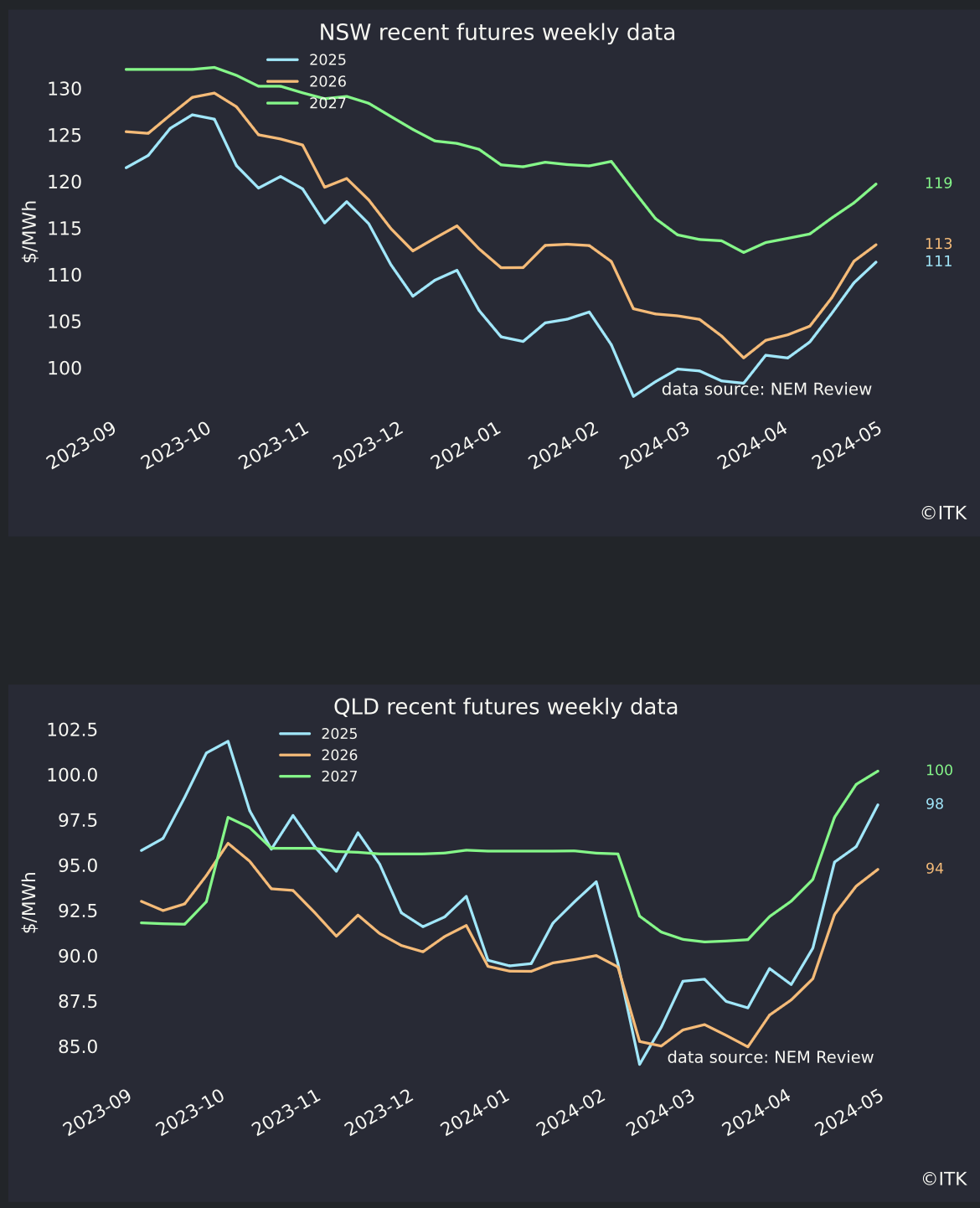

Futures prices have risen

This surprises me given:

- Eraring is likely to stay open a year or two;

- Callide C is coming back on line;

- There is plenty of new renewable supplyover the next year, even if not enough to replace Eraring. If there is new supply, coal prices stay controlled in NSW and Eraring stays open prices seem likely to fall.

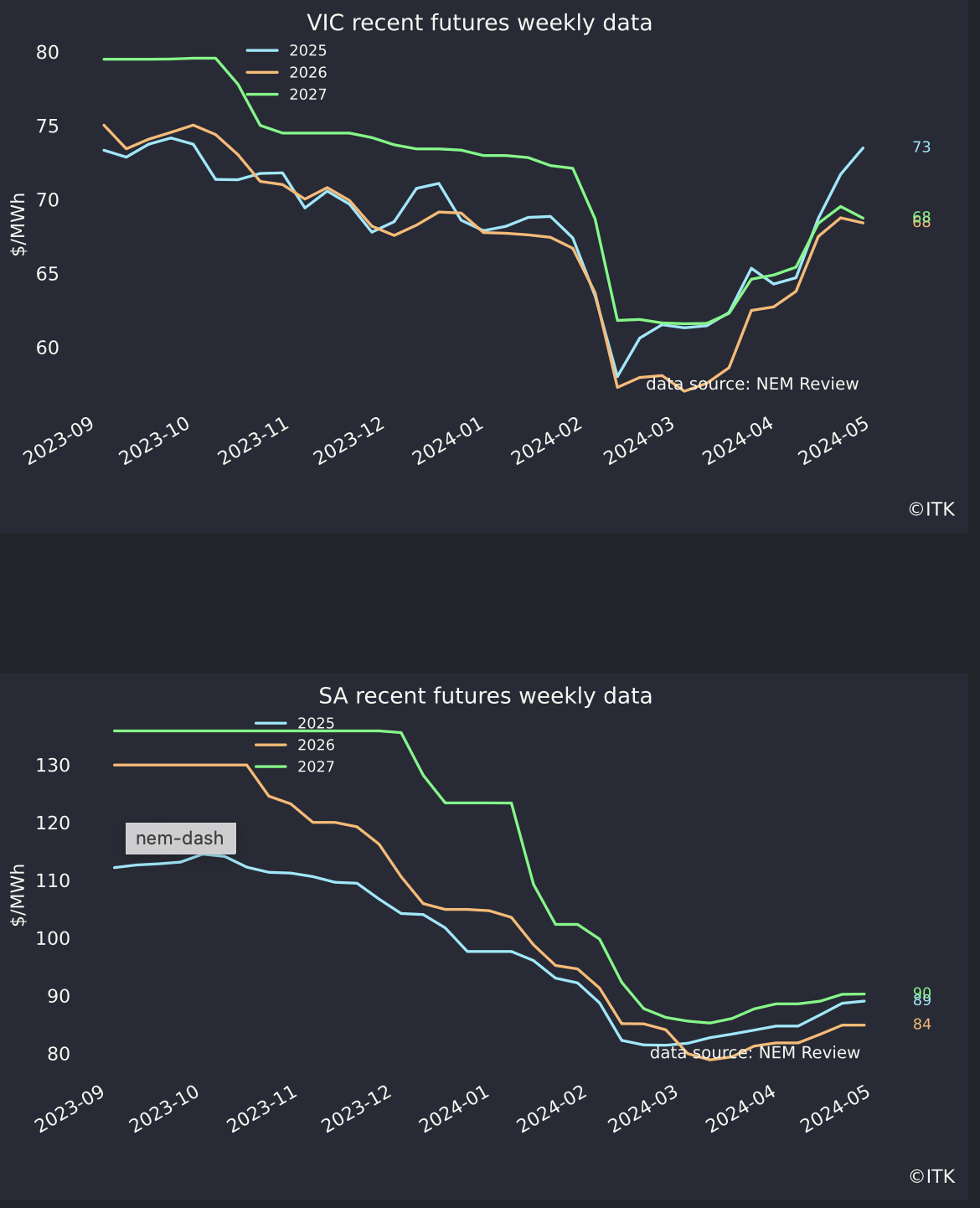

Traders finally seem to have worked out that Sth Australian prices will be lower than historically. Or maybe its just AGL’s control on the price loosening.

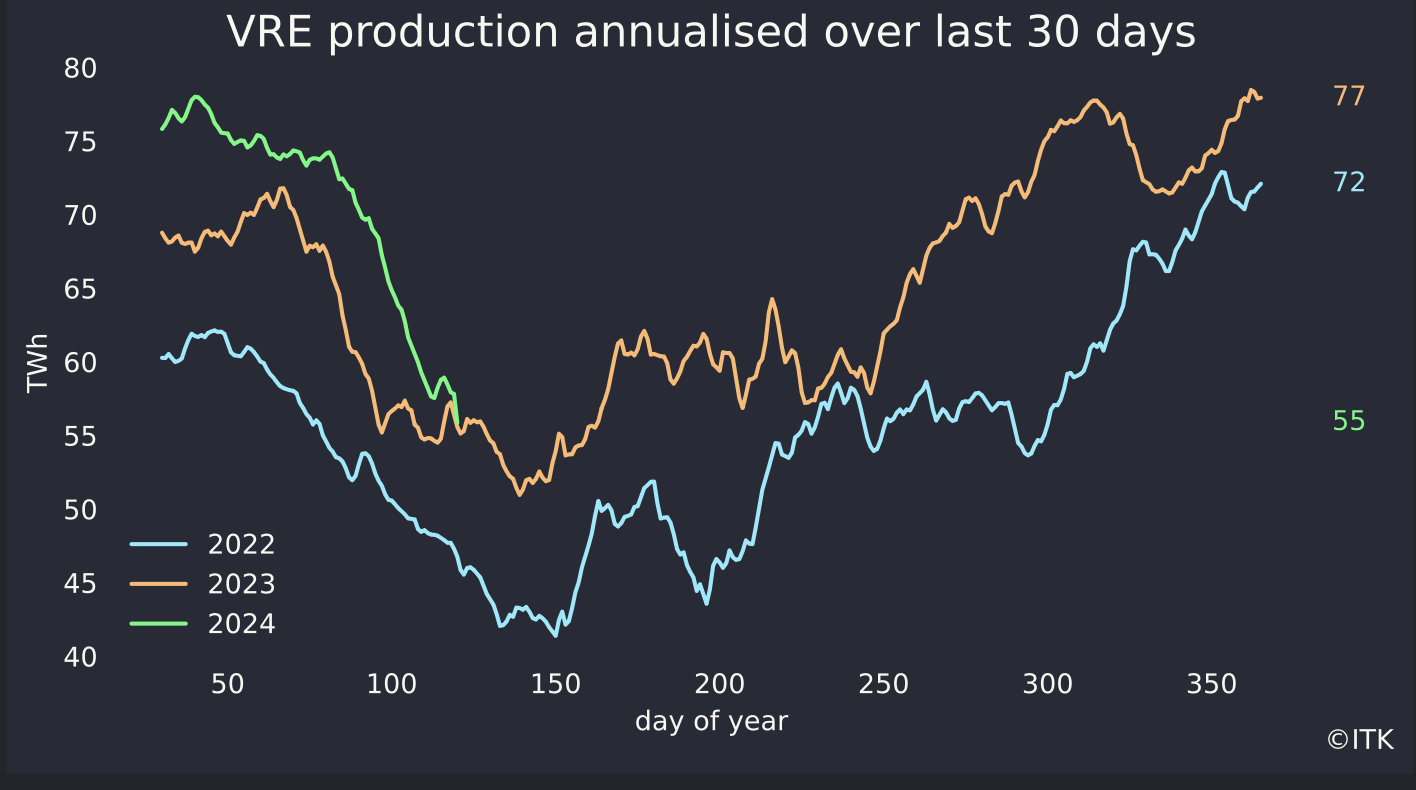

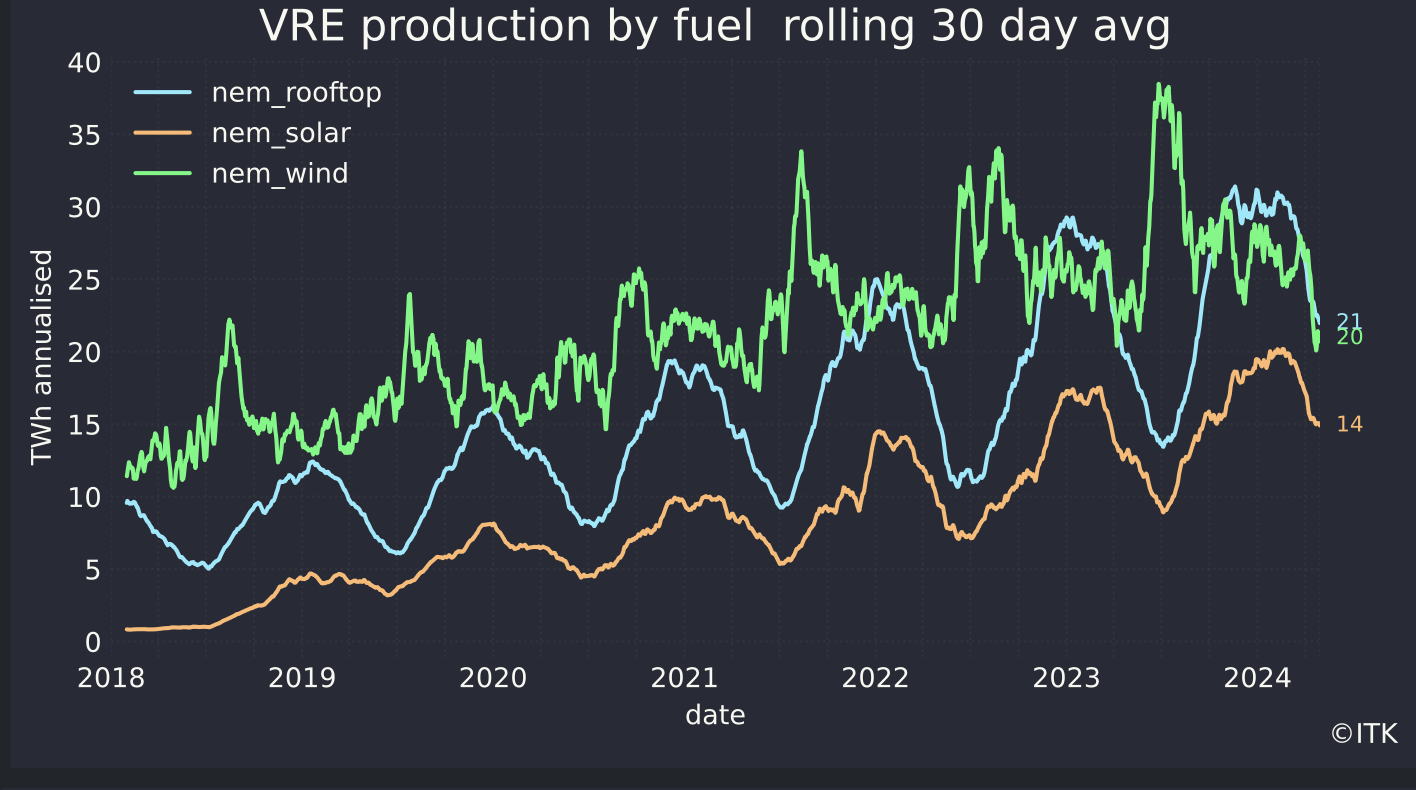

Meanwhile lower wind has dragged down VRE production to be flat on last year

I don’t think there is anything to see here really but it shows how wind output does matter particularly as solar production has seasonally slowed.