QLD Govt v QLD People - Govt wins, people lose

Having reviewed the QLD Govt Energy Plan it seems to me that:

- Wholesale prices will stay the same maybe even rise over the next few years, this is as much to do with price spikes as with the overall supply demand balance even though the latter is not great either;

- There will be enough supply for existing demand but no support for new energy intensive demand. The Qld Govt can make it look as though supply is increasing sharply by adding batteries and generation together but few analysts would agree with that presentation;

- Coal generation is going to decline or alternatively it will take a lot of capital to keep Callide B and Tarong going but there is no clear statement of how replacement generation other than gas peakers will be supported.

- The QLD Govt is backing new gas. Everyone else is backing new batteries not just in QLD but across the NEM. Why? Gas is expensive and hard to get, gas turbines are in short supply and expensive and long construction times (see eg Kurri Kurri) and operationally gas takes time to start up, is carbon emitting and part operation efficiency is poor. As a reserve fuel supply owned by Govt maybe fine, but for day to day operations not so much.

- Renewable developers get the message: they’re not welcome.

- And this is arguably the most important but also most controversial point. So long as the QLD Govt owns most of the generation and all of the distribution it will control what happens. And if incoming Govts have different views then policy will back flip and the overall outcome will be garbage. No matter how often Governments try to support coal and ignore climate change the economics and the science will just grind away. QLD can carry on in a no change, no growth environment but looking backwards instead of forwards is pretty dumb.

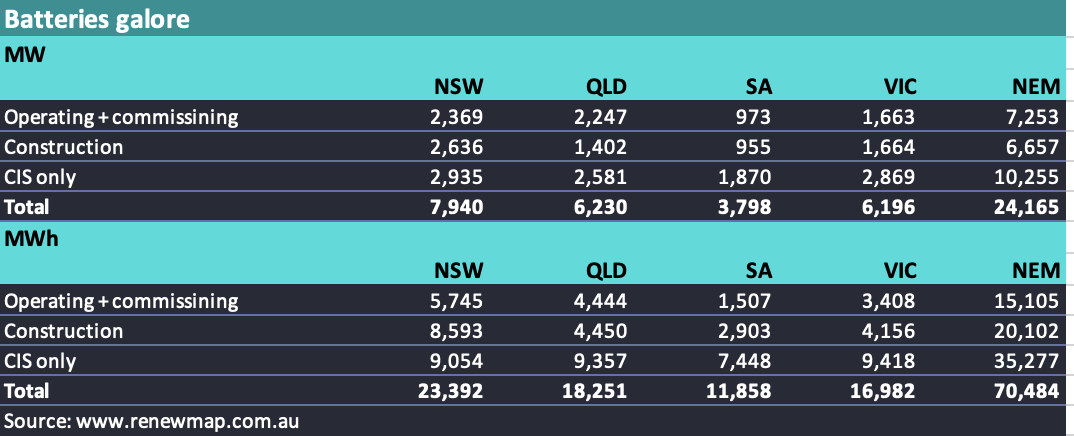

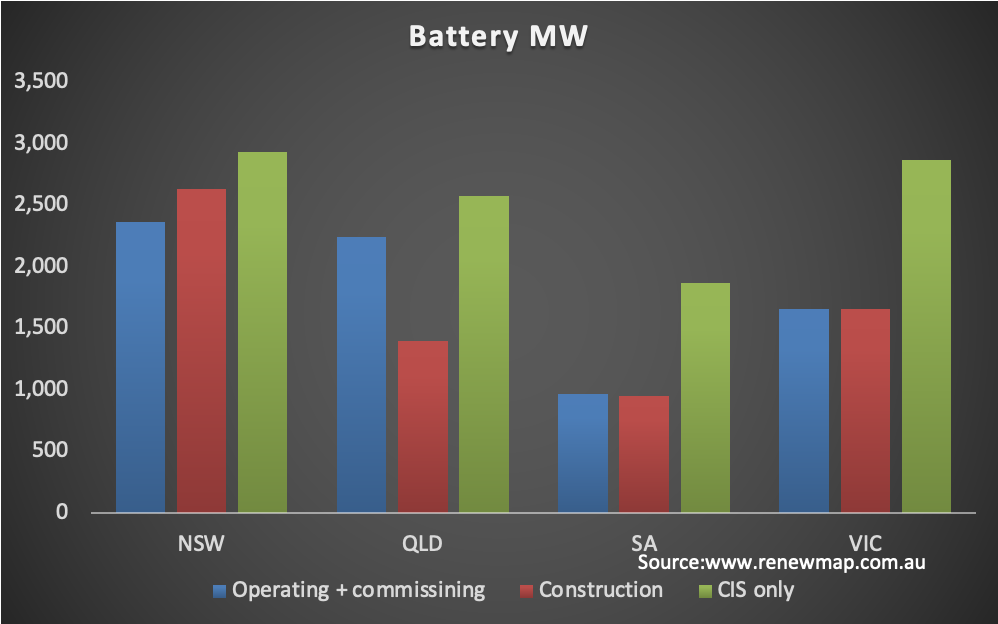

Just replacing Gladstone will take an effort by renewable suppliers and will have to be done in the face of a QLD Govt that is clearly anti renewables. This can be seen most clearly in the battery market. Everywhere else in Australia batteries under construction are booming but much less so in QLD.

The complete investment environment is up the creek. State owned generators turn taps off and on depending on the Govt of the day, competition and the private sector seem to be dirty words in QLD. Without State support it’s hard getting utility scale generation projects going in Queensland. To be sure it’s hard in every State but in NSW and Victoria and South Australia the State and Federal Governments at least welcome you. In Queensland the message is “you have to compete with coal, we won’t support renewables but we will pour money into coal generators”. But really there is no clear policy, lot of talk about coal decline trajectories but no real end game other than somehow ending up at net zero by 2050.

But the real point is growth, something QLD used to be good at, and wholesale prices. QLD coal production is being hurt by Indonesian competition. Coal generation is going to decline over time. Without clear plans to increase electricity supply relative to demand and thus lower prices and thus stimulate demand QLD is going to stagnate. The coal mining community, the coal generation employees are going to get resentful. Why? Because over time there will be fewer jobs and now there are no alternative jobs.

Mentioning decarbonisation only in the vague never never dream time of 2050 is another example of wishful thinking by a QLD Govt too attracted to the siren of the Federal LNP. Queenslanders deserve leadership but what they get is the sugar hit that comes from looking backwards instead of forwards. Rain bombs, fires and droughts, road damage, flood insurance, coral bleaching are on the menu, while the State tries to contain costs building for the 2032 Olympics. And when the international tourists come, Queenslanders will be able to proudly say “we are a coal state”.

All that said one suspects developers will continue background work in QLD and just wait for better times.

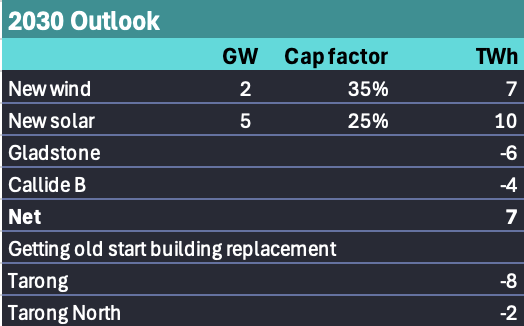

Capacity under the plan

One new gas plant 400 MW Brigalow plant is under construction.Others are mooted although why I don’t know. The private sector wants to built batteries. Governments want to build gas generation. Who is right? Other than gas the plan notes by 2030 2.4 GW of new wind and 4.4 GW of large scale solar. I’ve ignored the new gas in this table because the Govt correctly says it will at best be used for firming.

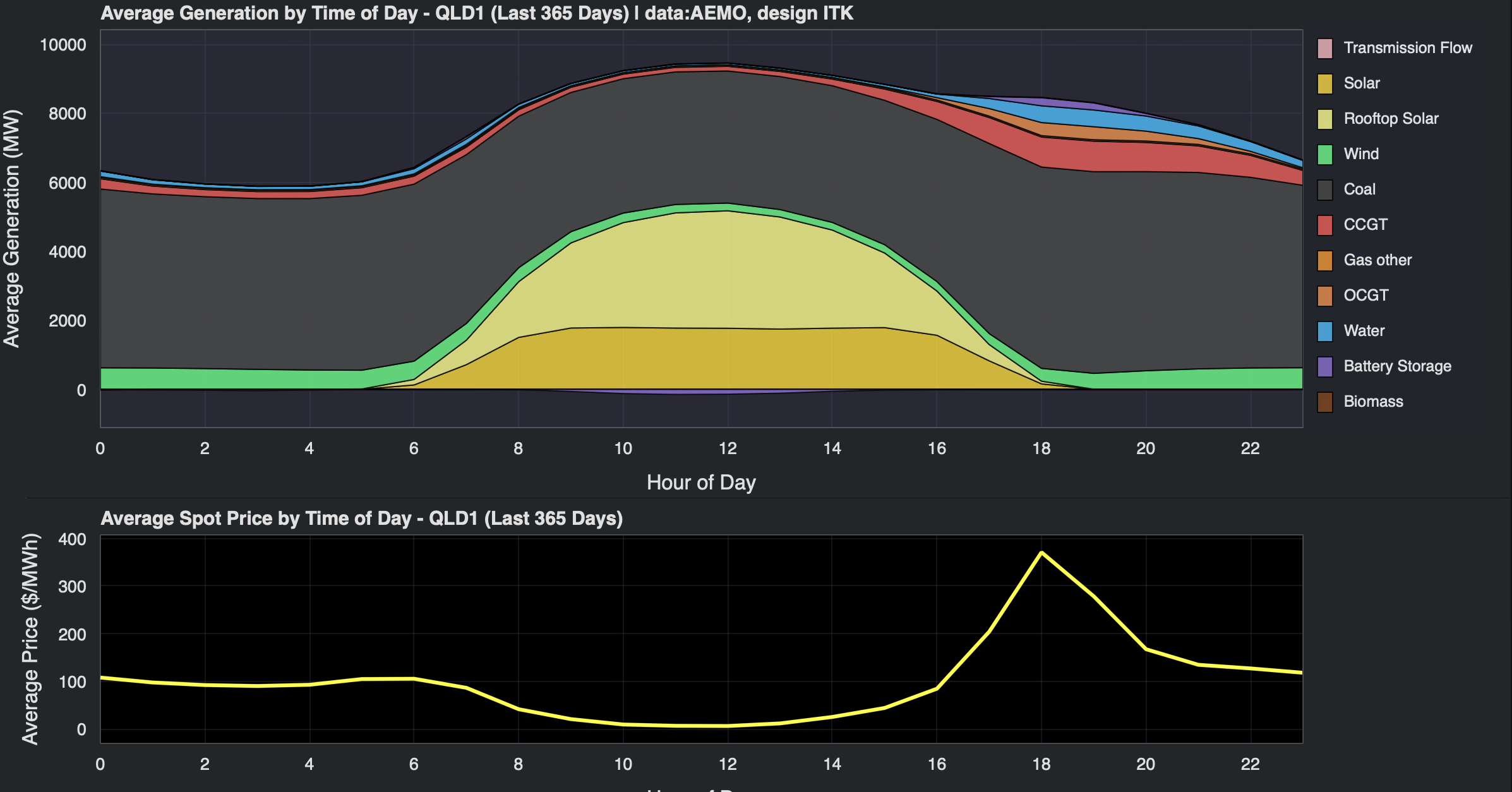

Equally there will be considerable new rooftop supply over the next 5 years in QLD even though penetration rates are already quite high. All of that will act to depress prices in the middle of the day which does provide a storage incentive. Low middle of the day prices don’t impact coal generators profitability much, or so it seems, because they make all their money when solar is not operating. What could impact coal generation profits is more batteries and or more wind. Since there wont be much more wind that leaves batteries.

It’s not clear to me what wind or solar projects are being referred to by the Govt other than Bungabpan (1.4 GW but bound to be two stages) Upper Calliope (1.1 GW solar) and Edify’s 600 MW solar Smoky Creek. Each of these projects has a PPA with RIO. None of those project have yet hit FID.

Hate renewables? Forget demand growth, forget AI

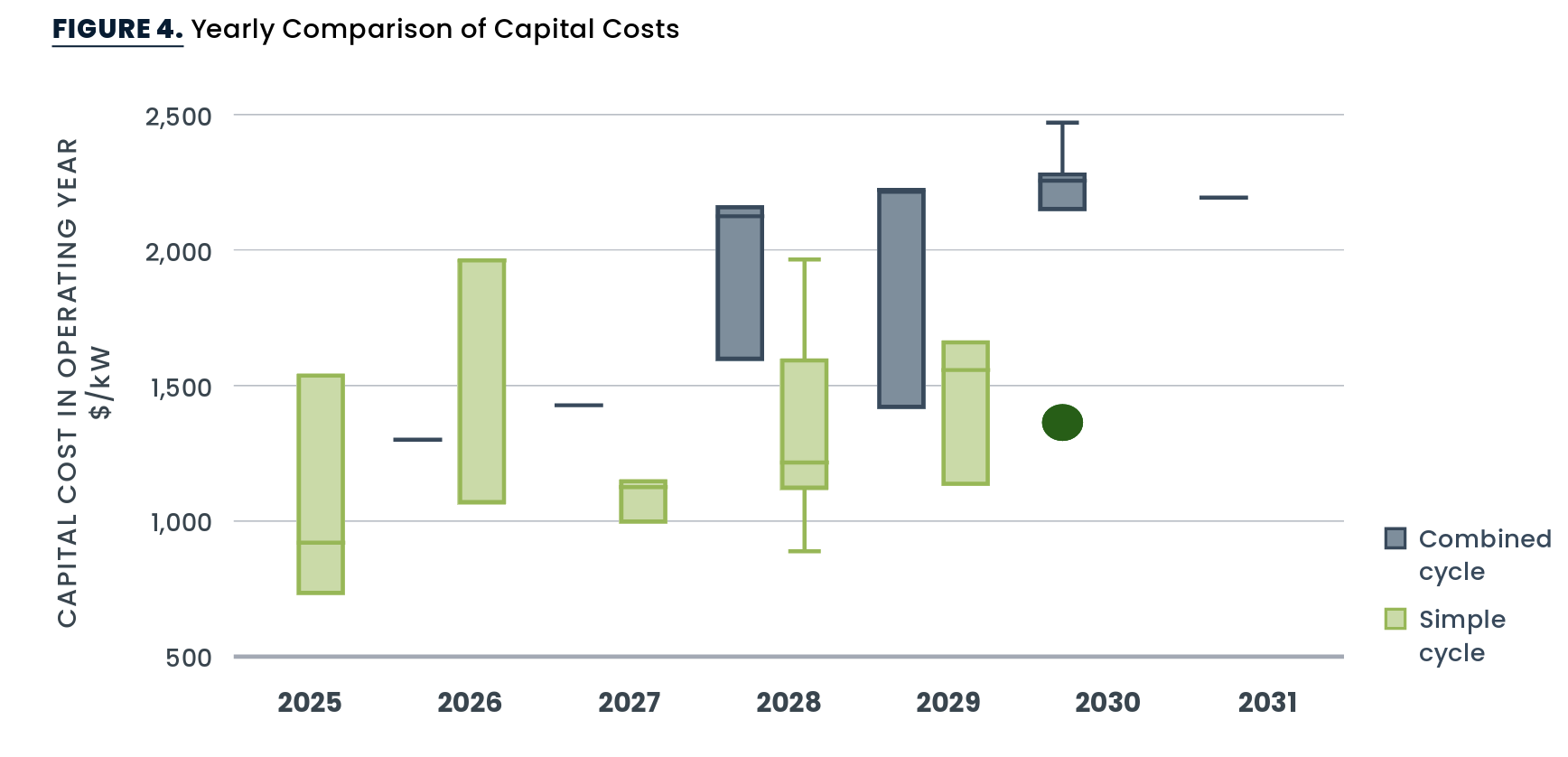

Even in QLD there is no real appetite for new coal generation. There is appetite for new gas generation but it’s not much easier building gas than wind. There isn’t much gas, turbines have at least doubled in price, and availability is low. The following figure is in $US

It’s well known that turbine availability is a minimum of four years. So no new gas fired generation is likely before 2030 in QLD in my opinion.

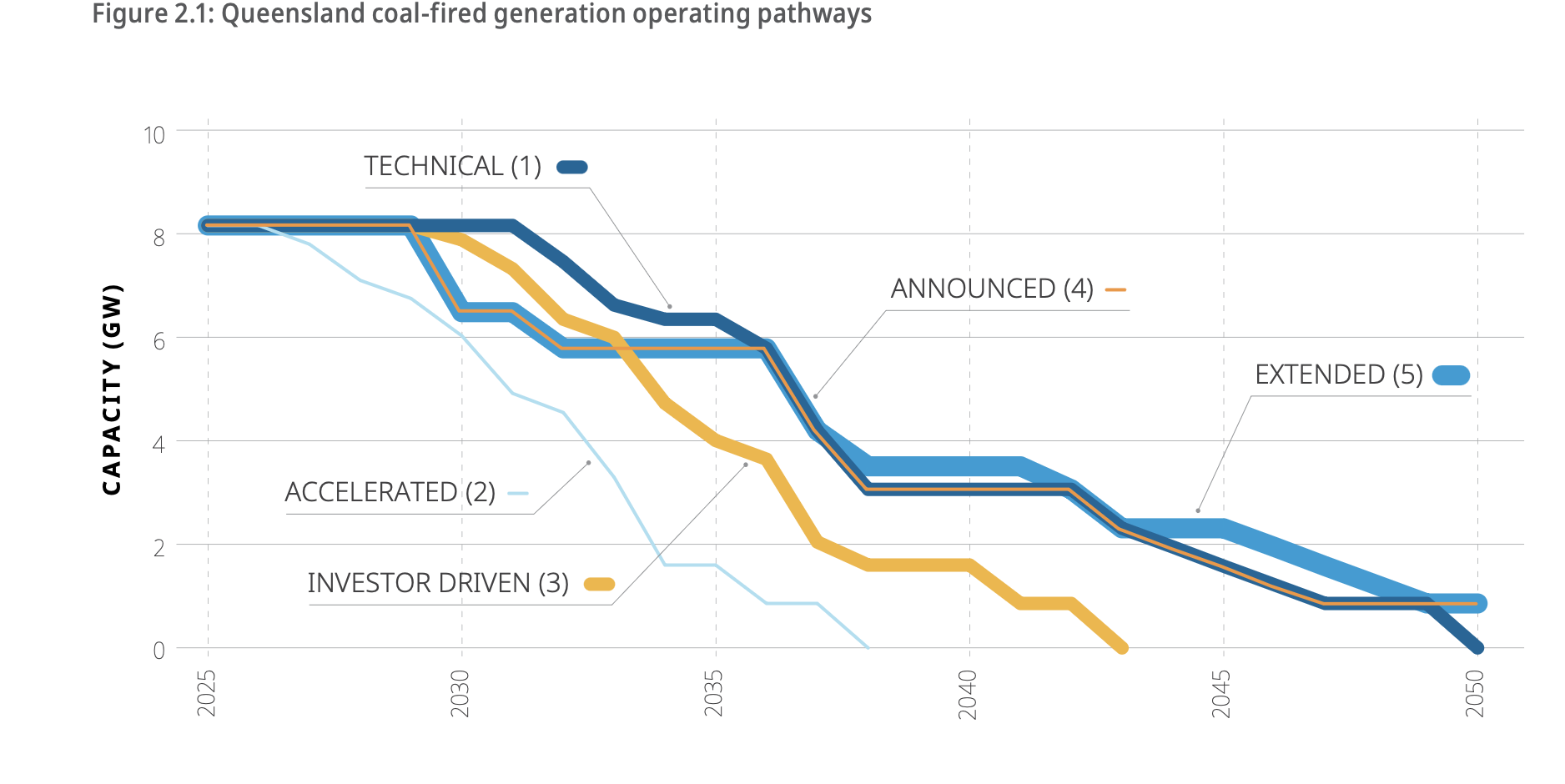

The QLD Govt modelled several scenarios of coal closures.

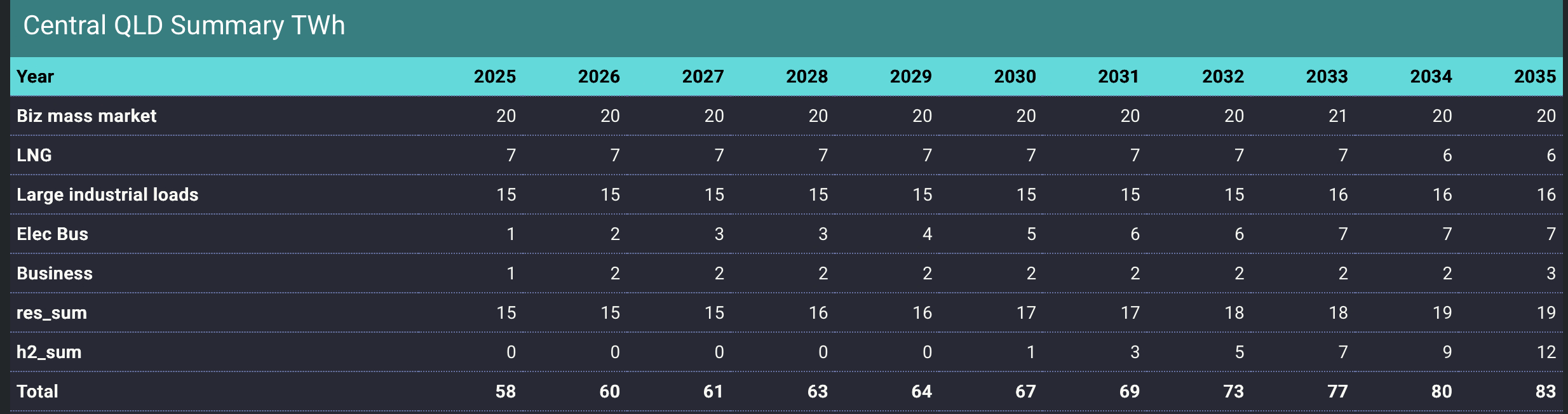

The somewhat amusing thing, from my point of view is that in each of these scenarios demand was set at the step change level from the ISP.

I’m never quite sure whether I’ve done the sums right but my read on the 2024 ISP step change demand forecast for QLD is

Let’s be conservative and assume zero hydrogen demand, even so overall QLD demand grows from say 58 TWh to 71 TWh a 22% increase in demand over 10 years.

In a zero hydrogen world, and backing out growth in rooftop solar, only moderate growth in utility supply might be required but it’s still growth in the face of coal closures.

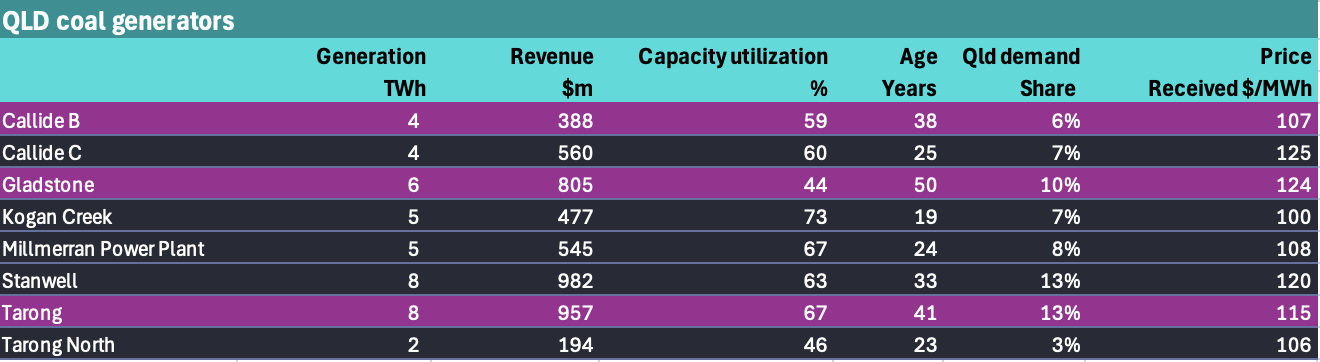

Over the past year coal generation in QLD has achieved average prices typically up around $108 despite often operating when lunchtime prices are low. So far as I am aware, the QLD generators have not shown the ability to two shift (switch off in middle of day then restart) in the way that Bayswater has just started to do in NSW. Some generators like the super critical Millmeran and Kogan Creek power stations would, in my opinion, arguably not be suited to two shifting. No doubt if the QLD Govt spends enough money it will be able to keep Tarong and Callide B running, but really is that how Queenslanders see the future? Running clapped out last century technology just to keep a few QLD seats in the Gladstone region?

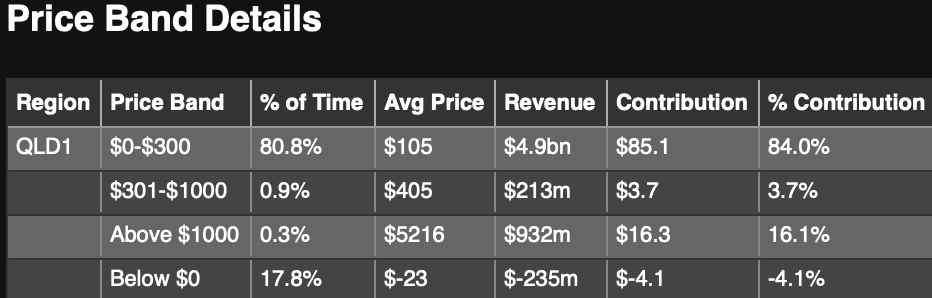

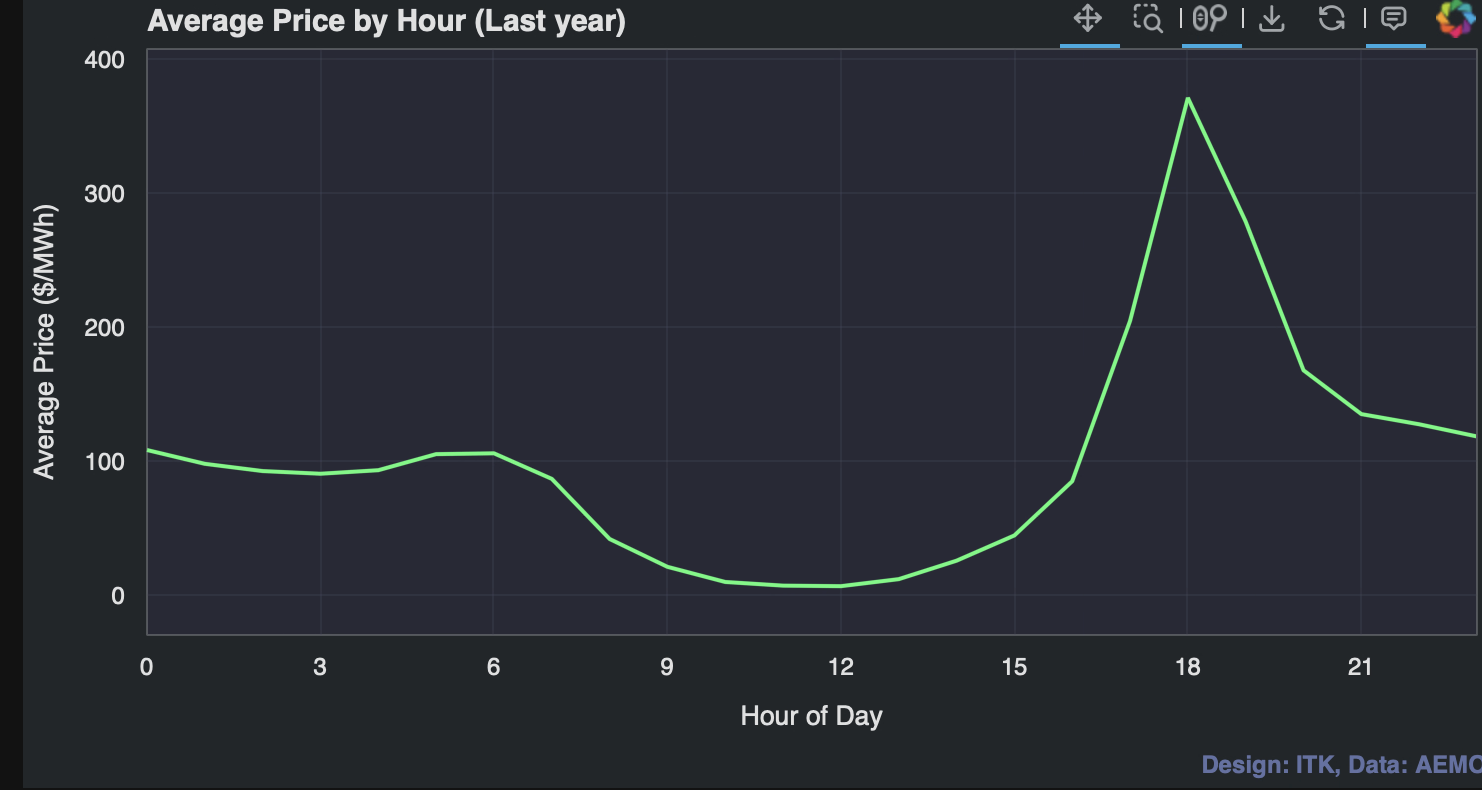

Regarding average price it’s not news to see how much of the average price is received during the peak hours.

You can see that more clearly here

And as with other States it’s the 1% of times that price is over $1000/MWh that keep generators going for much of the year, far outweighing the negative impact of the 18% of time where the price is below zero.

So really for QLD coal generators in terms of economics, the returns will be driven by the ongoing existence of price spikes and the evening peaks. Without lots more batteries and with the closure of Gladstone there will be lots more price spikes.

For years here at ITK we have been saying that when batteries hit their straps gas and coal generators will have less pricing power. But is that really true? We don’t know because the battery surge is still in its early days, but it has started. First lets look at the existing and forthcoming battery supply.

To say the least if all the batteries with CIS awards but not yet in FID are built we are still only about 1/3 of the way to what’s needed.

but even in batteries the dead hand of QLD conservatism is evident when we look at what is under construction.

The best we can say for long suffering South East Queensland consumers is that the surge in batteries in NSW may end up limiting high priced QLD coal exports in the early evening.

Although it will be investors that determine what happens, unless there is a strong price signal in QLD , you can expect under investment to continue. Right now there is only another 1 GW of batteries (4.5 GWh) under construction. I don’t think that’s enough to really take the edge off prices.

Across the NEN and allowing for the closure of Gladstone, Eraring and Yallourn it’s likely that every MW of the 10 GW of CIS awarded batteries and the 6 GW under construction will be needed. Still 70 GWh of battery storage is an awesome number enough to run the NEM for about 3 hours all on its own.