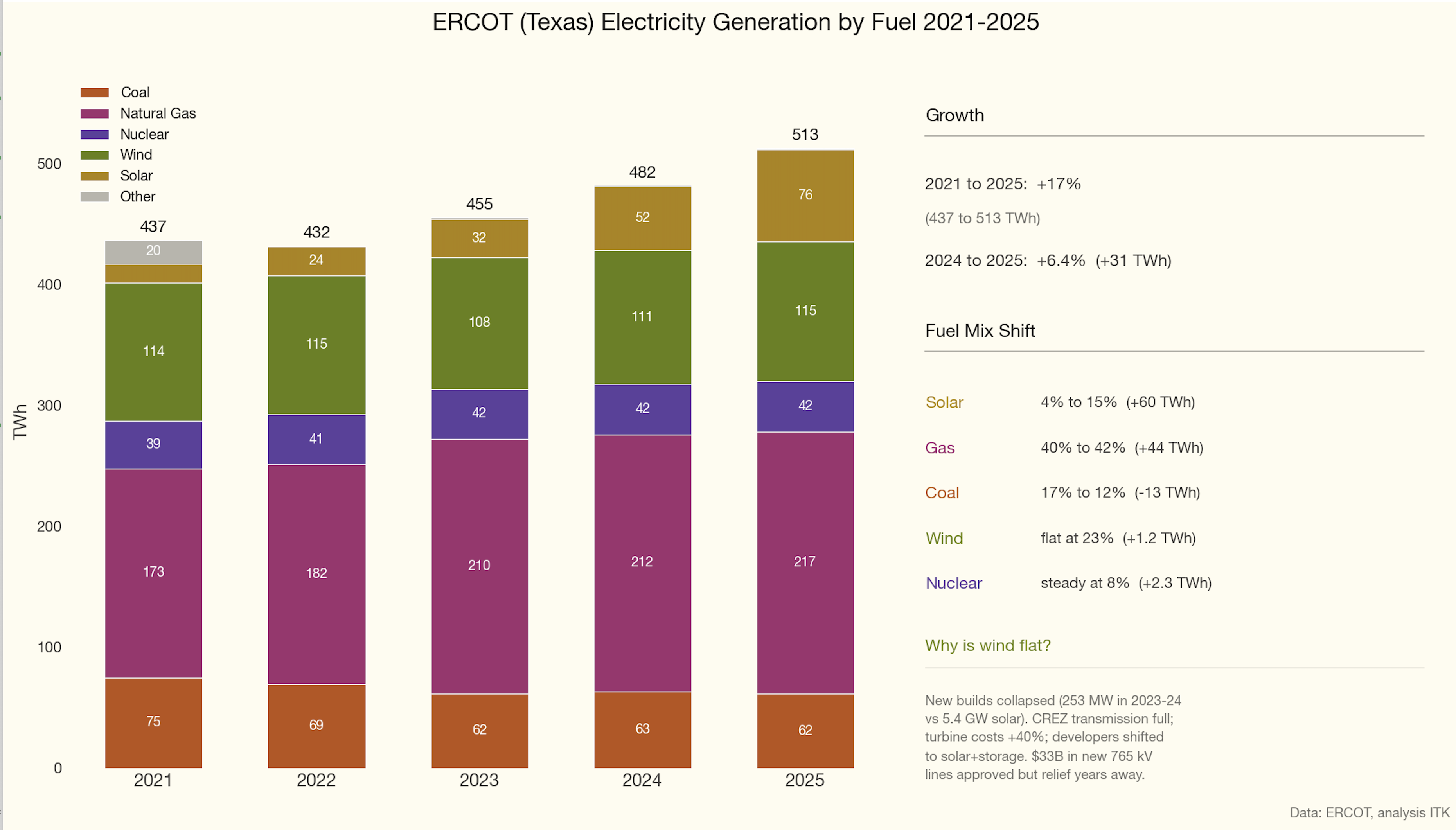

It’s interesting and not at all surprising to see China has grown its electricity consumption so much faster than the USA. That may change with data centre demand, certainly Texas consumption is growing faster than most places in the world, but it remains an open question how long that growth burst will be sustained.

Typically electrification is cited as the main driver of growth, and that’s what’s assumed in AEMO’s forecast documents. However at least in China the best view is that it’s simply growth from traditional industries.

What is of interest though is how China has increased its wind and solar share even as electricity demand has boomed. In the past 12 months, however, the USA’s coal-fuelled electricity production actually grew.

Electricity supply in the USA grew 3.4% last year. That’s very substantial by USA standards. Demand in China grew by a touch over 4%. Demand in Texas has been booming, like really booming. Despite that, and despite all the talk of data centres, the overall growth story is very modest.

I don’t know whether to think it’s comforting or worrying that Texas faces the same wind challenges as Australia, that is, cost increases and existing transmission is fully built out, though more capacity will arrive in a few years. I do know it’s unsurprising. Texas is also a huge battery market, although proportionally it may be smaller than the NEM. Doesn’t matter, the trends are similar.

ITK Research, February 2026