The good news and the bad news in wind capital costs

The good news is that in A$, Goldwind turbines’ average sales price is under $0.5 m AUD/MW - less than half the Vestas price. You could overstate that difference given that most Goldwind turbines are sold in China where everything is cheap whereas lots of Vestas output is sold internationally. Even so, and with no prior preference, and no ideological overtones whatsoever I reckon you’d be a nutter not to be thinking seriously about Goldwind for projects in Australia.

If you are using Vestas, the fall in the AUD-EURO rate has meant that Vestas turbine prices have increased significantly for Australian users.

The really bad news though is that since 2020, based on Australian PPI (wholesale price inflation indexes), non-turbine costs are likely up about 25%.

Again making the somewhat heroic assumption that costs in 2020 were say A$2.5 m/MW (assuming that the connection cost was a capital cost and not variablised to effectively use the transmission company’s cost of capital). The 25% inflation puts you at say A$3.1 m/MW. But the 2020 number wasn’t necessarily $2.5, and electricity capital cost inflation (e.g., transformers) may be more than industry-wide PPI numbers suggest. Nevertheless the high end of the range the IPC showed for the Hills of Gold wind farm was about A$3.2/MW.

In terms of shutting the door after the horse has bolted what this really points to is that Australia fully wasted its opportunity when the A$ was high and when other costs were much lower to get on with building lots of stuff.

Projects like Golden Plains, Clarke Creek, and even Macintyre (in the seemingly unlikely event it operates properly) were lower cost because the developers just did it. Golden Plains didn’t have a PPA when it commenced, but it’s looking like a decent asset now.

Delay, delay, delay - and watch costs continue to rise, or so it seems.

Still, right now cost inflation seems to be hibernating.

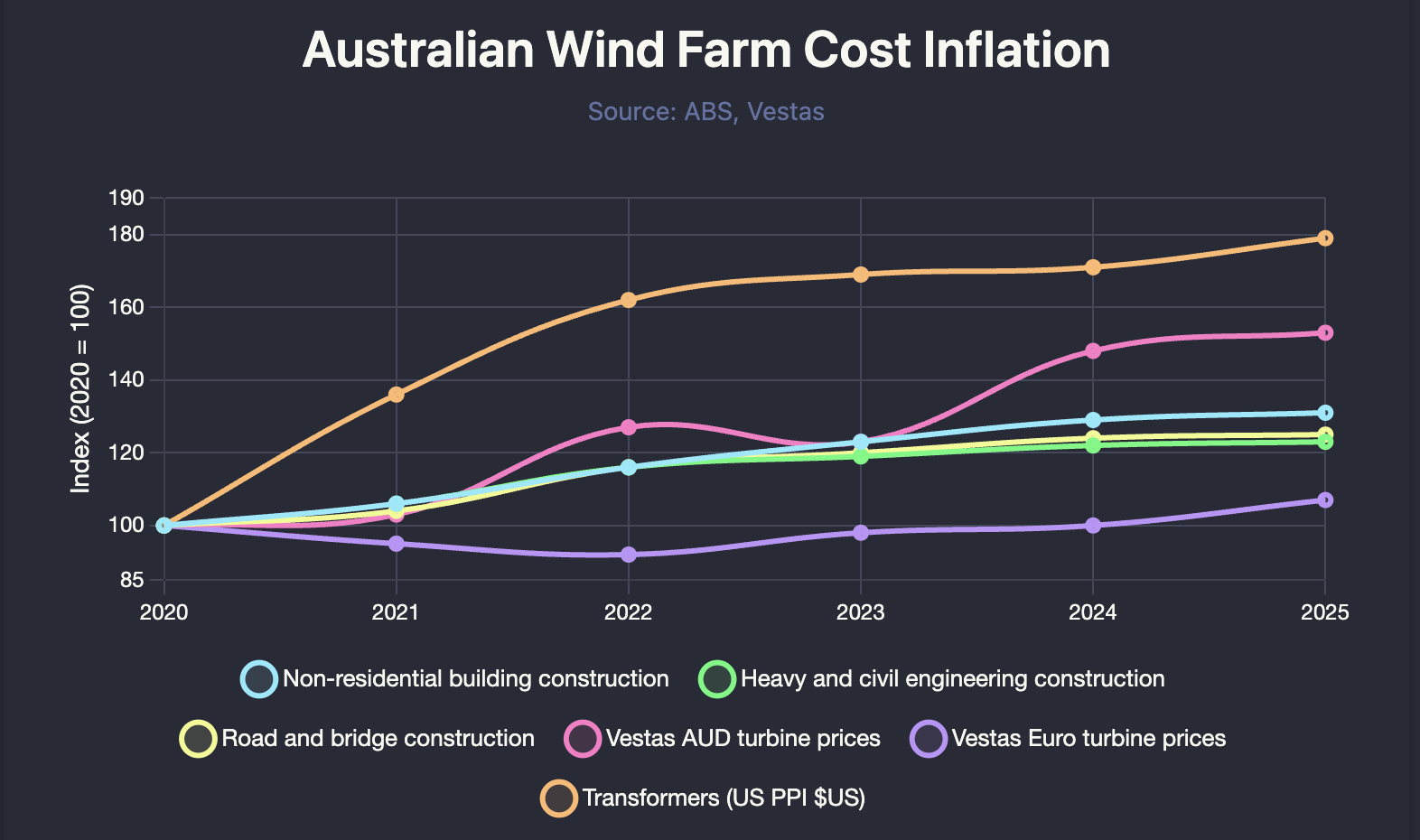

In the following note I’ve converted the PPI and Vestas turbine numbers to an index where December 2020 represents 100. You can see that transformers are the real cost problem, not just in Australia but the USA and, by implication, most places. In A$ transformer inflation would be materially worse. No doubt there are also delays getting transformers.

For domestic construction, the damage was done in 2022 when non-turbine costs rose about 10%.

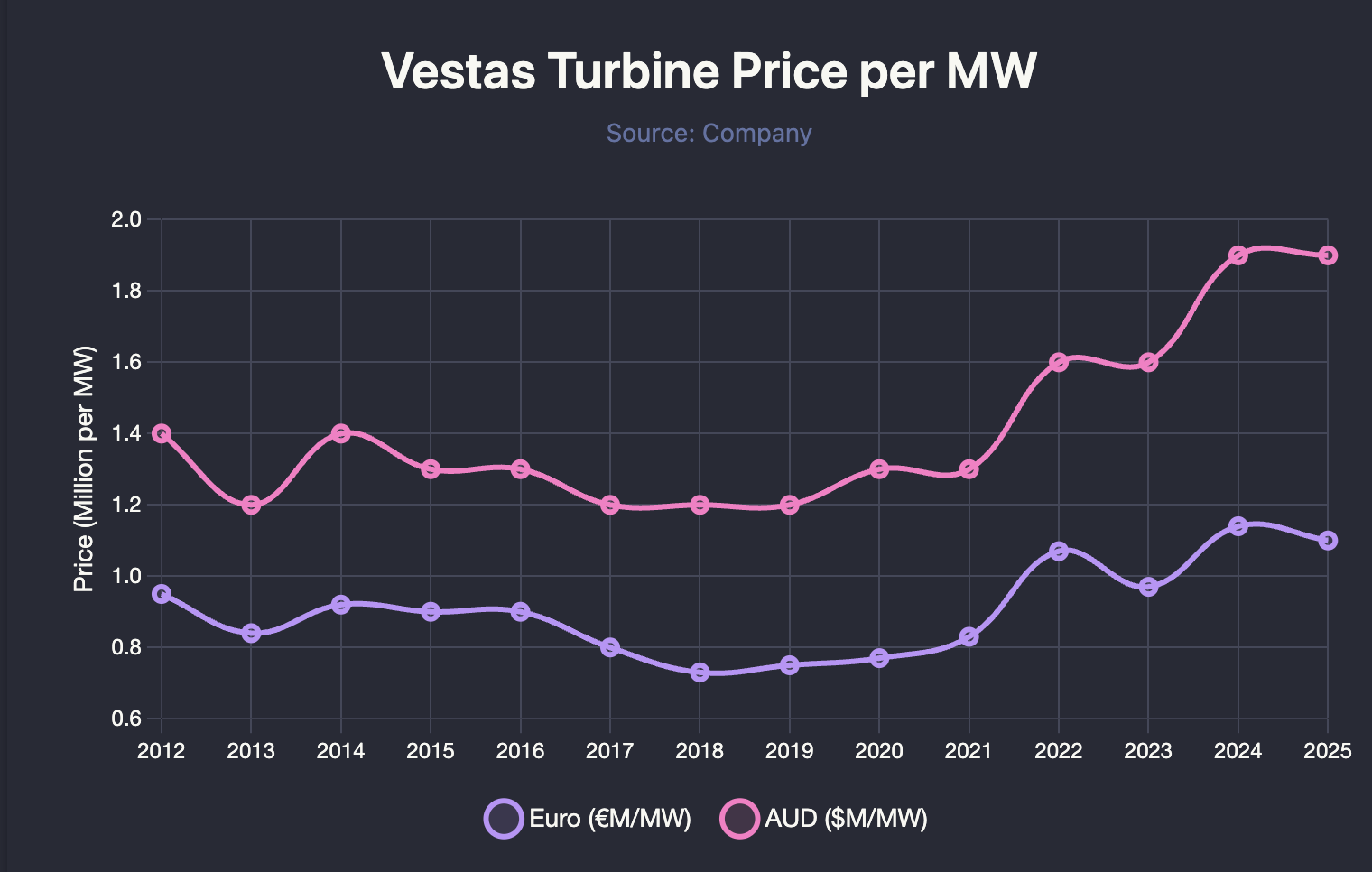

Here’s a longer-term history of Vestas turbine prices taken from their website. Some years may include offshore turbines but there was hardly any in 2025 YTD.

Right now you are paying in A$ 1.8 million/MW for a Vestas turbine. I don’t think this is an unfair price; Vestas is barely profitable. Nevertheless the lift from A$1.2 to A$1.8 pretty much forces developers to look at alternatives.

Here’s an extract from the Goldwind interim results presentation.

When you work the numbers through, it’s about A$0.45 m/MW - less than 1/4 of the Vestas price in AUD. Also, Goldwind reports a positive EBITDA margin, it’s no less and possibly more profitable than Vestas. The real question then is what does a Goldwind 6 MW turbine cost in Australia? Goldwind themselves are expected to give the go-ahead to the Coppabella wind farm but that uses 4.2 MW turbines.

If I assumed that the price in Australia for Goldwind was double the price Goldwind reported, it means an Australian project could save quite significantly on capital costs. Of course Goldwind only has to bid below Vestas at some level that compensates a developer for any perceived risk.

In saying that I might be completely wrong. I’m drawing a lot of conclusions from a very small amount of data, and quite possibly a complete misunderstanding of how things work. Unless I was sitting on a committee reviewing capital cost quotes and budgets I don’t have any real idea of what the numbers are. Disclosure is very limited here in Australia. Therefore, there is little or no way to recalibrate the numbers to market data. This exercise merely points to where I would be looking for more evidence if I could.