Australian Safeguard Mechanism

“Of all follies there is none greater than wanting to make the world a better place.” — Molière

Policy reviews - safeguards matters less than EVs

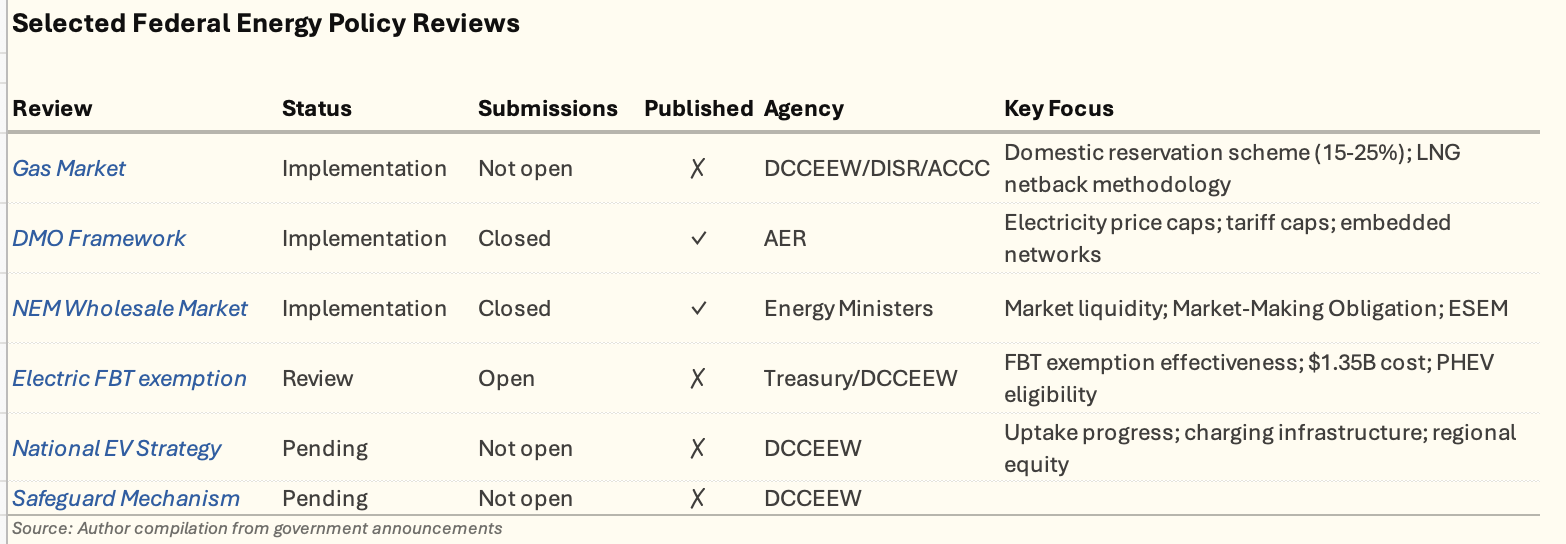

The Federal Government is undertaking a series of policy reviews for some of which submissions have closed and others yet to start.

To me it is just blindingly obvious that the National EV Strategy Review should take precedence over the FBT exemption. I already wrote about this so not going to repeat here.

It’s blindingly obvious to me that the two best, (fastest, cheapest, and most beneficial) ways for Australia to decarbonise are to decarbonise electricity supply by getting more supply built and by transport electrification (reduce oil imports). To me these should be the Government’s priorities for the next five years. They are achievable objectives that can be politically popular as well as improving life for Australians and making Australia a more powerful middle power. We become more powerful by becoming a model for how to do it and by reducing risk of being over exposed to a sunset industry group.

I’ve also covered to some extent the Nelson Review and the industry changing potential of ESEMs.

So that brings us up to the safeguards review. Except the way it’s working out maybe we should rename it the “Safeguard Gas producers Review”. And do we need a review? So far it’s doing a pretty good job of safeguarding gas producers.

Overview

The Safeguard Mechanism is Australia’s principal policy for reducing greenhouse gas emissions from the nation’s largest industrial facilities. Reformed in July 2023, it operates as a baseline-and-credit scheme requiring covered facilities to progressively reduce their emissions in line with national targets .

Legislative basis: National Greenhouse and Energy Reporting Act 2007 (Cth), administered under the Safeguard Mechanism Rules

Administering bodies:

- Department of Climate Change, Energy, the Environment and Water (DCCEEW) - policy

- Clean Energy Regulator (CER) - compliance and administration

Facilities emitting more than 100,000 tonnes CO2-e per year (scope 1 emissions) are covered.

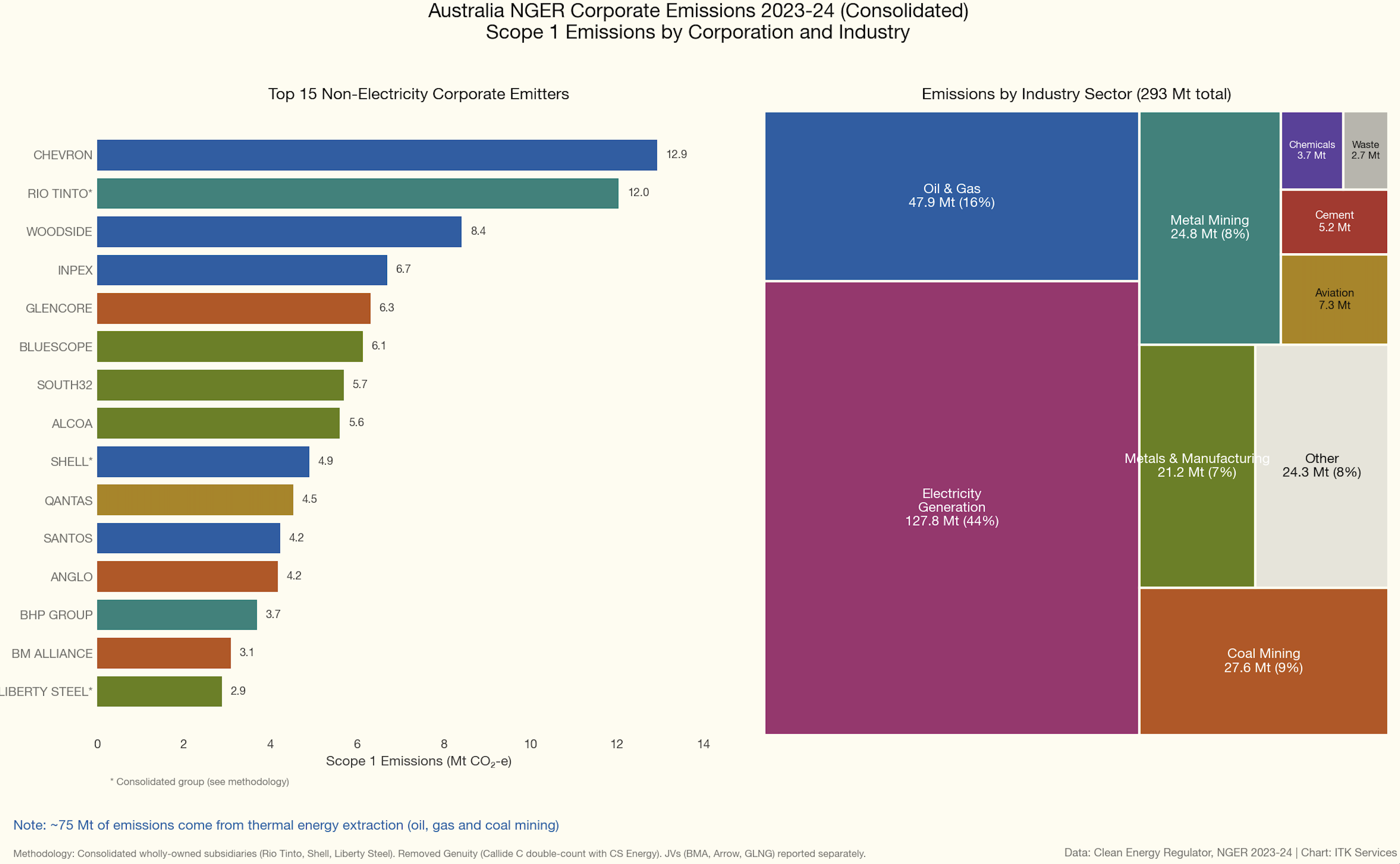

The following visualisation shows the top emitters and the industries. I’ve included electricity in the industry overview although it’s excluded from the Safeguards scheme.

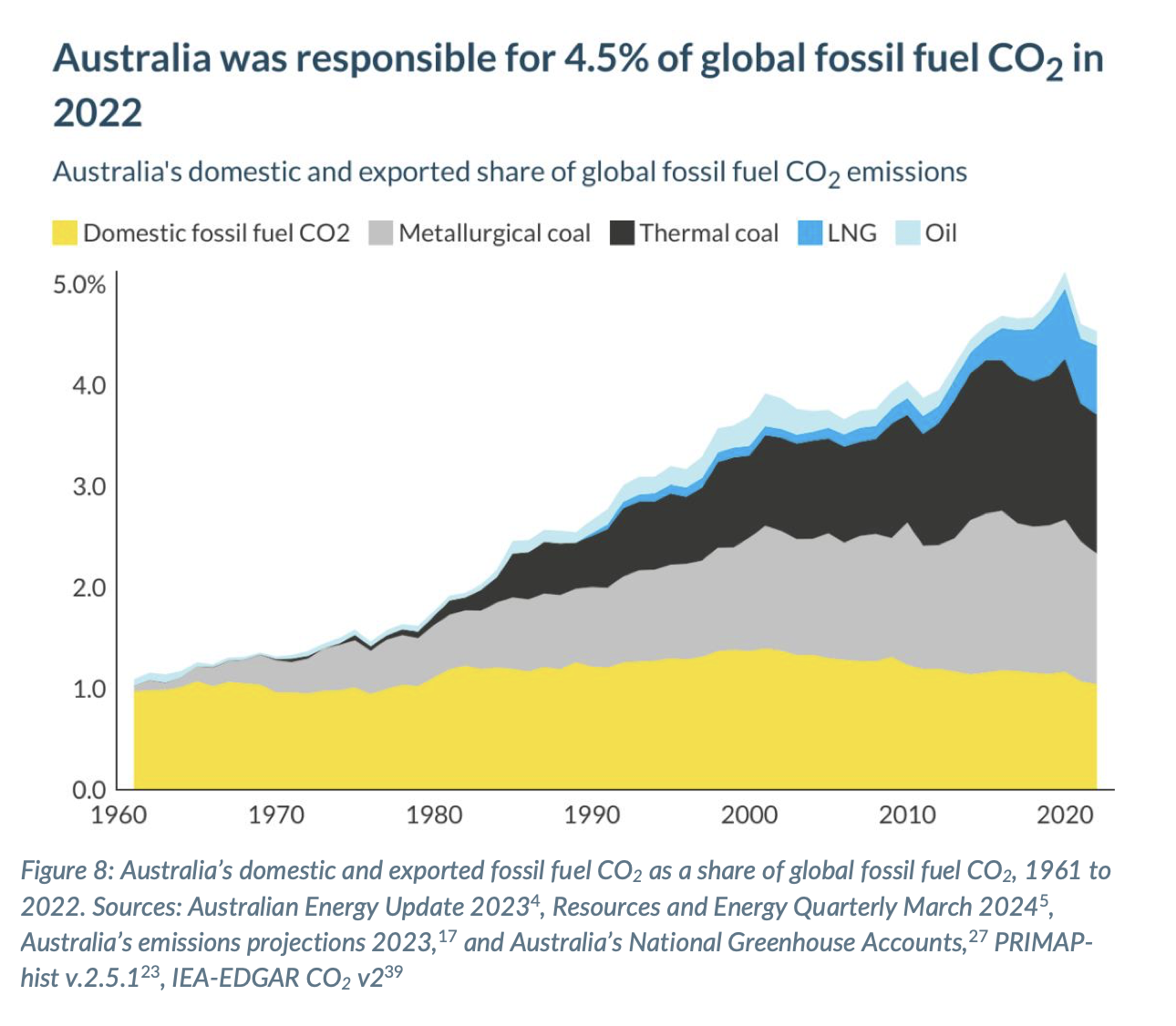

75 MT or about 14% of Australia’s emissions come from producing coal, gas and oil, just so we can pollute the rest of the world by having them burn those fuels and release far more emissions.

If we include scope 3 emissions, Australia is about 4.5% of the global total.

{#fig-Grant,Hare Climat Analytics 2023}

{#fig-Grant,Hare Climat Analytics 2023}

So don’t let anyone tell you it doesn’t matter. It’s perhaps a stretch to compare exporting coal to someone selling cigarettes to pensioners. We just sell ’em; they are the ones that smoke them. But it’s not that much of a stretch.

That said there are no easy votes in a tougher Safeguards scheme, whereas there are tons of votes and photo opportunities in a home battery scheme. In fact, if the Safeguards scheme worked it would likely in time lead to less gas and coal production. Let’s be honest, problems for gas in West Australia are politically very hard work.

How It Works

Each facility receives an emissions intensity baseline - a limit on emissions relative to production output. Baselines decline annually to drive emissions reductions.

Decline rate: 4.9% per year (to 2030)

This rate is designed to deliver a proportional share of Australia’s 2030 target (43% below 2005 levels).

Compliance Options

Facilities exceeding their baseline must manage excess emissions through:

Surrender Australian Carbon Credit Units (ACCUs) - Offsets representing emissions reduced/removed elsewhere (e.g., reforestation, landfill gas capture)

Surrender Safeguard Mechanism Credits (SMCs) - Credits issued to facilities that beat their baseline, tradeable within the scheme

Flexibility measures:

- Multi-year monitoring periods (averaging emissions over 2-3 years)

- Borrowing from future baselines

- Trade-exposed baseline-adjusted (TEBA) facility provisions (reduced decline rate for internationally competitive industries)

Facilities surrendering ACCUs equal to or exceeding 30% of their baseline must publicly explain why on-site abatement wasn’t undertaken.

Emissions Performance Data

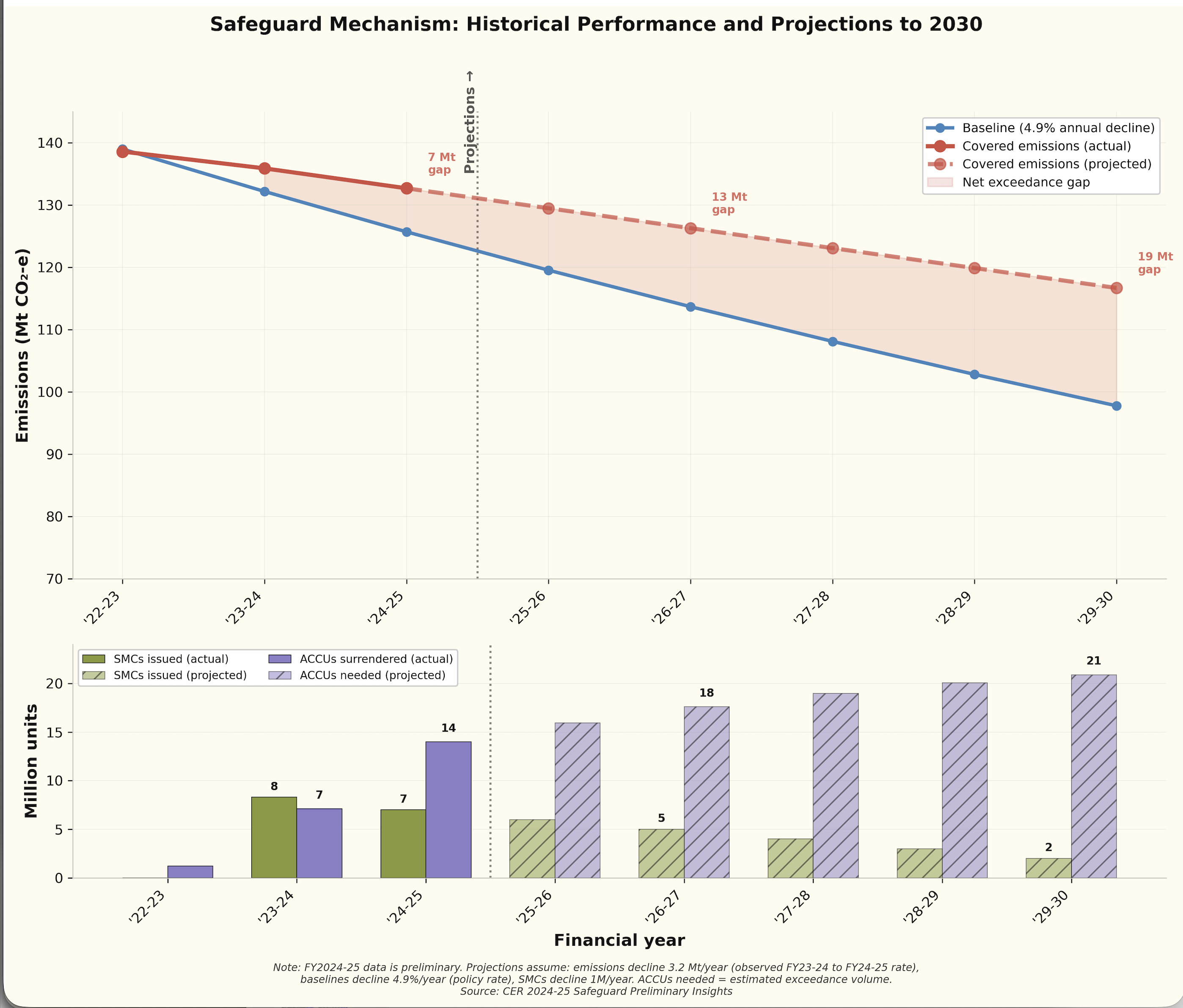

If you are a gas or coal producer, your emissions have been safeguarded. Emissions have exceeded the baseline in the first two years with the difference being made up by ACCUs. This is exactly what everyone expected. In the following plot I have made naive forward projections assuming that actual emissions from covered facilities decline at the same rate as the past two years leading to ever larger shortfalls. This means less and less SMCs (credits from outperformance that can be sold) and more and more reliance on ACCUs.

Key observations:

- Emissions declining but slower than baselines: Covered emissions fell 4.3% over two years (139→133 Mt), but baselines declined 7.3% in FY2024-25 alone — facilities are not decarbonising fast enough

- Exceedances surging: Facilities in exceedance rose from 142 to 143, but exceedance volume jumped from 9.2 Mt to 14 Mt — a 52% increase in compliance liability

- ACCU reliance growing: Surrenders increased six-fold from 1.2 million (pre-reform) to 7.1 million in the first reformed year, indicating heavy offset reliance rather than on-site abatement

- SMC supply tightening: Fewer facilities earning SMCs (62→59) means reduced credit supply as demand increases

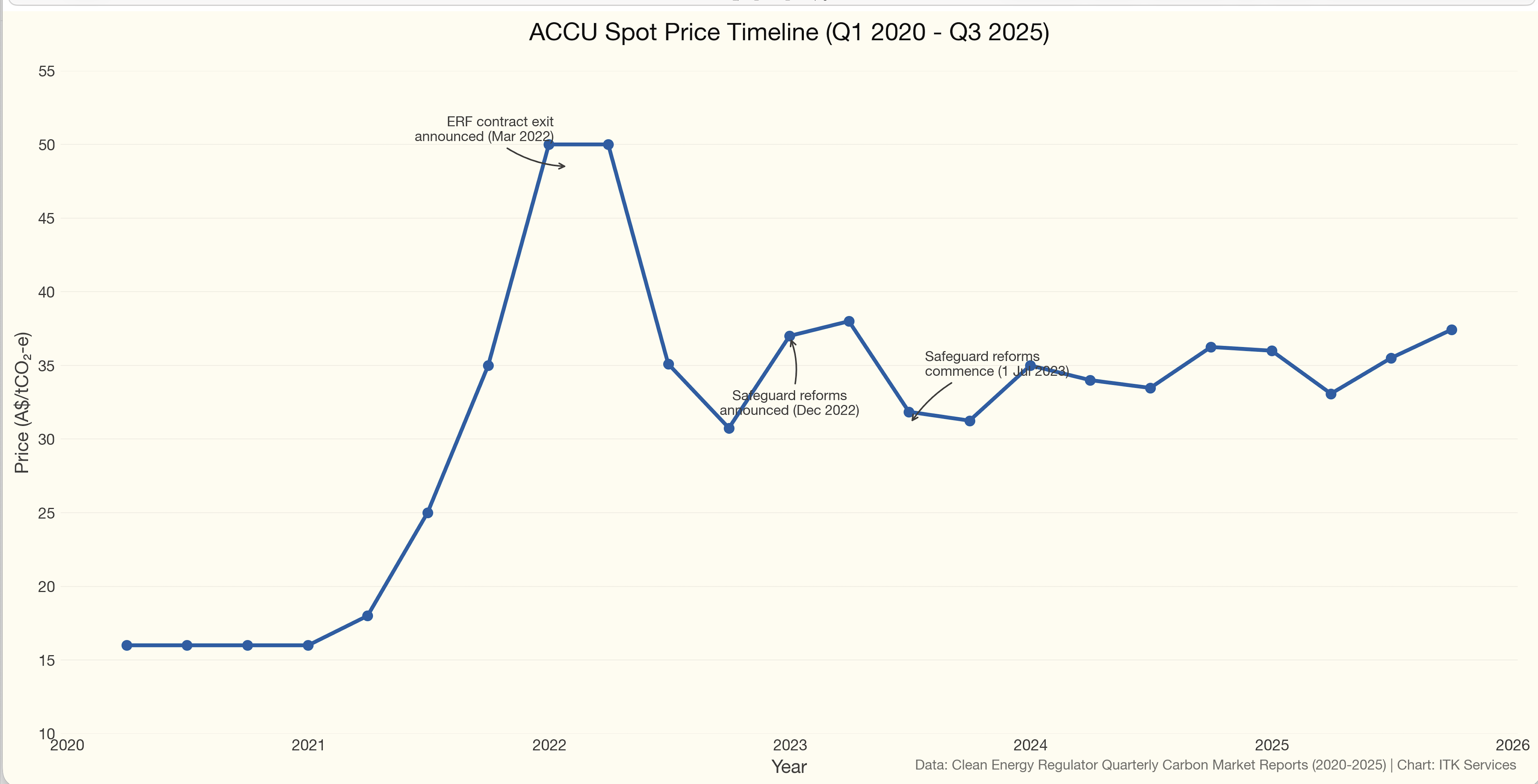

- I would expect the price of an SMC to be about the same as the price for an ACCU since they can both be used to satisfy the obligation. But the essential point is, as long as there are enough ACCUs and their price is below the cost of actually abating carbon at the producing facilities then producers will keep buying ACCUs.

Ultimately the whole thing is a cosmic joke. But it could be made to work

Ultimately, the idea of increasing the cost of LNG and coal facilities for emitting carbon in Australia during production—when the vast majority of the carbon is emitted by burning the fuel, and the entire mindset of the gas and coal industry is that carbon emissions don’t matter—is a joke. Worse, it encourages cynicism. Cynicism is ultimately very corrosive. As Kevin Rudd showed you can’t say you are serious about climate change and then back down. The public sees through it.

However, if the costs of doing something about the production emissions were so high as to make production unprofitable, then like Al Capone and taxes the industry could be weakened indirectly.

As I said above, I don’t believe the Government as a whole really wants the scheme to work. I think they want to set up a version of the scheme that could be made to work, that looks as if it’s working but not to press the “go hard” button. And as I stated at the very beginning, if the Federal Government went really hard on decarbonising electricity and on EVs then I could forgive them persisting with a scheme that safeguards gas and coal from their production emissions.

And so that brings us to the get out of gaol card - ACCUs.

J’ACCUSe - Excuse pun

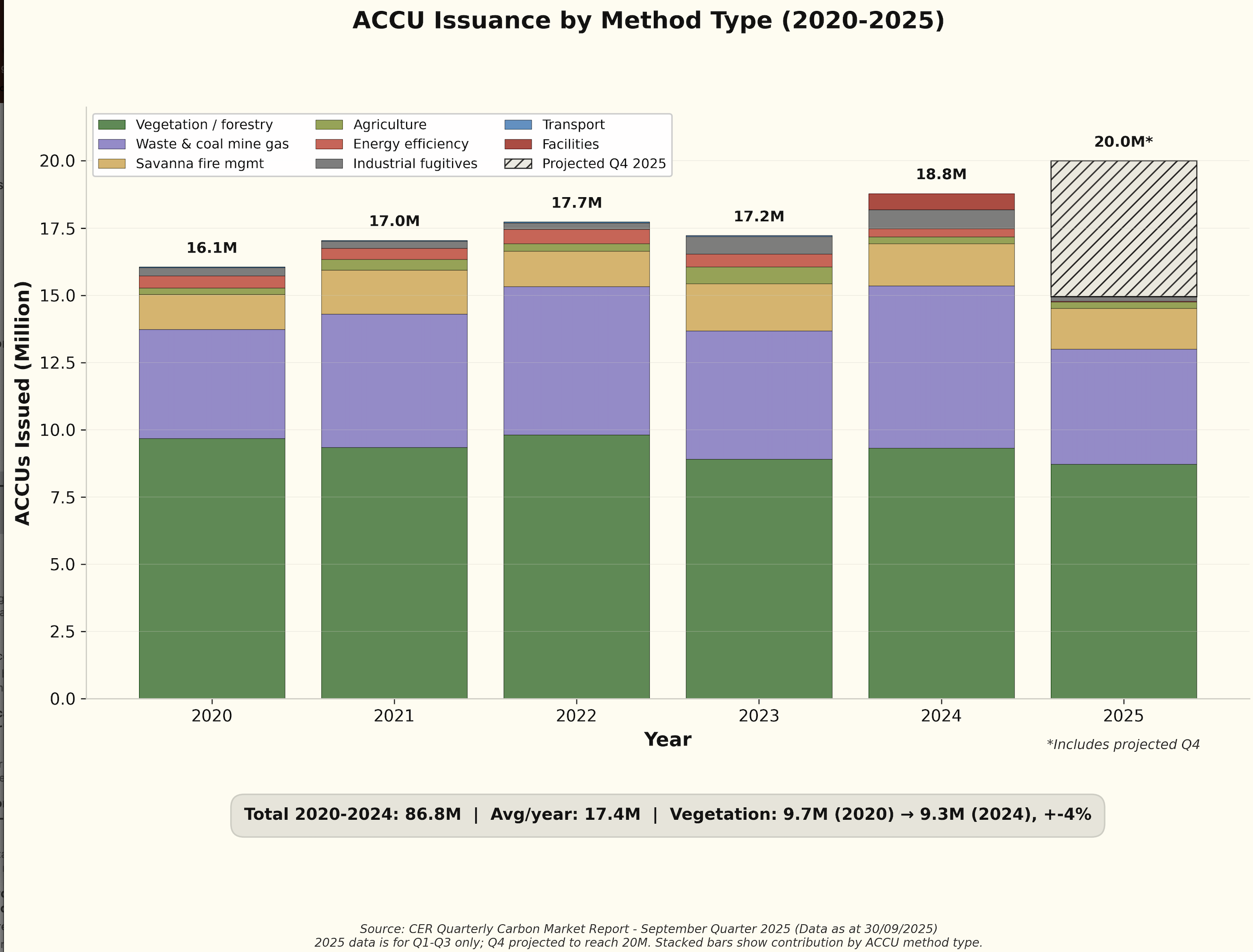

ACCUs (Australian Carbon Credit Units) are certificates with a market value issued for abating carbon emissions. It turns out in Australia we apparently abate about 19 mt per year.

Over half the abatement comes from vegetation/forestry. I don’t want to get into how genuine such credits are. My expectation is that they will be a mixture of the completely genuine and largely bull dust commercial operations. Honestly, I see potential for schemes where land is deliberately cleared just so it can be rewilded for credit purposes. That’s the cynical investment bank research analyst that I try to keep in his cage. It doesn’t matter that much. The point is that so long as there are enough ACCU credits and the Government limits their price, no coal mine or LNG facility is going to do that much. And when you look at the way the scheme has been designed it’s obvious the Government foresaw the use of ACCUs and wanted facilities to use ACCUs. There is a price limit on ACCUs so that the coal and LNG facilities can be guaranteed not having to overpay. The Government has bent over backwards to avoid saying there are problems with vege credits (“eat up your greens kids”) etc.

It seems like about 40% of ACCUs created each year are being consumed via the Safeguards scheme and as the Safeguards scheme demand rises, the ACCU price should also rise.

We can argue about it all day. In a pure economics view, as the price of ACCUs rises it will provide an incentive for LNG and coal producers to abate production emissions if the cost of doing so is below the ACCU price. Far more likely in my opinion is that there will be a mad rush to create more ACCUs. But I don’t really know how much it costs to produce an ACCU.

What I do know is that the goal must be (1) get rid of coal and gas. Let’s make no bones about it; and (2) Find export industries or import replacement industries (replace imported oil with EVs) so that Australia can continue to prosper.

Key Questions for 2026-27 Statutory Review

The following questions are specified for the scheduled review (source: policy_reviews.md):

- Is the 4.9% annual baseline decline rate appropriate for post-2030?

- Should the facility threshold be lowered from 100,000 tonnes CO2-e to capture more emitters?

- Should the scheme move from facility-level to organisation-level coverage?

- Are current offset arrangements (ACCUs and SMCs) appropriate, or should limits be imposed?

- How should new entrant facilities (particularly fossil fuel projects) be treated?

- What is the pathway for baselines to reach net zero by 2049-50?

- How does the scheme interact with Australia’s 2035 NDC target (62-70% reduction)?

- Are trade-exposed baseline-adjusted (TEBA) facility provisions working effectively?

Review status: The formal consultation has not yet opened. The review is scheduled for FY2026-27 (commencing July 2026), once two full years of post-reform compliance data are available.

Research on Review Questions

1. Is the 4.9% decline rate appropriate for post-2030? Answer obviously not - it’s too high to safeguard gas and not high enough for the NDC.

Current settings: The 4.9% annual decline rate applies only to 2030. For 2030-31 to 2049-50, an indicative rate of 3.285% is set in the Safeguard Rules (Department of Climate Change, Energy, the Environment and Water, 2025). However, actual post-2030 rates will be determined through the 5-year baseline setting process.

2035 NDC implications: The Climate Change Authority’s analysis indicates that meeting the 2035 NDC target range (62-70% below 2005 levels) requires higher decline rates (Climate Change Authority, 2025):

Implied Baseline Decline Rates for 2035 NDC Targets

| 2035 Target | Implied Annual Decline Rate |

|---|---|

| 62% (minimum) | 4.82% |

| 65% (middle) | 5.50% |

| 70% (ambitious) | 6.85% |

Source: CORE Markets analysis (CORE Markets, 2025)

Key finding: The indicative 3.285% post-2030 rate is inconsistent with even the minimum 2035 target. The 2026-27 review will need to set rates for 2030-35 by July 2027, incorporating advice from the Climate Change Authority and the government’s final position on 2035 ambition level (Department of Climate Change, Energy, the Environment and Water, 2025).

3. Should coverage move to organisation-level?

My opinion is that official industry data should be provided by ultimate owner so that related entities can easily be linked together. Corporates certainly do this for their own purposes.

4. Are offset arrangements (ACCUs/SMCs) appropriate?

Parallel reviews: The 2026-27 Safeguard review will coincide with the Climate Change Authority’s review of the ACCU Scheme, which will assess whether Australia’s carbon credit supply can meet demands of a tightening compliance market (CORE Markets, 2025).

My opinion is that the use of ACCUs should be strictly limited. If ACCUs are genuine they should receive a benefit for decarbonisation via a completely separate scheme.

5. How should new entrant fossil fuel projects be treated?

Current treatment: New facilities entering the scheme receive baselines based on industry benchmarks. New extraction facilities are assumed to enter as “new entrants” with associated baseline entitlements.

Major new LNG projects: Three large projects - Pluto, Barossa, and Browse - are entering the scheme between 2025 and 2029. By 2030, these three projects alone account for approximately 69% of annual emissions from new facilities, with new domestic gas extraction (Waitsia, Narrabri, Beetaloo) accounting for a further 13% (RepuTex Energy, 2023).

Key tension: The entry of major new LNG projects risks consuming a substantial portion of the scheme’s remaining emissions budget, potentially forcing deeper cuts on other facilities or reliance on offsets to maintain budget integrity.

My opinion is that over time global economics will limit the potential for new developments and the baselines of the scheme should not change for new entrants.

6. What is the pathway to net zero by 2049-50?

Legislated trajectory:

- FY2029-30: Net emissions ≤100 Mt CO2-e

- FY2049-50: Net zero emissions

- Cumulative budget (FY2020-30): ≤1,233 Mt CO2-e

Indicative post-2030 decline rate: 3.285% per year from 2030-31 to 2049-50 is set in the Safeguard Rules as an indicative rate (Department of Climate Change, Energy, the Environment and Water, 2025). Actual rates will be confirmed through the 5-year baseline setting process.

Just not enough: The gap between the indicative 3.285% rate and rates required for the 2035 NDC (4.82-6.85%) creates uncertainty for facility operators attempting to plan long-term decarbonisation investments.