TL;DR

- The Federal Government should collect and make available data that shows comparative electricity costs on a global basis and where Australia sits. This information should show average spot prices, average industrial prices. By making the actual facts available, all parties, including the BHP CEO will be better informed. At the moment because of the information vacuum, it’s hard for the industry and the media to quickly establish the facts. Good information leads to better decisions.

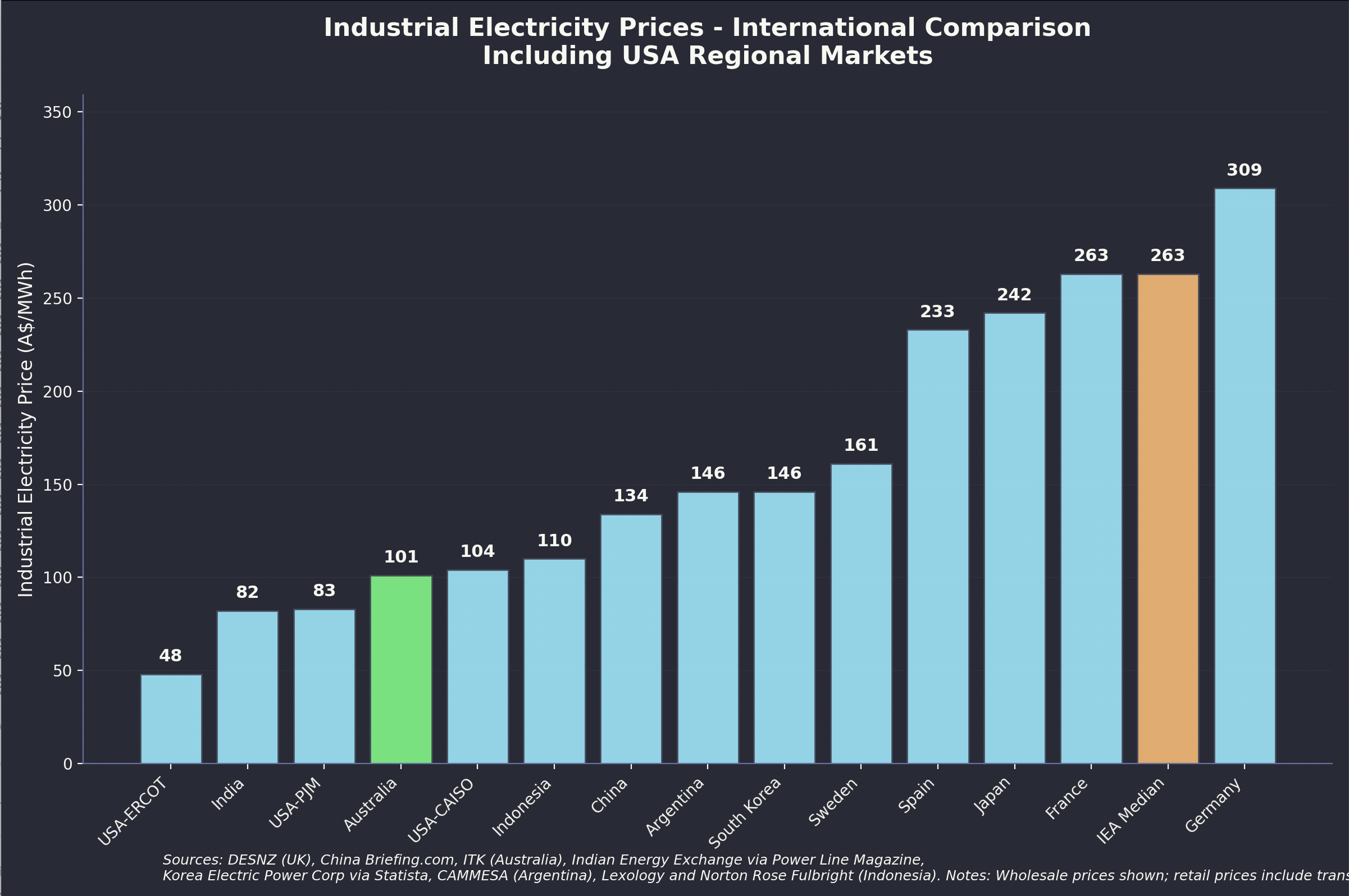

- The data available to me is inconsistent with BHP CEO’s assertion that Australia’s electricity costs are two to three times higher than the countries we trade with and 50-100% higher than in the USA. Only in Texas would that be the case on my data.

The fog of disinformation and talking the book

Colour me skeptical but despite never having attended I tend to think of the Annual AFR Energy conference as a place where senior management can talk to the general public, that is the AFR audience, as opposed to the industry. When you speak at one of the many energy and even more specialised conferences the audience tends to be from the industry or at least knowledgeable.

When you speak on TV or at a general public conference the speaker is much more likely to be able to say something without the “ifs and buts, the i-dotting and t-crossing” that would be required at a specialised conference. Not to put too fine a point on it my hypothesis is that

“the more general the audience the more likely the speaker is to talk their book”.

No doubt if I worked at a University I might be able to get a grant to study this. For the time being it remains a hypothesis.

Normally I don’t mind this. If a gentailer CEO wants to say how much he cares about decarbonisation without actually signing any PPAs or causing any renewable generation to be built, fine, those of us who follow the industry can follow the scoreboard.

Where I do think people have to take notice is when the chief executive of BHP starts telling everyone he meets that Australian electricity prices are double those of countries we compete with.

BHP chief executive Mike Henry lashed out at high energy prices in Australia and warned the economy must have affordable power to deliver emissions reduction goals.

“We have to have stable, reliable and affordable energy on the path to net zero. The reality is right now Australia has electricity costs that are two to three times higher than countries that we are competing with and 50 to 100 per cent higher than the US,” Mr Henry told a shareholder forum on Monday.

That quote is taken from what Perry Williams reported in “The Australian” about one month ago. My understanding is that similar comments were made at the AFR conference.

I am unaware of the evidence and data that Mr Henry uses for this statement but coming from one of Australia’s most senior business executives we all need to take the assertion seriously.

If it’s correct then perhaps Australians may need to think again, if it’s incorrect then perhaps we need to consider our opinion of Mr Henry and his motivations in making such statements.

Electricity price data is really hard to find on a global basis

The following plot shows my comparison of 2024 or 2025 prices generators receive or in some cases it’s the ex-tax industrial price. The primary data source is from the UK Government website but for non IEA data and including USA regions I have used other sources. It is true that the other sources are mostly related to prices generators receive rather than the prices industrial consumers (steel works, aluminium smelters etc) pay and that’s because industrial power price data is even harder to find than generator prices received. So to that extent the European prices are upwardly biased. That said for electricity at least in Australia industrial consumers tend to pay a price close to the price generators receive. Transmission costs are small, there are rarely taxes to pay etc.

I should add that I don’t really see that much difference in this context between say $90/MWh and say $110-120/MWh that’s just year to year variation. Readers could pay particular attention to Indonesia, a country with very cheap coal that has been capturing market share and one that does lots of mineral processing. If it’s not an Australian competitor I don’t know what is. The price its generators receive is almost identical to Australia’s.

Based on my data the BHP CEO is misinforming his audience

BHP has outperformed the ASX 200 since his appointment was announced in 2019 although it’s underperformed in the past two years. Mike Henry will have access to far more data than I do. He is the CEO of a big global international company that no doubt has access to every data set that could conceivably be relevant.

Whereas I am at best an amateur spectator.

On the basis though of the data available to me Mr Henry is flat out wrong. And if my data is roughly correct he does a disservice to himself and to BHP and to Australia by spruiking a misleading message.

And that’s why I think every Australian that works in critical minerals, every Australian that works at an aluminium smelter or an alumina refinery or any Australian or multinational looking at doing a data centre deserves to be able to look at some official data from the Australian Government about comparative international power prices.

In Texas (the ERCOT) region, according to Doug Lewin, there are now 200 GW of load requests. Even in this region with some of the cheapest electricity in the US, Texas will not be able to supply 200 GW of new load any time soon and if it tried to do that prices would rise quite a lot.

What is clear is that the only possible way to stay competitive in electricity is to continue to invest. Households invest in rooftop solar every day to the tune of well over 2 GW per year, a far better effort collectively than our Gentailers manage. Growing supply faster than demand is the only way to keep prices down. And keeping prices down is the only way to grow demand and stay competitive. Like the American declaration of independence these truths should be self evident.

International gas price data is also hard to come by

About the most interesting article I’ve seen on gas recently was a guest piece in the AFR by Stephen Harty, CEO of GLNG titled “Manufacturers want cheap gas that no longer exists”. Of course Mr Harty talks the GLNG book but what I found interesting was:

“Manufacturers tout US gas prices of $3/GJ gas in the US. The Henry Hub price on Friday was equivalent to $4.90/GJ, but that is not the price industrial customers pay.

In Ohio, where BlueScope’s North Star plant is located, the average industrial gas price in May this year was more than $17/GJ, higher than Australia’s gas price cap of $12/GJ. In six out of the top 10 manufacturing states in the US, industrial gas prices in May were higher than $12/GJ.”

Equally the reason East Coast Gas prices are high is because of the linkage that Santos deliberately created between Australian and International prices by driving development of LNG plants. China, Japan, Singapore, and South Korea, which are indeed our trading partners, all buy exported LNG, and additionally bear the regasification and transport costs within the destination country. They are all paying more than us.

Perhaps in Indonesia gas prices are indeed low.